O'Reilly Auto Parts 2012 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2012 O'Reilly Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

O’REILLY AUTOMOTIVE 2012 ANNUAL REPORT

13

11

11

13

440

84

65

67

87

72

72

72

24

16

110

35

18

3

95

101

90

112

130

109

115

130

112

142

167

584

48

33

48

483

56

41

30

58

147

183

145

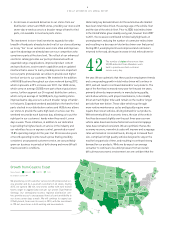

Distribution Centers •

Store Counts 200-600 100-199 1-99

We provide top-notch customer service to both professional ser-

vice provider and do-it-yourself customers in 42 states. During

2012, we opened 180 net, new stores staffed with well trained

teams eager to aggressively execute our proven Dual Market

Strategy. Our strategically located, regional distribution cen-

ters provide access to unsurpassed levels of parts availability to

our stores seven days a week. We will continue to expand our

O’Reilly brand, from coast to coast, in 2013, with the investment

in 190 net, new stores in both existing and new markets.

Growth from Coast to Coast

• An increase in weekend deliveries to our stores from our

distribution centers and HUB stores, providing our stores with

seven-day-a-week access to a broader range of hard-to-find

parts, not available in most auto parts stores.

The investment in store-level inventories expands the wide

breadth of hard parts already stocked in all of our stores allowing

us to say “Yes” to our customers even more often and improves

upon the advantage we already have over our competitors who

carry fewer parts at the store level. The rollout of our enhanced

electronic catalog provides our parts professionals with an

expanded range of applications, improved product content

and specifications, easier search capabilities and an updated

interface that is easier to learn, providing one more important

tool our parts professionals can utilize to provide even higher

levels of service to our customers. We invested in the addition

of 48 HUB locations throughout our store network during 2012,

which represents a 25% increase over 2011. Our HUB stores,

which carry on average 20,000 more parts than a typical store

carries, further augment our 24 regional distribution centers,

which carry an average of 142,000 parts, by providing stores

improved same-day access to a much broader range of harder-

to-find parts. Expanded weekend availability to the hard-to-find

parts stocked in our distribution centers and HUB stores allows

our stores to provide the same high level of service over the

weekend we provide each business day, allowing us to put the

right part in our customers’ hands when they need it, seven

days a week. These initiatives, in addition to our dedication

to providing the highest levels of service in the industry and

our relentless focus on expense control, generated a record

15.8% operating margin for the year. Our 20 consecutive years

of record operating income results prove that by providing

consistent, unsurpassed customer service, we can profitably

grow our business in periods of both strong and more difficult

macroeconomic conditions.

Historically, key demand drivers for the automotive aftermarket

have been total miles driven, the average age of the vehicle fleet

and the size of the vehicle fleet. Prior to 2008, total miles driven

in the United States grew steadily every year; however from 2007

to 2011, the recession contributed to historically high levels of

unemployment, reducing the number of commuter miles driven

and resulting in a decrease in total miles driven over that period.

During 2012, unemployment levels improved and commuters

returned to the road, driving an increase in total miles driven for

the year. We are optimistic that these positive employment trends

and corresponding growth in total miles driven will continue in

2013, and will result in continued demand for our products. The

age of the fleet has increased every year for the past ten years,

primarily driven by improvements in manufacturing quality,

which allow vehicles, with proper maintenance, to be reliably

driven at much higher miles and remain on the road for longer

periods than ever before. These older vehicles go through

more routine maintenance cycles and typically require more

repairs than newer vehicles, driving demand for our products.

With extremely difficult economic times, the size of the vehicle

fleet has decreased slightly over the past three years as new

vehicle sales have been below historical levels and scrappage

rates have remained consistent. We are optimistic that as the

economy recovers, new vehicle sales will improve and scrappage

rates will remain at consistent levels, driving an increased fleet

size, comprised of high quality vehicles designed to stay on the

road for long periods of time, and resulting in continued strong

demand for our products. While we do expect our average

consumer to continue to be under pressure from an overall

difficult macroeconomic environment, we are confident that the

42The number of states where more than

53,000 dedicated Team Members work

hard to provide excellent customer

service every day.