O'Reilly Auto Parts 2012 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2012 O'Reilly Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-k

hard-

onal

each

al

of

240

g

and

store

ic

nior

and

ly

positive

ed

d

t

targets

e

auto

i)

r

e

per

a

,

to

ets.

d

to

at

e

f

d

s

industry

leading

or

fessional

the

e

7

performance. During 2012, we relocated 32 stores and renovated 70 stores. We believe that our ability to consistently achieve growth

in same store sales is due in part to our commitment to maintaining an attractive store network, which is strategically located to best

serve our customers.

Continually Enhance the Growth and Functionality of Our E-Commerce Website:

Our user-friendly website, www.oreillyauto.com, allows our customers to search product and repair content, check our in-store

availability of products, and place orders for either home delivery or in-store pickup. We continue to enhance the functionality of our

website to provide our customers with a friendly and convenient shopping experience, as well as a robust product and repair content

information resource, that will continue to build the O’Reilly Brand.

Team Members

As of January 31, 2013, we employed 53,615 Team Members (33,931 full-time Team Members and 19,684 part-time Team

Members), of whom 45,180 were employed at our stores, 5,937 were employed at our DCs and 2,498 were employed at our corporate

and regional offices. A union represents 49 stores (527 Team Members) in the Greater Bay Area in California, and has for many

years. In addition, approximately 71 Team Members who drive over-the-road trucks in two of our DCs are represented by a labor

union. Except for these Team Members, our Team Members are not represented by labor unions. Our tradition for 56 years has been

to treat all of our Team Members with honesty and respect and to commit significant resources to instill in them our “Live Green”

Culture, which emphasizes the importance of each Team Member’s contribution to the success of O’Reilly. This focus on

professionalism and fairness has created an industry-leading team and we consider our relations with our Team Members to be

excellent.

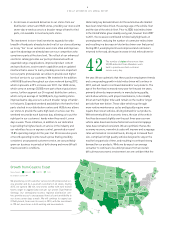

Store Network

Store Locations and Size:

As a result of our dual market strategy, we are able to profitably operate in both large, densely populated markets and small, less

densely populated areas that would not otherwise support a national chain selling primarily to the retail automotive aftermarket. Our

stores, on average, carry approximately 23,500 SKUs and average approximately 7,200 total square feet in size. At December 31,

2012, we had a total of approximately 29 million square feet in our 3,976 stores. Our stores are served primarily by the nearest DC,

which averages 142,000 SKUs, but also have same-day access to the broad selection of inventory available at one of our 240 Hub

stores, which, on average, carry approximately 42,000 SKUs and average approximately 10,000 square feet in size.

We believe that our stores are ''destination stores'' generating their own traffic rather than relying on traffic created by the presence of

other stores in the immediate vicinity. Consequently, most of our stores are freestanding buildings and prominent end caps situated on

or near major traffic thoroughfares, and offer ample parking, easy customer access and are generally located in close proximity to our

professional service provider customers.

The following table sets forth the geographic distribution and activity of our stores as of December 31, 2012 and 2011:

December 31, 2011

2012 Net, New and

Acquired Stores December 31, 2012

State

Store

Count

% of Total

Store Count

Store

Change

% of Total

Store Change

Store

Count

% of Total

Store Count

Cumulative % of

Total Store Count

Texas 563 15.1% 21 8.9% 584 14.7% 14.7%

California 474 12.7% 9 3.8% 483 12.1% 26.8%

Missouri 181 4.8% 2 0.8% 183 4.6% 31.4%

Georgia 161 4.3% 6 2.5% 167 4.2% 35.6%

Illinois 141 3.8% 6 2.5% 147 3.7% 39.3%

Washington 141 3.8% 4 1.7% 145 3.6% 42.9%

Tennessee 138 3.7% 4 1.7% 142 3.6% 46.5%

Arizona 128 3.4% 2 0.8% 130 3.3% 49.8%

N

orth Carolina 120 3.2% 10 4.2% 130 3.3% 53.1%

Ohio 101 2.7% 14 5.9% 115 2.9% 56.0%

Oklahoma 112 3.0% - 0.0% 112 2.8% 58.8%

Alabama 112 3.0% - 0.0% 112 2.8% 61.6%

Michigan 94 2.5% 16 6.8% 110 2.8% 64.4%

Minnesota 106 2.8% 3 1.3% 109 2.7% 67.1%

Arkansas 99 2.6% 2 0.8% 101 2.5% 69.6%

Indiana 89 2.4% 6 2.5% 95 2.4% 72.0%