O'Reilly Auto Parts 2012 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2012 O'Reilly Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

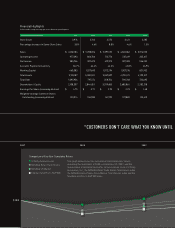

Free Cash Flow and Share Repurchases

Through our focus on a combination of profitable growth and

increased productivity of our net inventory investment, we

generated a record $950 million in free cash flow during 2012,

which represented a 20% increase over our 2011 record free

cash flow of $791 million. This significant achievement is due in

large part to the execution of the comprehensive financing plan

we established at the beginning of 2011, when we received our

inaugural investment grade credit ratings and re-launched a

very attractive supplier financing program. We have been very

pleased with the success of the supplier financing program

over the past two years, which has allowed us to decrease our

working capital requirements by $781 million, and we will work

to continue to grow this program in the future.

In August of 2012, we issued $300 million in investment-grade,

credit-rated senior notes. This issuance was a component of our

comprehensive financing plan aimed at optimizing our capital

structure, and we will continue to incrementally increase our

leverage as we cautiously, but constructively, move closer to

our targeted leverage ratio of 2.00 to 2.25 times adjusted debt to

adjusted EBITDAR. We are steadfastly committed to maintaining

and improving our investment grade credit ratings, and will

ensure we maintain adequate liquidity to execute our profitable

growth plans.

By effectively executing our comprehensive financing plan and

generating record free cash flow, we have been able to directly

return $2.6 billion in value to our shareholders over the past two

years by repurchasing 34 million shares at an average price of

$76.37. These share repurchases, along with our strong top-line

sales growth and record 15.8% operating margin, generated

an outstanding 25% increase in 2012 adjusted diluted earnings

per share. After we have invested in our profitable growth and

exhausted any potentially accretive acquisition opportunities, we

expect to continue to directly return value to our shareholders in

2013 through share repurchases.

Looking Forward to 2013

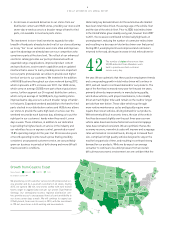

As we look ahead to 2013, we are excited about the opportunities

to continue to profitably grow market share and enhance

shareholder value. We continue to identify and mentor the

next generation of store managers and are confident that the

190 new stores we will open from coast to coast will be staffed

with great leaders, supported by strong teams, who are ready

to provide industry leading customer service. We will continue

our growth into central Florida, which will be supported by a

new, state-of-the-art distribution center scheduled to open in

Lakeland, Florida, during the first quarter of 2014. Our recently

acquired VIP stores will be converted to our systems and signage

during the year, and we are anxious to begin implementing

our Dual Market Strategy as we use these acquired stores

as a springboard for expansion in the New England market.

Most importantly, we will continue to perpetuate our

Culture throughout the Company and remain focused on the

fundamental tool that has been the backbone to our success and

will be the catalyst of our future profitable growth - consistent,

superior customer service.

We are very grateful to each of our shareholders for your

ongoing support and are honored that you have placed your

trust in O’Reilly, and we remain committed to continuing our

long track record of strong and profitable growth. Finally, we

would like to again thank our Team Members for their many

contributions to our continued success. We are very proud of

our strong financial performance in 2012 and we look forward to

another great year in 2013.

8

O’REILLY AUTOMOTIVE 2012 ANNUAL REPORT

GREG HENSLEE

Chief Executive Officer

and President

THOMAS MCFALL

Chief Financial Officer

and Executive Vice President of Finance

Experienced Management Team

With more than 285 years of automotive industry

experience, O’Reilly’s executive management team

provides something that not all companies can brag

about – proven leaders who know the ins and outs of

their business from having worked in virtually every

facet of the Company.

Front row, left to right: Tony Bartholomew,

Randy Johnson, Greg Henslee, Jeff Shaw, Tom McFall

Back row, left to right: David O’Reilly, Ted Wise,

Mike Swearengin, Greg Johnson, Steve Jasinski