Nikon 2015 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2015 Nikon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

06 NIKON REPORT 2015

To Our Stakeholders

n Nikon’s Social Responsibility

Awareness of the importance of fairness and integrity

As a corporate citizen, we naturally comply with set rules, including laws. On that basis, I believe an ethos of

fairness and integrity to be of importance. In 2015, the Corporate Governance Code was formulated and will raise

an awareness of improvements to transparency in management in Japan. Plans call for creating a policy to deter-

mine a response to the Corporate Governance Code that will be discussed and decided by the Board of Directors.

In the meantime, if we truly consider our contributions to the sustainable development of society, there will be

a need to step up our overall awareness of all aspects, without bias, with regard to the expectations of a variety of

stakeholders, including, of necessity, shareholders and investors, local communities, employees, and customers.

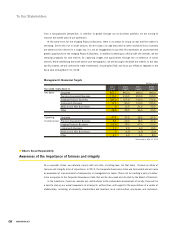

Management’s Numerical Targets

(Billions of yen)

Years ended / ending March 31

2015

(result)

2016

(target)

2017

(target)

2018

target)

Net Sales Corporate 857.7 860.0 890.0 990.0

Precision Equipment Business 170.7 210.0 200.0 210.0

Imaging Products Business 586.0 525.0 530.0 570.0

Instruments Business 72.3 80.0 100.0 120.0

Medical and New Businesses 0 15.0 24.0 50.0

Other 28.6 30.0 36.0 40.0

Operating

Income (Loss)

Corporate 43.4 30.0 38.0 65.0

Precision Equipment Business 8.3 20.0 18.5 27.0

Imaging Products Business 56.6 38.0 42.0 55.0

Instruments Business 1.1 2.0 6.0 10.0

Medical and New Businesses 0 (6.0) (6.0) (9.0)

Other 6.7 4.0 4.5 8.0

*Announced on May 14, 2015

from a Companywide perspective. In addition to growth through our six-business portfolio, we are aiming to

improve the overall pace of our operations.

At the same time, for the Imaging Products Business, there is no reason to simply accept that the market is

shrinking. Due to the rise in smart devices, we are living in an age described as when several billions of photos

are shared on the Internet in a single day. It is not an exaggeration to say that this represents an unprecedented

growth opportunity for the Imaging Products Business. In addition to seeking an afnity with the Internet, we are

realizing proposals for new devices for capturing images and applications through the co-existence of smart

devices. While addressing the smart-device user demographic, we are striving to revitalize the market. In the next

two scal years, we will continue to make investments, including for R&D, and focus our efforts on regrowth in the

scal year ending March 31, 2018.