Nikon 2015 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2015 Nikon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 NIKON REPORT 2015

Business Review for the Fiscal Year Ended March 31, 2015

Semiconductor Lithography Business

Summary for the Fiscal Year Ended March 31, 2015

• Aimed to improve performance and expand

sales of systems focusing on ArF immersion

scanners, but number of units sold decreased

due to the impact of changes to customers’

capital investment plans

• Recorded impairment loss on xed assets of

approximately ¥15.2 billion

Market Environment

Capital investment was rm in the semiconduc-

tor-related eld. This trend is expected to con-

tinue for the time being, and in addition to

making improvements to system performance,

we aimed to increase our market share by

enhancing the sales structure and services.

Initiatives and Achievements

Working to improve performance and expand

sales of systems, focusing on ArF immersion

scanners, we made our rst shipment of the new

NSR-S630D scanner that offers extremely high

overlay accuracy and improved productivity.

Beset by such factors as changes to customers’

capital investment plans, fewer than the expected

number of overall units were sold, but the NSR-

S630D has been well received by customers.

We are further enhancing the support we

provide to customers after system delivery and

shortening the lead times needed to build mass

production systems at customer sites by estab-

lishing a new department.

Summary for the Fiscal Year Ended March 31, 2015

• In line with a shrinking market, the number

of units sold decreased signicantly

• Maintained high share of the lithography system

market for small and medium-sized high- denition

panels as well as OLED panels

Market Environment

Although recovery was evident in capital invest-

ment for large-sized panels, our performance was

weakened as a result of a settling down of capital

investment for small and medium-sized panels. It

is expected that capital investment for small and

medium-sized panels will recover rapidly, while

capital investment for large-sized panels will

remain stable.

Initiatives and Achievements

Focusing on sales of such systems as the

FX-67S that are ideal for the production of small

and medium-sized high-denition panels for

smartphones and tablet computers, we were

affected by the settling down of capital invest-

ment, resulting in sluggish sales compared with

the previous scal year. In systems for large-

sized panels, sales of the new FX-86S2 and

FX-86SH2 sold steadily due to a recovery in

customers’ capital investment.

Since sales volumes of FPD lithography

systems tend to be affected by market conditions,

we suffered a signicant drop in the number of

units sold but maintained our high share of

the market.

Summary for the Fiscal Year Ended March 31, 2015

• Impacted by delayed recoveries in European

and Chinese markets, and suffered decreases in

revenue and prot

• Achieved ratio of operating income to net sales

above that of previous year by cost reductions,

such as in advertising expenses

Market Environment

The market for digital cameras–interchangeable

lens type was sluggish mainly in Europe and

China, and the compact digital camera market

continued to shrink.

Despite a delayed recovery in the European

and Chinese markets, the contraction of the

market for digital single lens reex (SLR) cam-

eras lessened from the previous year.

Initiatives and Achievements

Among digital cameras–interchangeable lens type

that were well received during the year were the

D750 and D810 digital SLR cameras, with full-

scale specications comparable with those of

professional models; the mid-class D7100 and

D7200; and the entry-class D3300 and D5500.

As a result, market shares increased signi-

cantly in the United States and Russia.

In compact digital cameras, sales were

strong for products including the COOLPIX P600

and COOLPIX S9700.

The cumulative production of interchange-

able lenses reached 95 million units in July 2015.

FPD Lithography Business Imaging Products Business

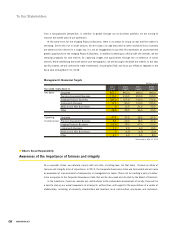

2013 2014 2015

0

15

30

45

60

4040

32

Semiconductor Lithography Systems,

Unit Sales by Technology

(Including refurbished equipment)

(Years ended March 31)

Units n ArF immersion n ArF n KrF n i-line

2013 2014 2015

0

15

30

45

60

43

56

34

FPD Lithography Systems,

Unit Sales by Generation

(Years ended March 31)

Units

n 7G and above n 5G / 6G n 4G

6,980

17,140

5,750

11,160

4,610

7,690

2013 2014 2015

0

5,000

10,000

15,000

20,000

Unit Sales of Digital Cameras

(Years ended March 31)

Thousands of units

n Digital cameras–interchangeable lens type

n Compact digital cameras