Nikon 2015 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2015 Nikon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 NIKON REPORT 2015

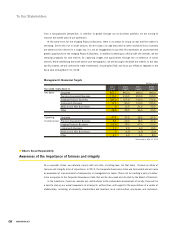

2006 2007 2008 2009

For the year:

Net sales ¥ 730,944 ¥ 822,813 ¥ 955,792 ¥ 879,719

Precision Equipment 242,318 291,913 290,814 219,915

Imaging Products 415,686 448,825 586,147 596,468

Instruments 53,280 59,252 59,043 44,642

Cost of sales 468,944 494,663 551,551 561,642

Selling, general and administrative expenses 195,413 226,143 269,072 269,892

Operating income (loss) 66,587 102,007 135,169 48,185

Precision Equipment 26,375 49,321 43,348 8,041

Imaging Products 34,369 45,678 83,974 40,039

Instruments 4,085 5,123 4,081 (2,724)

EBITDA*187,347 124,632 160,847 81,095

Income (loss) before income taxes and minority interests 40,925 87,813 116,704 39,180

Net income (loss) 28,945 54,825 75,484 28,056

Per share of common stock (yen and U.S. dollars)*2:

Basic net income (loss) ¥ 78.16 ¥ 146.36 ¥ 189.00 ¥ 70.76

Diluted net income 69.33 131.42 181.23 67.91

Cash dividends applicable to the year 10.00 18.00 25.00 18.00

Capital expenditures ¥ 25,817 ¥ 30,432 ¥ 39,829 ¥ 43,467

Depreciation and amortization 20,760 22,625 25,678 32,910

R&D costs 37,139 47,218 58,373 61,489

Proportion of R&D spending to net sales (%) 5.1 5.7 6.1 7.0

At year-end:

Total assets ¥ 690,920 ¥ 748,939 ¥ 820,622 ¥ 749,805

Total equity 243,122 348,445 393,126 379,087

Interest-bearing debt 178,841 105,338 76,544 114,940

Financial ratios:

Equity ratio (%) 35.2 46.5 47.9 50.5

Debt equity (D/E) ratio*1 (times) 0.74 0.30 0.19 0.30

ROE*1 (%) 13.2 18.5 20.4 7.3

ROA*1 (%) 4.4 7.6 9.6 3.6

Number of subsidiaries 47 49 48 48

Number of employees 18,725 22,705 25,342 23,759

Environment-related data:

CO2 emissions from Nikon Corporation and Group manufacturing

companies in Japan (thousand tons of CO2)*3————

CO2 emissions from Group manufacturing

companies outside Japan (thousand tons of CO2)*4— — — —

Water use by Nikon Corporation and Group manufacturing

companies in Japan (thousands m3) — — — —

*1. Throughout this annual report, EBITDA is calculated as operating income (loss) plus depreciation and amortization expenses, ROE is calculated as net income (loss) divided by average

shareholders’ equity, ROA is calculated as net income (loss) divided by average total assets, and D/E ratio is calculated as interest-bearing debt divided by total equity.

*2. Per share of common stock information is computed based on the weighted average number of shares outstanding during the year.

*3. The values above are the aggregated results of CO2 emissions from energy use.

The CO2 emission factors are the weighted average values of the actual emission factors between the year ended March 31, 2006, and the year ended March 31, 2008 (xed for the entire period).

The CO2 emissions are calculated using the following unit heating values:

City gas: Specic value of each gas company

Other fuels: Values contained in the Manual for Calculating and Reporting Greenhouse Gas Emissions for the baseline emission calculation

*4. The CO2 emission factors are the weighted average values of International Energy Agency (IEA) factors by country between 2005 and 2007 (xed for the entire period).

For the year ended March 31, 2012, the calculation of CO2 emissions from Nikon (Thailand) Co., Ltd. was limited to the period from April through September due to the temporary

shutdown of the company’s plants as a result of the ood in Thailand.

*5. U.S. dollar gures are translated for reference only at ¥120.17 to US$1, the exchange rate at March 31, 2015.

Environment-related data applies to seven Group manufacturing companies in Japan and two Group manufacturing companies outside Japan.

For more details, please refer to “The Nikon Group’s Environmental Management Systems and Environmental Performance Data Boundary” on our website.

http://www.nikon.com/about/csr/environment/promote/management/

Performance Highlights

Nikon Corporation and Consolidated Subsidiaries

Years ended March 31