Nikon 2014 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2014 Nikon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strengthen business fundamentals Growth drivers

Priority Measures

Foster new businesses and strengthen existing businesses

Profi tability

Growth potential

Microscope Solutions Business /

Industrial Metrology Business

• Aim for business with net sales on

the scale of ¥100 billion

• Switch emphasis mainly from

hardware to solutions

• Aggressively pursue M&A and

alliances

M&A Program

• Spend ¥200 billion in M&A funds on the Medical and

Instruments businesses

• Launch corporate venture capital on the scale of ¥30 billion for

the Medical Business and encourage open innovation

R&D Program

• Of ¥220 billion R&D budget (March 2015 fi scal year to March

2017 fi scal year), invest ¥50 billion in the Medical Business

and new business domains

• Generate synergies among technologies, setting the Core

Technology Division as a hub

• Cultivate venture companies

Human Resources Program

• Enable the interdivisional fl ow of personnel

• Hire experienced experts

• Reform the mind-set among all employees and cultivate the next

generation of leaders

Cost Reduction Program

• Reduce costs in design and manufacturing processes

• Reduce overhead at headquarters and in business units

• Fundamentally review production regime to refl ect the rebuilding

of the business portfolio

Four Programs to Achieve Transformation

FPD

Lithography

Business

Imaging Products

Business

Medical

Business

Maintain

profi tability

Solidify

profi tability

Improve

profi tability New growth

drivers

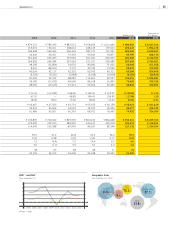

Management Numerical Targets

Foreign Exchanges Assumptions (Yen)

Years ended / ending March 31

2014

(result) 2015

(forecast) 2016

(forecast) 2017

(forecast)

US$ 100.17 101 100 100

Euro 134.21 136 140 140

Net Sales / Operating Income / Operating Margin

(Years ended / ending March 31)

Billions of yen %

R&D Expenses

Cumulative for March 2015 fi scal year

to March 2017 fi scal year

¥220 billion

Of which, ¥50 billion to be invested in Medical

Business and new businesses

Capital Expenditures

Cumulative for March 2015 fi scal year

to March 2017 fi scal year

¥110 billion

■

■ Net sales (left scale)

■

■ Operating income (left scale)

—

Operating margin (right scale)

* Figures for the fi scal year ending March 2015 are as of August 7, 2014; fi gures for the fi scal year

ending March 2016 and the fi scal year ending March 2017 are as of the announcement of the

Medium-Term Management Plan on June 17, 2014.

62.9 53.0 90.0 110.0

9.2

8.6

5.9

6.4

980.6 900.0

1,050.0

1,200.0

2014

(result)

2015

(target)

2016

(target)

2017

(target)

2,000

1,200

1,600

800

400

0

10

8

6

4

2

0

Microscope

Solutions

Business

Industrial

Metrology

Business

Concentrated shift

of management

resources from

existing businesses

Medical Business

• Aim for business with net sales on

the scale of ¥200 billion

• Redirect internal and external

management resources to Medical

Business

• Aggressively pursue M&A and

alliances

Semiconductor

Lithography

Business

15

NIKON REPORT 2014