Navy Federal Credit Union 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

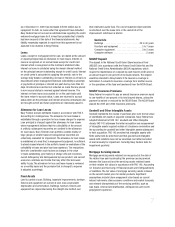

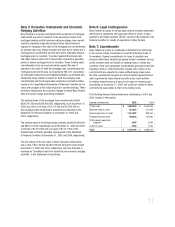

Note 11: Loan Protection Life and Life

Savings Insurance

Navy Federal purchases loan protection and life savings insurance

on the lives of its qualifying members. Navy Federal pays the

premium for the group policies with no charge to its members for

the insurance. Premiums paid to the insurer, CUNA Mutual Insurance

Society, are based on a premium rate per thousand dollars on

insurable account balances and are adjusted semiannually based on

actual claims experience. Total premiums paid were approximately

$7,561,000 and $11,051,000 in the years ended December 31, 2005

and 2004, respectively.

To provide more options to its members regarding credit life

insurance, Navy Federal implemented Payment Protection Plans

in November 2004. These plans offer members the opportunity

to purchase an insurance plan that will pay their loan in full or

will cancel their loan payments during specific “life events.” All

new consumer and credit card loans that are made after the

implementation of the new plan are no longer covered by Loan

Protection Insurance, but members are eligible to enroll for a

Payment Protection Plan. Existing loans covered by Loan Protection

Insurance will continue to be covered by the same insurance plan

until the loan is paid off or refinanced.

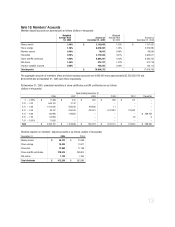

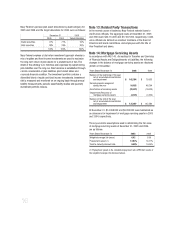

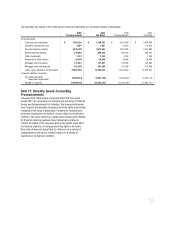

Note 12: Retirement Benefits

Navy Federal Credit Union Employees’ Retirement Plan

This is a defined benefit retirement plan which means that benefits

are based on a set formula. Navy Federal’s plan converted to a

Cash Balance Plan design as of 1 January 2001, but still retains

the Traditional Plan design for those employees who opted to

remain in the Traditional Plan. The following describes how the

benefits are calculated:

• Cash Balance Plan – This plan provides either a single sum

payment upon retirement or a monthly annuity option depend-

ing on the amount of the accrued benefit.

• Traditional Plan – This plan is designed to provide a lifetime of

monthly retirement benefits, determined by a set formula, to

vested employees. The formula is based on the final average

earnings (average from the three highest consecutive years of

income) multiplied by 2% multiplied by the length of service.

Navy Federal 401(k) Savings Plan

This is a defined contribution plan where employees can contribute

pre-tax money to a 401(k) retirement account and receive employer

matching contributions. The matching contributions are based

on participation in a defined benefit retirement plan. Employees

participating in the Cash Balance Plan receive a 100% employer

match on the first 6% of pay they contribute to their 401(k)

account, and employees participating in the Traditional Plan

receive an employer match of 50% on the first 6% of pay they

contribute to their 401(k) account.

The cost recognized for the 401(k) Plan including matching

contributions and administrative costs was $6,894,000 and

$6,026,000 for the years ended December 31, 2005 and

2004, respectively.

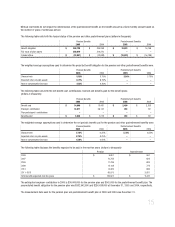

Deferred Compensation Plan (457)

This is a non-qualified deferred compensation plan as allowed

under Internal Revenue Code Section 457(b). This plan offers a

before-tax savings opportunity to highly compensated employees in

the Executive and Professional compensation programs. The annual

deferral amount allowed mirrors the 401(k) plan and contributions

are held by Navy Federal and earn monthly interest based on Navy

Federal’s gross income for the month divided by the average earn-

ings on assets (loans and investments) for the month.

Non-Qualified Supplemental Retirement Plan (SERP)

This non-qualified plan is designed to “make up” for benefits

not paid through the defined benefit retirement plan as a result of

limitations imposed by the IRS. The Internal Revenue Code Section

401(a)(17) limits the amount of compensation that can be used

in the defined benefit retirement plan’s annuity calculation and

Internal Revenue Code Section 415 limits the amount of monthly

annuity that can be paid by the defined benefit retirement plan.

All benefits are paid from the plan trust. Navy Federal makes all

contributions to the trust in accordance with the company’s funding

policy and in compliance with all federal laws and regulations.

Navy Federal accrued $1,440,000 and $1,935,000 to cover this

expense at December 31, 2005 and 2004, respectively.

Retiree Medical Plan

Navy Federal provides postretirement benefits to retired employees

in the form of a contributory group medical plan and supplemental

retirement income to offset the cost of medical insurance premi-

ums or out-of-pocket medical expenses (Medical Plan). Under the

provisions of the Medical Plan, the retirees are responsible for the

full payment of the medical insurance premiums. The supplemental

retirement income benefit is an annual benefit of $75 multiplied by

the number of years of continuous service the retiree had with

Navy Federal. There are no assets set aside to pre-fund the liability

associated with the Medical Plan.