Navy Federal Credit Union 2005 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2005 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2navy federal report to members 2005

We at Navy Federal believe that vibrant organizations are con-

stantly looking for ways to improve. In 2005, we continued

to expand products and enhance convenience as we sought

ways to better meet the unique needs of our members, who now

number over 2.6 million.

Being able to meet the needs of the military and their families

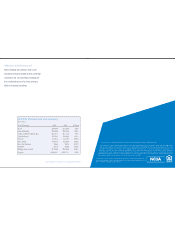

requires us to be on solid financial footing, and 2005 was a very

successful year. Assets reached more than $24.6 billion, up 8%

from last year, and reserves increased 11% to $2.7 billion, assuring

our safety and soundness.

Our financial stability allowed us to concentrate on improving

members’ overall account access and convenience by adding new

member service centers and ATMs in 2005. We also made major

enhancements to

Navy Federal Online

®Account Access, giving

members even greater control of their own account management.

New products, services and special offers continue to attract and

keep members. Several are especially popular with younger mem-

bers, many of whom are just starting to develop a financial plan. The

HomeBuyers Choice mortgage, introduced in 2005, requires no

money down and no PMI (private mortgage insurance). It’s a favorite

among first-time homebuyers.

The EasyStart Certificate was a frequent choice in 2005, with its

low $250 minimum and rates that increased eight times throughout

Chairman Lockard and President Dawson

report from the

chairman and

the president