Navy Federal Credit Union 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

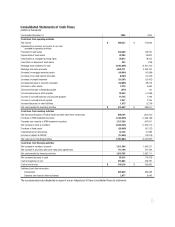

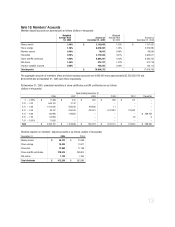

Consolidated Statements of Cash Flows

(dollars in thousands)

The accompanying notes (beginning on page 6) are an integral part of these consolidated financial statements.

Years Ended December 31 2005 2004

Cash flows from operating activities

Net income $ 266,337 $ 273,836

Adjustments to reconcile net income to net cash

provided by operating activities:

Provision for loan losses 244,369 149,750

Depreciation of fixed assets 42,395 35,802

Amortization of mortgage servicing rights 20,672 19,033

Loss/(Gain) on disposal of fixed assets 353 (759)

Mortgage loans originated for sale (4,363,626) (4,451,241)

Mortgage loan sales proceeds 4,442,771 4,345,233

(Increase) in mortgage servicing assets (49,954) (41,884)

(Increase) in accrued interest receivable (8,207) (10,332)

(Increase) in prepaid expenses (19,201) (23,402)

(Increase)/decrease in accounts receivable (50,099) 89,279

Decrease in other assets 2,270 3,694

(Decrease)/increase in dividends payable (674) 120

Increase/(decrease) in drafts payable 29,442 (11,669)

Increase in accrued expenses and accounts payable 14,724 7,249

Increase in accrued interest payable 2,347 2,236

Increase/(decrease) in other liabilities 1,573 (2,274)

Net cash provided by operating activities $ 575,492 $ 384,671

Cash flows from investing activities

Net Decrease/(increase) in Federal funds and other short-term investments 856,164 (502,301)

Purchase of HTM investment securities (1,388,549) (1,568,184)

Proceeds from maturity of HTM investment securities 1,137,280 647,917

Net increase in loans to members (2,444,345) (1,550,277)

Purchase of fixed assets (95,045) (81,232)

Sale/retirement of fixed assets 32,136 31,999

Increase in deposit to NCUSIF (13,504) (20,919)

Net cash used in investing activities (1,915,863) (3,042,997)

Cash flows from financing activities

Net increase in members’ accounts 1,321,506 1,840,227

Net increase in securities sold under repurchase agreements 112,199 747,484

Net cash provided by financing activities 1,433,705 2,587,711

Net increase/(decrease) in cash 93,334 (70,615)

Cash at beginning of year 255,882 326,497

Cash at end of year $ 349,216 $ 255,882

Additional cash flow information:

Interest paid 505,040 395,099

Transfers from loans to other real estate 2,977 6,443