National Grid 2016 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2016 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

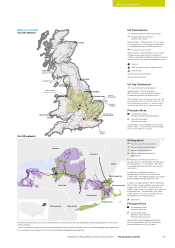

Our Long Island generation plants sell capacity to LIPA under 15-year

and 25-year power supply agreements, and within wholesale tariffs

approved by FERC. Through the use of cost based formula rates,

these long-term contracts provide a similar economic effect to cost

of service rate regulation.

US regulatory filings

The objectives of our rate case filings are to make sure we have

the right cost of service, with the ability to earn a fair and reasonable

rate of return while providing safe, reliable and economical service

to our customers. In order to achieve these objectives and to reduce

regulatory lag, we have been requesting structural changes, such as

revenue decoupling mechanisms, capital trackers, commodity-related

bad debt true-ups and pension and other post-employment benefit

true-ups, separately from base rates. These terms are explained

below the table on page 182.

Below, we summarise significant developments in rate filings and

the regulatory environment during the year. We completed the final

stabilisation upgrade to our new financial systems in July 2014.

With 12 months of historical ‘test year’ data available from the

stabilised financial systems, we commenced a new round of full

rate case filings, starting with the filing for Massachusetts Electric in

November 2015, and followed by the filings for KEDNY and KEDLI in

January 2016. We expect to make a number of such filings over the

next two to three years to update the capital investment allowances

and rate bases across many of our businesses. These filings are

expected to capture the benefit of recent increased investments

in asset replacement and network reliability, and reflect long-term

growth in costs, including property tax and healthcare costs. Along

with a clear focus on productivity, the filings are key to improving

achieved returns in the Company’s US distribution activities.

Moreover, as part of current regulatory initiatives, we filed a proposal

for investments in grid modernisation in Massachusetts and anticipate

a similar proposal for innovative technology deployments and service

offerings as part of the Reforming the Energy Vision (REV) effort in

New York in 2016.

Massachusetts

Massachusetts electric rate case

On 6 November 2015, we filed a one-year rate plan for our

Massachusetts electric business to take effect from 1 October 2016,

which was updated on 29 April 2016. The updated rate case filing

requests an annualised net increase in distribution revenue of

approximately $137 million. The filing includes a request to increase

annual capital investment subject to the capital investment recovery

mechanism from $170 million to $285 million, and to include property

tax recovery on incremental capital placed in service. The filing also

requests an increase in annual base rate funding of the storm fund

mechanism from $4.3 million to $14 million, and a 14-month extension

of the incremental funding to address the storm fund’s deficit, created

by weather events occurring through February 2015. The filing is

based on an RoE of 10.5% and a capital structure of 52% equity

and 48% debt.

Capital investment programmes

On the gas side, on 30 October 2015, we filed the second plan in a

20-year programme to replace ageing gas infrastructure by receiving

concurrent cost recovery for eligible capital investments. On 29 April

2016, MADPU approved our proposal to place an additional $28.9

million into rates effective from 1 May 2016, related to $219 million

of anticipated investments in 2016 under this accelerated pipe

replacement plan. The Company filed the reconciliation of the 2015

investments on 29 April 2016. Additionally, the Company continues

to recover costs associated with its pre-existing leak prone pipe

replacement programme outside of base rates until the next rate

case, including the submittal of a proposal to begin recovery of an

additional $4.1 million of incremental revenue requirement effective

from 1 November 2016.

Storm fund recovery

The Massachusetts electricity business collects $4.3 million annually

in base rates to credit towards a storm fund devoted to fund major

storm response and restoration efforts. The severity and frequency of

storms in Massachusetts between February 2010 and February 2016

resulted in approximately $252 million of incremental storm-related

costs as at 31 March 2016.

MADPU allowed us to begin collecting $40 million annually for three

years beginning on 4 May 2013, and an additional $7.6 million from

1 July 2014, towards the replenishment of the storm fund. This

annual recovery was further extended through 4 August 2016.

Ultimate recovery of the storm costs is subject to a prudency review

by MADPU of the underlying costs. The Company expects an order

on the prudency of $213 million of storm-related costs from the

February 2010 through March 2013 storm events by August 2016.

As explained above, in the Massachusetts electric rate case, we

proposed to collect the deficit created by storm events through

February 2015, subject to a prudency review, and increase the annual

base rate funding of the storm fund. Recoverable costs associated

with storm events after February 2015 are deferred for future recovery

and subject to future prudency review.

Grid modernisation

In response to a 2014 regulatory requirement, the Company filed

a Massachusetts electricity grid modernisation plan on 19 August

2015 that proposed multiple investment options that would further

MADPU’s goals of reducing the effect of outages, optimising demand,

integrating distributed resources, and improving workforce and asset

management. The Company presented a range of investment options

for MADPU to consider, with investment levels over five years ranging

from $225 million to $831 million. MADPU established criteria that,

if met, would allow the capital costs from the plan to be recovered

through a separate capital recovery mechanism. MADPU initiated

its review of the Company’s plan in April 2016.

New York

Upstate New York 2015 petition to use deferred credits

to fund capital expenditures

With the three-year rate plan for Niagara Mohawk’s electricity

and gas businesses expiring on 31 March 2016, in December

2015, we filed a petition with NYPSC to use up to $124 million and

$27 million of deferred credits associated with its electricity and gas

operations, respectively, to fund incremental capital expenditures

for those businesses in 2017 and 2018 above the capital allowances

in the expiring rate plan. The Company expects an order in May

or June 2016.

Reforming the Energy Vision (REV)

In April 2014, NYPSC instituted the REV proceeding, which envisions

a new role for utilities as distributed system platform (DSP) providers

who create markets for distributed energy resources (DER) and more

fully integrate DER in distribution system operations and planning.

The REV proceeding’s objectives include: enhanced customer energy

choices and control; improved electricity system efficiency, reliability,

and resiliency; and cleaner, more diverse electricity generation.

NYPSC is expected to issue an order in 2016 to address rate-making

issues under REV, including opportunities for outcome-based

shareholder incentive mechanisms, market-based earnings, changes

to rate design, DER compensation and the rate-making process.

The Company’s first five-year distributed system implementation

plan is expected to be filed in June 2016 and will identify incremental

investments in utility infrastructure necessary for implementation

of the DSP role and greater DER integration.

Additional Information

179National Grid Annual Report and Accounts 2015/16 The business in detail