National Grid 2016 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2016 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

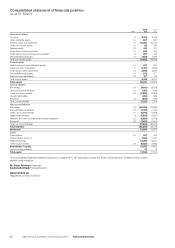

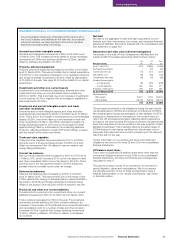

Unaudited commentary on consolidated statement of financial position

The consolidated statement of financial position shows all of

theGroup’s assets and liabilities at the year end. As a capital-

intensive business, we have significant amounts of physical

assets and corresponding borrowings.

Goodwill and other intangible assets

Goodwill and intangibles increased by £255m to £6,202m as at

31March 2016. This increase primarily relates to foreign exchange

movements of £184m and software additions of £220m, partially

offset by software amortisation of £147m.

Property, plant and equipment

Property, plant and equipment increased by £2,641m to £43,364m

as at 31 March 2016. This was principally due to capital expenditure

of £3,673m on the renewal and extension of our regulated networks

and foreign exchange movements of £543m, offset by depreciation

of £1,468m in the year. See page 24 for further details of our capital

expenditure.

Investments and other non-current assets

Investments in joint ventures and associates, financial and other

investments and other non-current assets have increased by

£233mto £961m. This is primarily due to an increase in investments

in jointventures of £79m, together with an increase in available-for-

sale investments of £152m.

Inventories and current intangible assets, and trade

andother receivables

Inventories and current intangible assets, and trade and other

receivables have decreased by £267m to £2,909m as at 31 March

2016. This is due to an increase in inventories and current intangible

assets of £97m, more than offset by a net decrease in trade and

other receivables of £364m. The £364m decrease consists of a

foreign exchange impact of £57m due to the stronger US dollar

against sterling offset by a decrease in the underlying balances

of £421m, reflecting collection of high 2015 winter billings, coupled

with the impact of the recent mild winter.

Trade and other payables

Trade and other payables have decreased by £7m to £3,285m,

primarily due to a foreign exchange impact of £48m more than

offset by movements in the US related to warmer weather and

energy billing settlements.

Current tax balances

Net current tax balances have increased by £51m to £175m as at

31March 2016, which includes a £77m current tax asset in trade

and other receivables (£60m current tax asset in 2014/15). This is

primarily due to the tax payments made in 2015/16 being only

partially offset by a smaller current year tax charge.

Deferred tax balances

Deferred tax balances have increased by £337m to £4,634m

asat31 March 2016. This was primarily due to the impact of the

£125m deferred tax charge on actuarial gains in reserves (£299m

tax creditin 2014/15) and foreign exchange movements being

offsetby the impact of the reduction in the UK statutory tax rate.

Provisions and other non-current liabilities

Provisions (both current and non-current) and other non-current

liabilities increased by £136m to £3,790m as at 31 March 2016.

Total provisions decreased by £16m in the year. The underlying

movements include additions of £63m, primarily relating to an

increase totheprovision for the estimated environmental restoration

and remediation costs for a number of sites and other provision

increases of £33m, together with foreign exchange movements

of£42m, offset by utilisation of £200m in relation to all classes

ofprovisions.

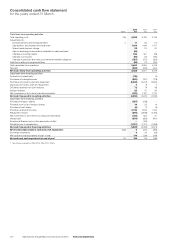

Net debt

Net debt is the aggregate of cash and cash equivalents, current

financial and other investments, borrowings, and derivative financial

assets and liabilities. See further analysis with the consolidated cash

flow statement on page 100.

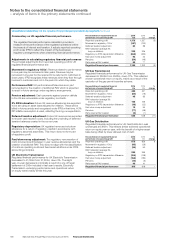

Net pension and other post-retirement obligations

A summary of the total UK and US assets and liabilities and the

overall net IAS 19 (revised) accounting deficit is shown below:

Net plan liability

UK

£m

US

£m

Total

£m

As at 1 April 2015 (672) (2,586) (3,258)

Exchange movements –(81) (81)

Current service cost (74) (147) (221)

Net interest cost (18) (94) (112)

Curtailments and other (24) (15) (39)

Actuarial (losses)/gains

– on plan assets (18) (320) (338)

– on plan liabilities 552 325 877

Employer contributions 239 348 587

As at 31 March 2016 (15) (2,570) (2,585)

Represented by:

Plan assets 19,401 7, 0 3 3 26,434

Plan liabilities (19,416) (9,603) (29,019)

(15) (2,570) (2,585)

The principal movements in net obligations during the year include

net actuarial gains of £539m and employer contributions of £587m.

Net actuarial gains include actuarial gains on plan liabilities of £877m

arising as a consequence of decreases in thenominal discount

ratein the US and experience gains reflecting liability experience

throughout the year including the impact of pension increases being

lower than assumed and some updates to the way a section of plan

liabilities is estimated. This is partially offset by actuarial losses of

£338m arising on planassets resulting from actual asset returns

being less than assumed returns which is based upon the discount

rate at the start of the year.

Further information on our pension and other post-retirement

obligations can be found in notes 22 and 29 to the consolidated

financial statements.

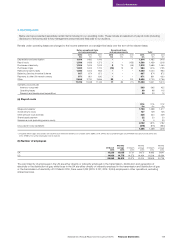

Off balance sheet items

There were no significant off balance sheet items other than the

contractual obligations shown in note 30(b) to the consolidated

financial statements, and the commitments and contingencies

discussed in note 27.

Through the ordinary course of our operations, we are party to

various litigation, claims and investigations. We do not expect

theultimate resolution of any of these proceedings to have a

material adverse effect on our results of operations, cash flows

orfinancial position.

Financial Statements

99National Grid Annual Report and Accounts 2015/16 Financial Statements