Napa Auto Parts 2007 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2007 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

e Automotive Parts Group also includes Balkamp, Inc., a majority-owned

subsidiary that purchases, packages and distributes over 40,000 service and

supply items through the NAPA system. Under the name Rayloc, we operate

four facilities where automotive parts are remanufactured and distributed

through the NAPA system.

is year, our U.S. platform was expanded further with our Heavy Duty

and Import Parts operations. We currently operate one heavy vehicle parts

distribution center under the name Traction and two import parts distribution

centers under the name Altrom.

Outside the U.S., we operate NAPA Canada/UAP Inc., one of Canada’s

leading automotive distributors as well as Canada’s largest independent

heavy vehicle parts distributor. e operating programs and marketing

initiatives utilized in our Canadian operations are fully integrated with our

U.S. NAPA system. We are represented in Mexico by Auto Todo, one of that

country’s largest automotive aftermarket organizations. We are encouraged

by the prospects of continued growth throughout the North American

markets we serve.

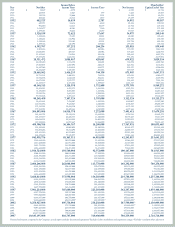

2007Performance

e Automotive Parts Group posted a 2% increase in revenue in 2007,

consistent with our sales growth in 2006. We remain encouraged by this

group’s ability to generate positive sales growth over these periods, as

demand in the automotive aftermarket has been impacted by macro-

economic trends, including high gas prices and its effect on miles driven

and consumer spending. Ongoing sales growth initiatives, combined with

effective cost management, support our efforts to consistently improve our

operating performance.

AutomotiveAftermarket

e growing automotive aftermarket industry is currently estimated at

$89 billion. e Wholesale or Do-it-for-Me (DIFM) market represents

professional service and repair facilities and accounts for an estimated

75% of the industry. e Retail market represents the Do-it-Yourself (DIY)

customer and is approximately 25% of the industry. e Automotive group

works in concert with our NAPA AUTO PARTS stores to continually

grow our business with both wholesale and retail customers.

WholesalePrograms

Over the years, NAPA has developed a significant number of program

offerings, which we believe best meet the demands of our wholesale

customers. Examples include NAPA AutoCare, NAPA Collision Centers

and NAPA Truck Service Center programs, which each provide business

tools and support to one of the nation’s largest independent automotive

service and repair networks. e NAPA Major Accounts Program assists the

NAPA AUTO PARTS stores in securing preferred vendor agreements with

nationally recognized companies. In 2007, the automotive group won several

new and significant supply agreements through this program. Integrated

Business Solutions (IBS) is a sophisticated inventory management service

that effectively handles the inventory procurement and stocking require-

ments for larger wholesale customers, including select AutoCare Centers.

We were successful in securing a number of new IBS contracts during the

year and prospects for continued expansion of this service are promising.

SpecialtyMarkets

We are also focused on the specialty markets component of our wholesale

business and we continue to invest in trained personnel, tailored inventory

and aggressive promotion. Specialized markets such as heavy duty, paint,

body & equipment, farm and marine, tools & equipment and import parts

offer us many growth opportunities. is year, we opened our first distribu-

tion center dedicated to replacement parts for heavy duty trucks and trailers.

In addition, we currently have two distribution centers located in the U.S.,

dedicated to original equipment import parts.

Stores

We continue to position our NAPA AUTO PARTS store base in market

areas where we anticipate significant growth opportunities. We also aim to

create an inviting shopping experience for the DIY customer and support

our complete and dominant product offering. To accomplish this, we are

focused on initiatives such as improved store merchandising, in-store

service and facility upgrades. Ensuring effective and consistent planograms,

competitive retail pricing, convenient retail hours, well-trained personnel

and store upgrades and resets also help drive the growth of our retail busi-

ness. In addition, our proprietary store inventory management system,

Marketplace Inventory Classification (MIC), provides the data necessary

to accurately align each store’s inventory with its specific market.

TechnologySolutions

Technology and connectivity remain essential elements in our customer

service strategy. e rollout of new and improved technology has better

enabled NAPA and NAPA AUTO PARTS stores to conduct business

with both retail and wholesale customers. e NAPA Wide Area Network

(WAN) connects thousands of stores and provides business-building tools

for both the NAPA stores and their commercial accounts. In addition,

NAPA TRACS, a leading shop management system, provides repair

estimating, management and technical solutions for any wholesale

customer. It also contains electronic ordering, eProcurement and 24/7

access to the on-line NAPA PartsPRO catalog, which has over 375,000

parts and product images, among other information. Other technological

applications at NAPA include NAPAONLINE.com, used primarily by

our retail customers, and NAPA PROLink and NAPA WebConnect

CRM, used by our wholesale customers.

OperationalExcellence

e Automotive Parts Group continues to show progress in realizing more

efficient and cost effective operations. Via Operational Excellence, we have

made a number of warehouse productivity enhancements, improved our

customer service and developed even more meaningful criteria for manag-

ing supply chain costs. Ongoing progress in these areas as well as many

others remains an important part of our overall strategy.

NAPABrand

e NAPA brand is widely recognized by North American consumers and

professional technicians and its continued strength gives us a competitive

advantage in the industry. Our national and local advertising is designed to rein-

force this awareness of NAPA and build on the benefits of quality parts, quality

service and knowledgeable people. e NAPA advertising program delivers

high visibility exposure through national television, radio, print and internet

advertising, targeted sponsorships and high-quality local advertising materials.

2008Outlook

We see opportunities for additional growth in the Automotive Parts Group

in 2008. Although we currently expect the macro economic conditions to

remain much the same again in 2008, our initiatives to grow sales and control

costs are in place to improve this group’s operating performance and further

strengthen our leadership position in the industry.

7

automotive parts group net sales

in billion of dollars

4.48

03 04 05 06 07

4.74

5.01

5.19

5.31