Napa Auto Parts 2007 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2007 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

this group’s drive to generate positive and consistent sales growth

in the year ahead. Demand in the automotive aftermarket has been

impacted by macro-economic trends, including high gas prices and

its effect on miles driven and consumer spending. Although we

currently expect these economic conditions to remain much the

same in 2008, specific plans to grow sales are in place and, with

good execution of these initiatives, we anticipate a solid perfor-

mance from the Automotive segment in the coming year.

S.P. Richards, our Office Products Group, reported a 1% decrease

in sales for the year, reflecting weak demand in the overall office

products industry. Our primary challenge was depressed activity

with our national accounts customer base, which offset our steady

sales growth to independent dealers during the year. Historically,

the Office Products Group has been one of our most consistent

and steady performers among our four businesses, and we expect

to see gradual strengthening in the office products industry in

2008. is anticipated industry improvement, combined with the

proper execution of our growth initiatives, will help drive stronger

results for the Office Products Group in the year ahead.

Although we experienced mixed results among our business

segments this past year, we are pleased to operate in four essential

and growing industries. We believe that this diversification

provides us excellent balance when we look at the company as

a whole and as we plan for future growth.

Management

During 2007, there were a number of management changes and

promotions that we would like to share with you. Effective June

2007, Paul D. Donahue joined the GPC Headquarters staff and

at our August 2007 Board meeting he was elected Executive Vice

President of the Company. Previously, Paul was President and

Chief Operating Officer of S.P. Richards Company, our office

products business. As Executive Vice President, Paul is involved in

the activities at several of our automotive businesses in addition to

his work with our global sourcing initiative. Charles A. Chesnutt

also moved to GPC headquarters in 2007 and at the August Board

meeting he was elected Senior Vice President, Technology and

Process Improvement. Charlie was previously the Chief Financial

Officer at EIS, our Electrical/Electronic segment. In his new

role, he is engaged in corporate wide IT and telecommunication

initiatives as well as process improvement programs across GPC.

We are pleased to have Paul and Charlie in these key leadership

positions and we look forward to their future contributions.

In the Automotive Parts Group, Daniel F. Askey has been promoted

to Senior Vice President, Sales, effective August 2007. Dan joined

the Company in 1979 and has held a variety of important automo-

tive positions over the years, including his most recent role as the

U.S. APG Western Group Vice President. Effective January 2008,

Scott W. LeProhon joined the Automotive Parts Group as Senior

Vice President, Merchandising and Product Strategy. Scott started

with the Company in 1987 and has done an outstanding job in his

many automotive assignments, most recently at Balkamp, where

he was President. Replacing Scott as President of Balkamp is Tip

Tollison, a member of the GPC team since 1977 and, prior to this

promotion, Balkamp’s Executive Vice President, Administration.

Dan, Scott and Tip are very talented and well prepared for their

new duties.

In another key automotive move, Gary Silva was promoted to

President of the Heavy Vehicle Parts Group, effective December

2007. Since joining the Company in 1985, Gary has served in

numerous automotive positions and with his expertise in sales,

product sourcing and business development, we are pleased to

have him leading this key area of growth for GPC.

At EIS, Robert R. Gannon, Executive Vice President, retired from

the Company in May 2007. Bob joined EIS in 1985 and held

many important management roles over his 22-year career with

the Company. We thank Bob for his valued contributions and

wish him all the best in his retirement. To replace Bob, Alexander

Gonzalez was promoted to Senior Vice President, Electrical and

Assembly. Alex began his career at EIS in 1989 and has success-

fully held a variety of key sales and management positions with the

Company. Also, Matthew C. Tyser joined EIS in October 2007 to

replace Charlie Chesnutt as Chief Financial Officer. Matt came to

EIS with more than 20 years of financial management experience

and is a great addition to the EIS team.

Conclusion

As we enter 2008, we recognize that we face a more uncertain

economic environment. However, our growth plans have been

built with this in mind, as have our Operating Initiatives, Asset

Management and Working Capital programs. Continued progress

in each of these areas is a top priority for the GPC Management

Team and you can read more about the individual initiatives in

each of the four business segments in the pages that follow.

In closing, we want to express our appreciation to our employees,

customers, vendors and shareholders for your commitment to and

ongoing support of Genuine Parts Company.

Respectfully submitted,

omas C. Gallagher Jerry W. Nix

Chairman, President and Vice Chairman and

Chief Executive Officer Chief Financial Officer

February 29, 2008

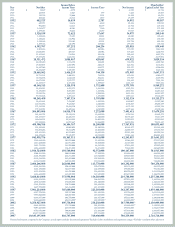

1.16 1.18 1.20 1.25 1.35

1.00 1.04 1.10 1.14

5

Dividends per share

in dollars

1.46

98 99 00 01 02 03 04 05 06 07