Napa Auto Parts 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GenuinePartsCompany

2007annualreport

8

0

y

e

a

r

s

o

f

p

r

o

g

r

e

s

s

Table of contents

-

Page 1

Genuine฀Parts฀Company 2007฀annual฀report 80 years of progress -

Page 2

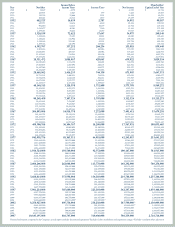

...544,377,000 2,693,957,000 2,549,991,000 2007 10,843,195,000 816,745,000 310,406,000 506,339,000 2,716,716,000 Financial information as reported in the Company's annual reports (includes discontinued operations) *Excludes facility consolidation and impairment charges **Excludes cumulative... -

Page 3

...฀distribution฀of฀automotive฀replacement฀parts,฀industrial฀ replacement฀parts,฀office฀products฀and฀electrical/electronic฀materials.฀ The฀Company฀serves฀numerous฀customers฀from฀more฀than฀2,000฀฀ operations฀and฀has฀approximately฀32,000฀employees... -

Page 4

.... 5,800 NAPA AUTO PARTS stores throughout the U.S. and over 670 wholesalers in Canada. Market฀Emphasis: Offers a broad assortment of automotive related products and services to both Wholesale/Do-it-for-Me and Retail/Do-it-Yourself customers. 49% of total GPC net sales Major฀Products: Access... -

Page 5

...equipment,฀safety฀and฀shop฀supplies,฀industrial฀ products฀and฀customized฀parts. Locations฀in฀U.S.,฀Puerto฀Rico,฀Dominican฀Republic,฀Mexico฀and฀Canada: 31 Branches and 3 Fabrication Facilities Market฀Emphasis: By stocking a broad product line locally, offering... -

Page 6

... Company has paid a cash dividend to shareholders every year since going public in 1948, and in 2007 we increased our dividend by 8% to $1.46 per share. The Board of Directors, at its meeting on February 18, 2008, once again raised the cash dividend payable April 1, 2008 by 7% to an annual rate... -

Page 7

... Office Products Group, reported a 1% decrease in sales for the year, reflecting weak demand in the overall office products industry. Our primary challenge was depressed activity with our national accounts customer base, which offset our steady sales growth to independent dealers during the year... -

Page 8

...parts,฀accessory฀items฀and฀฀ service฀items.฀This฀group฀consists฀of฀58฀NAPA฀ Distribution฀Centers฀in฀the฀United฀States฀฀ serving฀approximately฀5,800฀NAPA฀AUTO฀฀ PARTS฀stores฀of฀which฀approximately฀ 1,100฀are฀company-owned.฀฀ 2007... -

Page 9

... to invest in trained personnel, tailored inventory and aggressive promotion. Specialized markets such as heavy duty, paint, body & equipment, farm and marine, tools & equipment and import parts offer us many growth opportunities. This year, we opened our first distribution center dedicated... -

Page 10

.... 2007 Highlights 8%฀increase฀in฀revenues฀฀฀฀Strengthened฀joint฀supplier฀initiatives฀฀฀฀product฀line฀expansion targeted฀industries฀฀฀฀branch฀expansion฀฀฀฀acquisitions฀฀฀฀specialized฀service฀offerings฀฀฀฀operational฀excellence... -

Page 11

...online lookup and ordering capabilities, as well as 24-hour customer service. Internally, Motion Industries' intranet site, inMotion, improves employee communications through online access to current announcements, customer performance results, best practices, sales tools, and marketing programs... -

Page 12

.... 2007 Highlights New฀products฀฀฀฀Product฀line฀expansion฀฀฀฀strong฀proprietary฀brands฀฀฀฀New฀customer฀channels฀฀฀฀Operational฀excellence Improved฀Marketing฀programs฀and฀dealer฀services฀฀฀฀enhanced฀management฀support฀tools... -

Page 13

... activity with our national accounts customer base. Sales to independent dealers, on the other hand, continued to show steady growth when compared to the prior year. Likewise, in 2007, we were able to grow our revenues at S.P. Richards Canada, where we added a new distribution center in Edmonton... -

Page 14

... ongoing commitment to key sales initiatives, cost management and operational process improvement helped drive our improved operating performance in 2007. Our focus on new products and markets, geographic expansion, operational excellence and strategic customer and supplier relationships serve as... -

Page 15

...-cash charge related to cash consideration received from vendors in c onjunction with the Financial Accounting Standards Board's EITF 02-16 Market฀Price฀and฀Dividend฀Information High and Low Sales Price and Dividends per Common Share Traded on the New York Stock Exchange Quarter... -

Page 16

... each Peer Group was weighted to reflect the Company's annual net sales in each industry segment. Each industry segment of the Company comprised the following percentages of the Company's net sales for the fiscal years shown: Industry Segment Automotive Parts ndustrial Parts I Office Products... -

Page 17

...Capital expenditures: Automotive Industrial Office products Electrical/electronic materials Corporate Total capital expenditures Net sales: United States Canada Mexico Other Total net sales Net long-lived assets: United States Canada Mexico Total net long... -

Page 18

...new and expanded product lines, geographic expansion, sales to new markets, enhanced customer marketing programs and cost savings initiatives. Each of our business segments participated in developing these initiatives, as discussed further below. Results of Operations Our results of operations... -

Page 19

... with product and customer expansion efforts and the continued development of effective marketing programs and dealer services should support growth for Office in the year ahead. Net sales in 2006 were $1.8 billion, up 7% over 2005. This represented a solid increase for the Office group and... -

Page 20

...are partially offset by ongoing product and customer expansion efforts and the continued development of effective marketing programs and dealer services. Through these initiatives, we believe Office will show progress in 2008. Electrical Group Operating margins in Electrical increased to 7.0% in... -

Page 21

... payable at December 31, 2007 increased $80 million or 9% from the prior year, due primarily to increased purchases related to sales growth, extended terms with certain suppliers and the increased utilization of procurement cards in 2007. Liquidity and Capital Resources The ratio of current... -

Page 22

... in the Company's common stock. We plan to remain active in our share repurchase program, but the amount and value of shares repurchased will vary annually. Total debt of $500 million at December 31, 2007 is comprised of two $250 million term notes with a consortium of financial and insurance... -

Page 23

distribution needs and are fulfilled by our vendors within short time horizons. The Company does not have significant agreements for the purchase of inventory or other goods specifying minimum quantities or set prices that exceed our expected requirements. As discussed in 'Construction and Lease ... -

Page 24

...Company earns inventory purchase incentives upon achieving specified volume purchasing levels and advertising allowances upon fulfilling its obligations related to cooperative advertising programs. The Company accrues for the receipt of inventory purchase incentives as part of its inventory cost... -

Page 25

... for the Company's products and services, the ability to maintain favorable supplier arrangements and relationships, competitive product and pricing pressures, including internet related initiatives, the effectiveness of the Company's promotional, marketing and advertising programs, changes in... -

Page 26

...Company's management, including our Chief Executive Officer and Chief Financial Officer, assessed the effectiveness of the Company's internal control over financial reporting as of Management's Report on December 31, 2007. Internal Control over Financial Reporting The management of Genuine Parts... -

Page 27

..., Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Genuine Parts Company's internal control over financial reporting as of December 31, 2007... -

Page 28

... and cash equivalents Trade accounts receivable, net Merchandise inventories, net Prepaid expenses and other current assets Total current assets Goodwill and intangible assets, less accumulated amortization Other assets Property, plant, and equipment: Land Buildings... -

Page 29

... except per share amounts) Year ended December 31 Net sales Cost of goods sold Gross margin Operating expenses: Selling, administrative, and other expenses Depreciation and amortization Provision for doubtful accounts Total operating expenses Non-operating expenses (income... -

Page 30

...,278 Comprehensive income Cash dividends declared, $1.46 per share Stock options exercised, including tax benefit of $4,438 530,262 530 14,438 Stock-based compensation 14,300 Purchase of stock (4,995,886) (4,996) (28,738) Balance at December 31, 2007 See accompanying... -

Page 31

...Trade accounts receivable, net Merchandise inventories, net Trade accounts payable Other long-term assets Other, net Net cash provided by operating activities Investing activities Purchases of property, plant and equipment Proceeds from sale... -

Page 32

... specified volume purchasing levels or other criteria. The Company accrues for the receipt of inventory purchase incentives and advertising allowances as part of its inventory cost based on cumulative purchases of inventory to date and projected inventory purchases through the end of the year, or... -

Page 33

... the following estimated useful life of each asset: buildings and improvements, 10 to 40 years; machinery and equipment, 5 to 15 years. Self-Insurance The Company is self-insured for the majority of group health insurance costs. A reserve for claims incurred but not reported Long-Lived Assets... -

Page 34

...classified as cost of goods sold to be consistent with the Company's policy of capitalizing these costs in inventory. These costs amount to $171,000,000 and $166,000,000 for fiscal years 2006 and 2005, respectively. The reclassification had no effect on net sales, operating margins, net income... -

Page 35

... effect is dependent upon acquisitions at that time. In December 2007, the FASB issued SFAS No. 160 (SFAS No. 160), Noncontrolling Interests in Consolidated Financial Statements -An Amendment of ARB No. 51. SFAS No. 160 establishes new accounting and reporting standards for the non-controlling... -

Page 36

... one year Long-term debt, excluding current portion 2007 2006 as an operating lease under SFAS No. 13, Accounting for Leases (SFAS No. 13) and related interpretations. Future minimum rental commitments under the Agreement have been included in the table of future minimum payments... -

Page 37

... methods subsequent to the adoption of SFAS No. 123(R). For the years ended December 31, 2007, 2006, and 2005 the fair value for options and SARs granted was estimated using a Black-Scholes option pricing model with the following weightedaverage assumptions, respectively: risk-free interest rate... -

Page 38

...Deferred tax liabilities related to: Employee and retiree benefits Inventory Property and equipment Other Net deferred tax asset Current portion of deferred tax liability Non-current deferred tax asset $ 136,432 160,521 296,953 $ 114,146 193,194 307,340 2007 2006... -

Page 39

... as a component of net periodic cost. SFAS No. 158 is effective for publicly held companies for fiscal years ending after December 31, 2006. The Company or one of its subsidiaries files income tax returns in the US federal jurisdiction, various states, and foreign jurisdictions. With few... -

Page 40

...of common stock of the Company with a market value of approximately $93,384,000 and $95,663,000, respectively. Dividend payments received by the plan on Company stock totaled approximately $2,945,000 and $2,723,000 in 2007 and 2006, respectively. Fees paid during the year for services rendered by... -

Page 41

... and Canada establish investment policies and strategies and regularly monitor the performance of the funds. The pension plan strategy implemented by the Company's management is to achieve long-term objectives and invest the pension assets in accordance with the applicable pension legislation... -

Page 42

...฀31,฀2007 7. Employee Beneï¬t Plans (continued) Net periodic benefit cost included the following components: Pension Benefits (in thousands) 2007 2006 2005 Service cost $ 53,700 $ 50,224 $ 41,910 Interest cost 82,029 72,246 64,102 Expected return on plan assets... -

Page 43

... Company's operations in the respective country. Corporate assets are principally cash and cash equivalents and headquarters' facilities and equipment. For management purposes, net sales by segment exclude the effect of certain discounts, incentives, and freight billed to customers. The line... -

Page 44

...Joseph W. Lashley J. Scott Mosteller Debbie E. Niffin Steven C. Schwan President Vice President - Human Resources Vice President - Marketing Vice President - Product Vice President - Information Services Vice President - Supply Chain Vice President - Finance Vice President - Electrical Sales 42 -

Page 45

... Canada Group Vice President - West Group Vice President - Southwest Group Vice President - Industrial Products Group Vice President - Integrated Services Vice President - Distribution Center Operations/Corporate Logistics Vice President - Human Resources 43 EIS,฀Inc.฀(Atlanta,฀GA) Robert... -

Page 46

... Directors of Atlantic Investment Company Chairman of the Board of Directors of UAP Inc. Chairman, President and Chief Executive Officer Retired President and Chief Executive Officer of the Federal Reserve Bank of Atlanta Chairman, President and Chief Executive Officer of Protective Life Corporation... -

Page 47

shareholder information Stock฀Listing Genuine Parts Company's common stock is traded on the New York Stock Exchange under the symbol "GPC". Certifications Our Annual Report on Form 10-K includes the certifications of our chief executive officer and chief financial officer required by Sections ... -

Page 48

Genuine฀Parts฀Company 2999฀circle฀75฀parkway฀฀atlanta,฀ga฀30339 770฀953฀1700 www.genpt.com