Napa Auto Parts 2004 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2004 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

We will remember 2004 as a year we can be proud of for a number

of reasons.

•Record levels of sales and profits were achieved.

•All four of our business segments contributed to our success in a

significant and positive way.

•Our GPC share price grew by 33% for the year providing an

outstanding return to our shareholders.

•Our balance sheet became even stronger with the generation of

$555 million in operating cash flow and with total debt reduced by

$177 million.

•A number of significant management changes occurred that will

assure us a high level of experienced and energetic leadership as

we move ahead.

The list could certainly be longer but perhaps we should move along

and give you a bit more detail on the fine year we had in 2004 and

some of our thoughts about next year and the future for GPC.

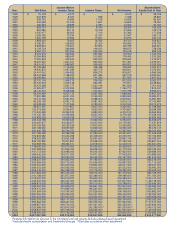

Total sales for 2004 reached a record $9.1 billion, an increase of 8%

compared to 2003. We started the year with a strong first quarter and

the pattern was consistent with notable improvement in the second,

third and fourth quarters. Net earnings of $396 million were up 12%

compared to 2003 before the cumulative effect of an accounting

change adopted January 1, 2003. Earnings per share were $2.25 in

2004 compared to $2.03 in 2003 before the accounting change. After

the cumulative effect, both net income and earnings per share were

up 18% over 2003.

Financial Strength

In 2004, we were able to strengthen our already sound balance

sheet and the Company is in excellent financial condition. Our ratio

of current assets to current liabilities was 3.2/1 at year-end, and we

generated especially strong cash flows, with approximately $555

million in cash flow from operations for 2004. During the year, we

invested $72 million in capital expenditures for our businesses and

we reduced total debt by approximately $177 million. For the third

consecutive year now, we have managed to significantly reduce our

debt, and our total debt to total capitalization ratio moved down to

16% from 23% in 2003. Our improved financial strength is the result

of greater operating efficiencies and productivity, combined with

conservative financial management.

As part of our gradual share repurchase plan, the Company also

used cash to purchase nearly 600,000 shares of our Company stock

during 2004. Currently, we have an additional 6.0 million shares

authorized for repurchase and we will remain active in the plan on

an opportunistic basis in 2005.

Dividends

In 2004, the Company continued its record of paying a dividend every

year since going public in 1948. 2004 was our 48th consecutive year

of increases, with dividends improving to $1.20 per share. We are

proud of our dividend record and we are once again pleased to

report that on February 21, 2005, the Board of Directors raised the

cash dividend payable April 1, 2005 to an annual rate of $1.25 per

share, or 56% of our 2004 earnings. This becomes our 49th consec-

utive year of dividend improvement.

Progress in Operations

As we mentioned earlier in our remarks, all our business segments

contributed significantly to our growth in sales and earnings for the

year. We will not go into great detail in these comments, but we

invite you to read more about our accomplishments and plans for

each group in the following pages of our report. Operating margin

improvement can also be seen in detail in the segment financial data

provided in this Annual Report. We are pleased with our progress in

this aspect of our business and it was a priority in 2004.

Our strongest sales improvement for the year came from our two

business segments directly serving the manufacturing sector of the

economy. Motion Industries, our Industrial Products Group, had an

excellent year with an 11% increase in sales. EIS, our Electrical/

Electronic segment, was also favorably impacted by the upturn in

the U.S. manufacturing sector and they posted a 13% sales increase

for the year. As we enter 2005, we are encouraged by the strength of

the U.S. industrial production numbers, which lends great support

for future growth at Motion and EIS.

In 2004, sales for both the Automotive Group and the Office Products

Group increased 6%. This was the best performance from these

groups in several years and we are encouraged by this improvement.

Automotive, our largest business group, continues to have market

conditions that bode well for their activities in 2005 and the future.

The age and mix of the vehicle population on our roads today, and

continued growth of miles driven, creates a splendid opportunity for

us in this business. S.P. Richards, our office products company, is

our most consistent performer, finding a way to add growth every

year, with an expanding customer base and numerous product

enhancements.

To our shareholders

LARRY L. PRINCE THOMAS C. GALLAGHER

Chairman of the Chairman, President and

Executive Committee Chief Executive Officer