Napa Auto Parts 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Genuine Parts Company

Annual Report 2004

Table of contents

-

Page 1

Genuine Parts Company Annual Report 2004 -

Page 2

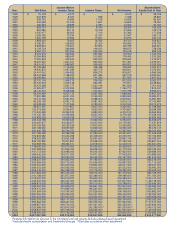

... 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 $ Net Sales 75,129 227,978 339,732 402,463 482,525 629,751 904...000 2,544,377,000 1 Financial information as reported in the Company's annual reports (includes discontinued operations) *Excludes facility consolidation and impairment... -

Page 3

...at a Glance GPC Net Sales by Segment 4 Letter To Our Shareholders 6 Business Narratives 13 Selected Financial Data 14 Segment Data 15 Management's Discussion and Analysis 21 Report of Management 4% 17% 52% 27% 22 Reports of Independent Registered Public Accountants 23 Consolidated Balance Sheets... -

Page 4

... an asset repair tracking program. These products and services allow customers to consolidate purchases and effectively manage inventories as well as equipment maintenance requirements. Web site: motionindustries.com Headquarters: Birmingham, Alabama AUTOMOTIVE PARTS GROUP NET SALES in billions... -

Page 5

... North America. Products range from insulating and conductive materials, to assembly tools, test equipment, safety and shop supplies, industrial products, and customized parts. Locations: 34 Full-Service Facilities Market Emphasis: Stocks a broad product line locally, offering a variety of inventory... -

Page 6

...strength is the result of greater operating efficiencies and productivity, combined with conservative financial management. 4 As part of our gradual share repurchase plan, the Company also used cash to purchase nearly 600,000 shares of our Company stock during 2004. Currently, we have an additional... -

Page 7

... 2004, the Board of Directors elected him Chief Executive Officer. Tom is only the fourth CEO in the 77-year history of our Company. At our Board meeting on February 21, 2005, the Board of Directors elected him to the additional position of Chairman of the Board. Tom is known and held in high esteem... -

Page 8

(TOP) OUR WHOLESALE CUSTOMERS, INCLUDING INDEPENDENT NAPA AUTOCARE CENTERS, PROVIDE PROFESSIONAL REPAIR AND MAINTENANCE SERVICES ALONG WITH QUALITY NAPA AUTO PARTS. (BOTTOM) IMPROVED STORE MERCHANDISING, SERVICE AND FACILITIES ENHANCE THE 6 NAPA AUTO PARTS STORE EXPERIENCE FOR OUR CUSTOMERS. -

Page 9

... on our on-going initiatives, we have defined our key drivers for 2005 as follows: Wholesale Business - We want our NAPA AUTO PARTS stores to become an unrivaled resource for our wholesale customers. Program offerings for Major Accounts, NAPA AutoCare Centers and Integrated Business Solutions (IBS... -

Page 10

... marketing programs, such as customized monthly and quarterly programs to promote specific products. This value-added sales approach proved beneficial in generating revenues in 2004 and will be an on-going part of our sales strategy in the future. We also emphasized our specialized service offerings... -

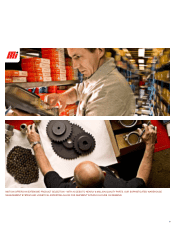

Page 11

MOTION OFFERS AN EXTENSIVE PRODUCT SELECTION - WITH ACCESS TO NEARLY 3 MILLION QUALITY PARTS. OUR SOPHISTICATED WAREHOUSE MANAGEMENT SYSTEM AND LOGISTICAL EXPERTISE ALLOW FOR SHIPMENT WITHIN 24 HOURS ON DEMAND. 9 -

Page 12

... recycled paper products, Elite Image new and remanufactured toner cartridges and Lorell office furniture. S.P . Richards has designed and implemented numerous marketing programs and dealer services to support and grow existing business as well as generate new business opportunities for the Company... -

Page 13

... Dealer Services, which include access to key account information, inventory levels, pricing, downloadable promotional materials, invoice and credit research and return authorizations. S.P . Richards' enhanced catalog offering also benefits our resellers. Today's selection includes: the General Line... -

Page 14

...materials to assembly tools, test equipment, safety and shop supplies, industrial products and customized parts. EIS provides cost effective distribution services through a network of 34 stocking locations in the U.S. and Mexico. Each location is a full service branch with sales personnel, complete... -

Page 15

... expenses. Diluted net income per common share before the 2001 Charges was $2.08. Market and Dividend information High and Low Sales Price and Dividends per Common Share Traded on the New York Stock Exchange Sales Price of Common Shares Quarter High $35.06 40.20 39.94 44.32 2004 Low $32.03 32.65 36... -

Page 16

... Capital expenditures: Automotive Industrial Office products Electrical/electronic materials Corporate Total capital expenditures Net sales: United States Canada Mexico Other Total net sales Net long-lived assets: United States Canada Mexico Total net long-lived assets 2004 $ 4,739,261 2,511,597... -

Page 17

..., due primarily to improved operating results, stock option exercises and improved payment terms with certain vendors. These extended payment terms as well as increased purchases explain our increase in accounts payable. Our liquidity and capital resources improved in 2004, as we reduced our total... -

Page 18

... volume incentives related to purchases, overall competitive pricing pressures and product and customer mix. The comparable decrease in SG&A expenses reflects our on-going cost savings initiatives. Effective January 1, 2003, the Company was required to adopt the Financial Accounting Standards Board... -

Page 19

... pension plans. Accounts payable at December 31, 2004 increased $150 million from 2003 due to the Company's increased purchases associated with increased sales volume, as well as improved payment terms with certain vendors. The change in debt is discussed below. LIQUIDITY AND CAPITAL RESOURCES... -

Page 20

... variable rate borrowings with interest at LIBOR plus .50%, reset every six months. These Notes were paid with cash generated from the operations of the Company. On October 31, 2003, the Company obtained a $350 million unsecured revolving line of credit with a consortium of financial institutions... -

Page 21

... advertising allowances. Generally, the Company earns inventory purchase incentives and advertising allowances upon achieving specified volume purchasing levels or other criteria. The Company accrues for the receipt of inventory purchase incentives and advertising allowances as part of its inventory... -

Page 22

... favorable supplier arrangements and relationships, competitive product and pricing pressures, including internet related initiatives, the effectiveness of the Company's promotional, marketing and advertising programs, changes in laws and regulations, including changes in accounting and taxation... -

Page 23

... the policies or procedures may deteriorate. The Company's management, including our Chief Executive Officer and Chief Financial Officer, assessed the effectiveness of the Company's internal control over financial reporting as of December 31, 2004. In making this assessment, it used the criteria set... -

Page 24

...2005 Atlanta, Georgia report of independent registered public accounting firm on the financial statements Board of Directors Genuine Parts Company We have audited the accompanying consolidated balance sheets of Genuine Parts Company and subsidiaries as of December 31, 2004 and 2003, and the related... -

Page 25

... Land Buildings, less allowance for depreciation (2004 - $125,104; 2003 - $111,646) Machinery and equipment, less allowance for depreciation (2004 - $397,124; 2003 - $378,869) Net property, plant and equipment $ Liabilities and Shareholders' Equity Current liabilities: Trade accounts payable Current... -

Page 26

...in thousands, except per share data) Year ended December 31, Net sales Cost of goods sold 2004 $ 9,097,267 ...accounting principle Diluted net income (loss) Weighted average common shares outstanding Dilutive effect of stock options and non-vested restricted stock awards Weighted average common shares... -

Page 27

... taxes of $1,764 Change in minimum pension liability, net of income taxes of $5,079 Comprehensive income Cash dividends declared, $1.20 per share Stock options exercised, including tax benefit Stock based compensation Purchase of stock Balance at December 31, 2004 173,473,944 - - $173,474 - - $16... -

Page 28

... of businesses and other investments, net of cash acquired Net cash used in investing activities Financing activities Proceeds from credit facilities Payments on credit facilities Stock options exercised Dividends paid Purchase of stock Net cash used in financing activities Effect of exchange rate... -

Page 29

... advertising allowances. Generally, the Company earns inventory purchase incentives and advertising allowances upon achieving specified volume purchasing levels or other criteria. The Company accrues for the receipt of inventory purchase incentives and advertising allowances as part of its inventory... -

Page 30

... to current market rates. At December 31, 2004 and 2003, the fair market value of fixed rate long-term debt was approximately $534,000,000 and $543,000,000, respectively, based primarily on quoted prices for these or similar instruments. The fair value of fixed rate long-term debt was estimated by... -

Page 31

... the Company's consolidated financial statements for the years ended December 31, 2004 and 2003. Until January 1, 2003, the Company had elected to follow Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to Employees (APB 25), and related Interpretations in accounting for stock... -

Page 32

...Under the new method, vendor allowances for advertising and catalog related programs are generally considered a reduction of cost of goods sold. On January 1, 2003, the Company adopted EITF 02-16 and recorded a non-cash charge of $19.5 million ($.11 and $.12 per basic and diluted share, respectively... -

Page 33

...in accounting principle in the Company's consolidated statement of income as of January 1, 2002. No tax benefits were recorded in connection with this goodwill impairment. The Company performed an annual goodwill impairment test during the fourth quarter of 2004 and 2003, utilizing the present value... -

Page 34

... months. The proceeds of the Notes were primarily used to repay certain variable rate borrowings. The Company repaid the Notes with cash generated from operations. On October 31, 2003, the Company obtained a $350,000,000 unsecured revolving line of credit with a consortium of financial institutions... -

Page 35

... to key personnel for the purchase of the Company's stock at prices not less than the fair market value of the shares on the dates of grant. Most options may be exercised not earlier than twelve months nor later than ten years from the date of grant. Pro forma information regarding net income and... -

Page 36

...effect of an accounting change Plus state income taxes, net of Federal tax benefit Other 2004 2003 2002 $ 222,572 22,370 (4,575) $ 240,367 $ 200,110 19,969 (1,978) $ 218,101 $ 212,008 23,081 3,147 $ 238,236 9. Employee Benefit Plans The Company's defined benefit pension plans cover substantially... -

Page 37

... 31, 2004 and 2003 were: Pension Benefits 2004 2003 Weighted-average discount rate Rate of increase in future compensation levels 6.00% 3.50% 6.25% 3.25% Other Postretirement Benefits 2004 2003 6.00% - 6.25% - A 10% annual rate of increase in the per capita cost of covered health care benefits was... -

Page 38

... payments received by the plan on Company stock totaled approximately $2,147,542 and $1,903,000 in 2004 and 2003, respectively. Fees paid during the year for services rendered by parties-in-interest were based on customary and reasonable rates for such services. The Company's benefit plan committees... -

Page 39

... the plans follow: Pension Benefits 2003 6.75% 4.15% 8.95% - Other Postretirement Benefits 2004 2003 2002 6.25% - - 10.00% 6.75% - - 10.00% 7.35% - - 6.50% 2004 Weighted average discount rate Rate of increase in future compensation levels Expected long-term rate of return on plan assets Health care... -

Page 40

... been classified as a reduction to operating profit of the office products segment for management reporting purposes. Additionally, for management purposes, net sales by segment excludes the effect of certain discounts, incentives and freight billed to customers. The line item "other" represents the... -

Page 41

... - Finance and Chief Financial Officer Executive Vice President Senior Vice President Information Technology Senior Vice President Human Resources Senior Vice President and Treasurer Vice President Planning and Acquisitions Vice President Compensation and Benefits Vice President Real Estate and... -

Page 42

...Sales and Marketing Senior Vice President and Chief Information Officer Senior Vice President Corporate Accounts Senior Vice President Sales and Strategic Planning Senior Vice President Human Resources Vice President - Inventory Management Vice President - Integrated Services EIS, Inc. (Atlanta, GA... -

Page 43

... 75 Parkway Atlanta, Georgia 30339 Certifications Our Annual Report on Form 10-K includes the certifications of our chief executive officer and chief financial officer required by Sections 302 and 906 of the Sarbanes-Oxley Act of 2002. Additionally, we filed with the New York Stock Exchange the... -

Page 44

GENUINE PARTS COMPANY 2999 Circle 75 Parkway Atlanta, GA 30339 770 953 1700 www.genpt.com