NVIDIA 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

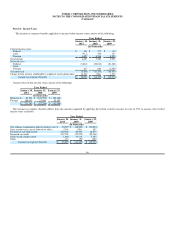

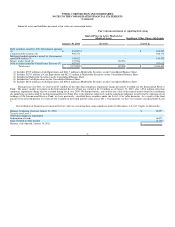

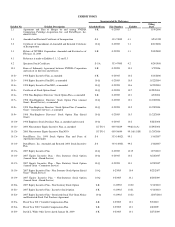

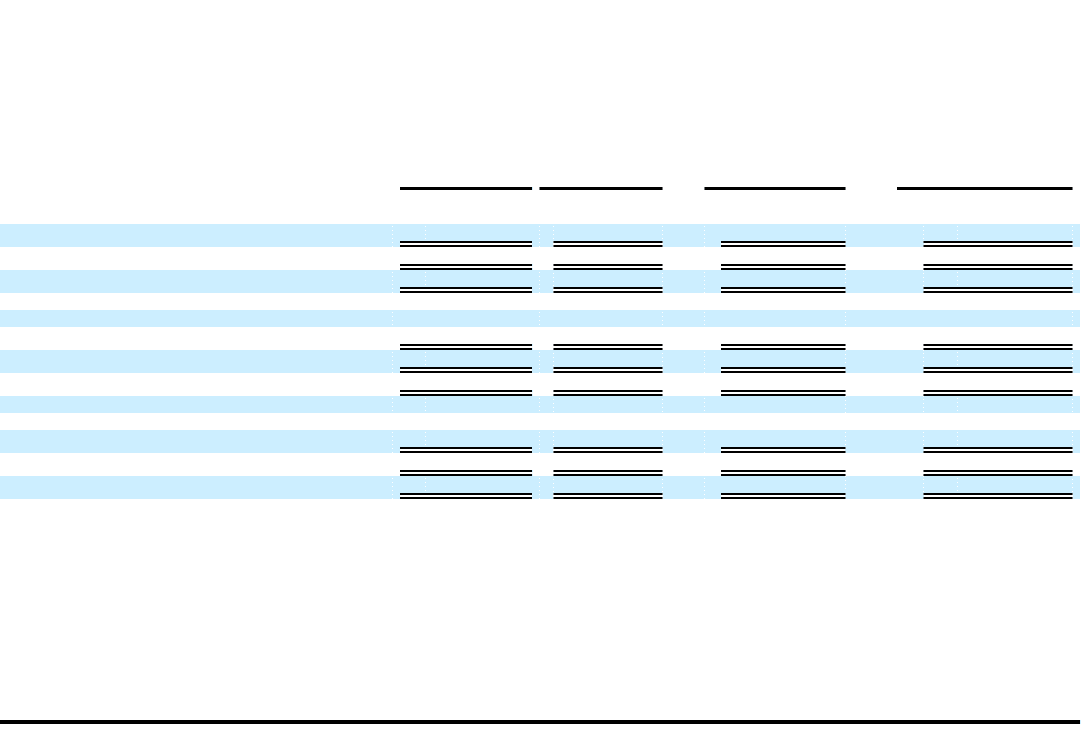

NVIDIA CORPORATION AND SUBSIDIARIES

SCHEDULE II – VALUATION AND QUALIFYING ACCOUNTS

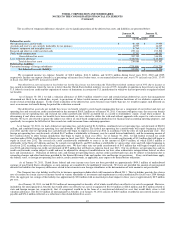

Description

Balance at

Beginning

of Period Additions Deductions Balance at

End of Period

(In thousands)

Year ended January 30, 2011

Allowance for doubtful accounts $ 961 $ 875(1) $ (1,047) (4) $ 789

Sales return allowance $ 15,369 $ 26,517(2) $ (26,837) (5) $ 15,049

Deferred tax valuation allowance $ 113,442 $ 34,574(3) $ - $ 148,016

Year ended January 31, 2010

Allowance for doubtful accounts $ 1,062 $ 550 (1) $ (651) (4) $ 961

Sales return allowance $ 17,336 $ 24,790 (2) $ (26,757) (5) $ 15,369

Deferred tax valuation allowance $ 92,541 $ 20,901 (3) $ - $ 113,442

Year ended January 25, 2009

Allowance for doubtful accounts $ 968 $ 608 (1) $ (514) (4) $ 1,062

Sales return allowance $ 18,724 $ 27,859 (2) $ (29,247) (5) $ 17,336

Deferred tax valuation allowance $ 82,522 $ 10,019 (3) $ - $ 92,541

(1) Allowances for doubtful accounts are charged to expenses.

(2) Represents allowance for sales returns estimated at the time revenue is recognized primarily based on historical return rates and is charged as a reduction

to revenue.

(3) Represents change in valuation allowance primarily related to state deferred tax assets that management has determined not likely to be realized due, in

part, to projections of future state taxable income.

(4) Represents uncollectible accounts written off against the allowance for doubtful accounts.

(5) Represents allowance for sales returns written off.

93