NVIDIA 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

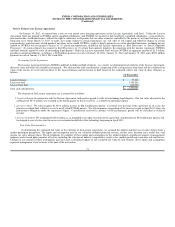

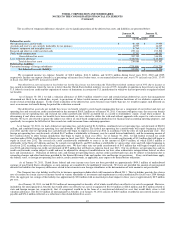

In early November 2005, after several months of mediation, NVIDIA and the Official Committee of Unsecured Creditors, or the Creditors’

Committee, agreed to a Plan of Liquidation of 3dfx, which included a conditional settlement of the Trustee’s claims against us. This conditional settlement

was subject to a confirmation process through a vote of creditors and the review and approval of the Bankruptcy Court. The conditional settlement called for a

payment by NVIDIA of approximately $30.6 million to the 3dfx estate. Under the settlement, $5.6 million related to various administrative expenses and

Trustee fees, and $25.0 million related to the satisfaction of debts and liabilities owed to the general unsecured creditors of 3dfx. Accordingly, during the three

month period ended October 30, 2005, we recorded $5.6 million as a charge to settlement costs and $25.0 million as additional purchase price for 3dfx. The

Trustee advised that he intended to object to the settlement. The conditional settlement never progressed substantially through the confirmation process.

On December 21, 2006, the Bankruptcy Court scheduled a trial for one portion of the Trustee’s case against NVIDIA. On January 2, 2007, NVIDIA

terminated the settlement agreement on grounds that the Bankruptcy Court had failed to proceed toward confirmation of the Creditors’ Committee’s plan. A

non-jury trial began on March 21, 2007 on valuation issues in the Trustee’s constructive fraudulent transfer claims against NVIDIA. Specifically, the

Bankruptcy Court tried four questions: (1) what did 3dfx transfer to NVIDIA in the APA; (2) of what was transferred, what qualifies as “property” subject to

the Bankruptcy Court’s avoidance powers under the Uniform Fraudulent Transfer Act and relevant bankruptcy code provisions; (3) what is the fair market

value of the “property” identified in answer to question (2); and (4) was the $70 million that NVIDIA paid “reasonably equivalent” to the fair market value of

that property. The parties completed post-trial briefing on May 25, 2007.

On April 30, 2008, the Bankruptcy Court issued its Memorandum Decision After Trial, in which it provided a detailed summary of the trial

proceedings and the parties’ contentions and evidence and concluded that “the creditors of 3dfx were not injured by the Transaction.” This decision did not

entirely dispose of the Trustee’s action, however, as the Trustee’s claims for successor liability and intentional fraudulent conveyance were still pending. On

June 19, 2008, NVIDIA filed a motion for summary judgment to convert the Memorandum Decision After Trial to a final judgment. That motion was granted

in its entirety and judgment was entered in NVIDIA’s favor on September 11, 2008. The Trustee filed a Notice of Appeal from that judgment on September

22, 2008, and on September 25, 2008, NVIDIA exercised its election to have the appeal heard by the United States District Court.

The District Court’s hearing on the Trustee’s appeal was held on June 10, 2009. On December 20, 2010, the District Court issued an Order affirming

the Bankruptcy Court’s entry of summary judgment in NVIDIA’s favor. On January 19, 2011, the Trustee filed a Notice of Appeal to the United States Court

of Appeals for the Ninth Circuit.

While the conditional settlement reached in November 2005 never progressed through the confirmation process, the Trustee’s case still remains

pending on appeal. Accordingly, we have not reversed the accrual of $30.6 million – $5.6 million as a charge to settlement costs and $25.0 million as

additional purchase price for 3dfx – that we recorded during the three months ended October 30, 2005, pending resolution of the appeal of the Trustee’s case.

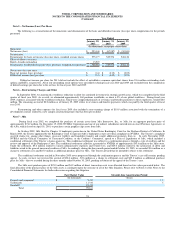

Rambus Inc.

On July 10, 2008, Rambus filed suit against NVIDIA, asserting patent infringement of 17 patents claimed to be owned by Rambus. Rambus seeks

damages, enhanced damages and injunctive relief. The lawsuit was filed in the Northern District of California in San Jose, California. On July 11, 2008,

NVIDIA filed suit against Rambus in the Middle District of North Carolina asserting numerous claims, including antitrust and other claims. NVIDIA seeks

damages, enhanced damages and injunctive relief. Rambus has since dropped two patents from its lawsuit in the Northern District of California. The two

cases have been consolidated into a single proceeding in the San Francisco division of the Northern District of California. On April 13, 2009, the Court issued

an order staying motion practice and allowing only certain document discovery to proceed. On February 11, 2011, the Court lifted the stay and ordered that

discovery on other issues may now proceed. A case management conference is currently scheduled for June 3, 2011.

82