NVIDIA 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

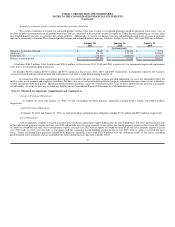

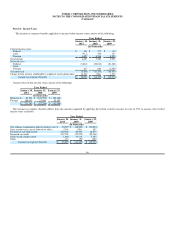

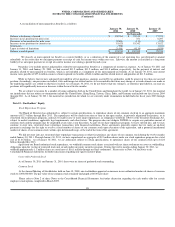

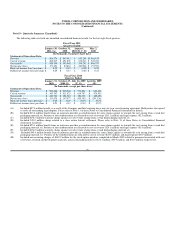

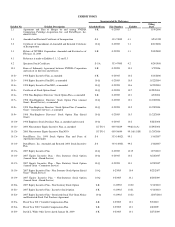

The following table presents summarized information for long-lived assets by geographic region. Long lived assets consist of property and equipment

and deposits and other assets and exclude goodwill and intangible assets.

January 30,

2011 January 31,

2010

Long-lived assets: (In thousands)

United States $ 529,797 $ 468,568

Taiwan 56,202 69,051

China 32,500 39,124

India 31,454 32,070

Europe 4,541 5,603

Other Asia Pacific 787 370

Total long-lived assets $ 655,281 $ 614,786

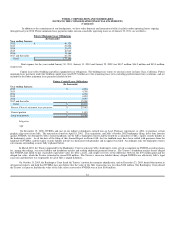

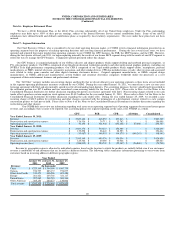

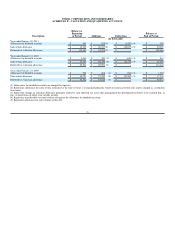

Revenue from significant customers, those representing 10% or more of total revenue for the respective dates, is summarized as follows:

Year Ended

January 30,

2011 January 31,

2010 January 25,

2009

Revenue:

Customer A 12 % 12 % 7%

Customer B 8 % 9 % 8%

Customer C 6 % 7 % 11%

Accounts receivable from significant customers, those representing 10% or more of total accounts receivable for the respective periods, is

summarized as follows:

January 30,

2011 January 31,

2010

Accounts Receivable:

Customer A 11 % 10%

Customer B 6 % 10%

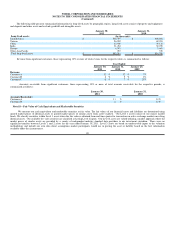

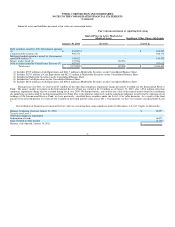

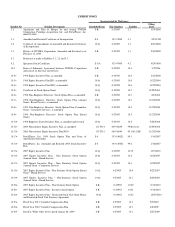

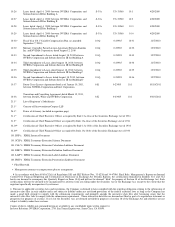

Note 18 – Fair Value of Cash Equivalents and Marketable Securities

We measure our cash equivalents and marketable securities at fair value. The fair values of our financial assets and liabilities are determined using

quoted market prices of identical assets or quoted market prices of similar assets from active markets. Our Level 1 assets consist of our money market

funds. We classify securities within Level 1 assets when the fair value is obtained from real time quotes for transactions in active exchange markets involving

identical assets. Our available-for- sale securities are classified as having Level 2 inputs. Our Level 2 assets are valued utilizing a market approach where the

market prices of similar assets are provided by a variety of independent industry standard data providers to our investment custodian. There were no

significant transfers between Levels 1 and 2 assets for the year ended January 30, 2011. Level 3 assets are based on unobservable inputs to the valuation

methodology and include our own data about assumptions market participants would use in pricing the asset or liability based on the best information

available under the circumstances.

90