NVIDIA 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

Note 4- Patent Cross License Agreement

On January 10, 2011, we entered into a new six-year patent cross licensing agreement, or the License Agreement, with Intel. Under the License

Agreement, Intel has granted to NVIDIA and its qualified subsidiaries, and NVIDIA has granted to Intel and Intel’s qualified subsidiaries, a non-exclusive,

non-transferable, worldwide license, without the right to sublicense to all patents that are either owned or controlled by the parties at any time that have a first

filing date on or before March 31, 2017, to make, have made (subject to certain limitations), use, sell, offer to sell, import and otherwise dispose of certain

semiconductor- and electronic-related products anywhere in the world. NVIDIA’s rights to Intel’s patents have certain specified limitations, including but not

limited to, NVIDIA was not granted a license to: (1) certain microprocessors, defined in the License Agreement as “Intel Processors” or “Intel Compatible

Processors;” (2) certain chipsets that connect to Intel Processors; or (3) certain flash memory products. In connection with the License Agreement, NVIDIA

and Intel mutually agreed to settle all outstanding legal disputes. Under the License Agreement, Intel will pay NVIDIA an aggregate amount of $1.5 billion,

payable in annual installments, as follows: a $300 million payment on each of January 18, 2011, January 13, 2012 and January 15, 2013 and a $200 million

payment on each of January 15, 2014, 2015 and 2016.

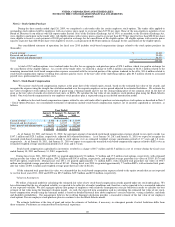

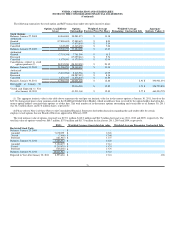

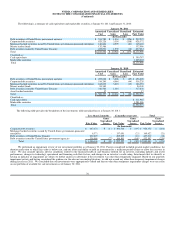

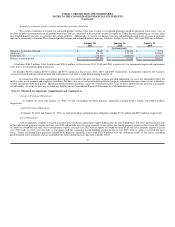

Accounting for the Agreement

The License Agreement between NVIDIA and Intel includes multiple elements. As a result, we determined each element of the License Agreement,

their fair value and when they should be recognized. We allocated the total consideration, comprising of the cash payments from Intel and the estimated fair

value of the license we received from Intel, to the legal settlement and the license to Intel based on the estimated relative fair value of these elements as

follows:

(in thousands)

Legal settlement $ 57,000

License to Intel 1,583,000

License from Intel (140,000)

Total cash consideration $ 1,500,000

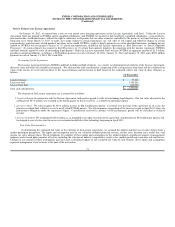

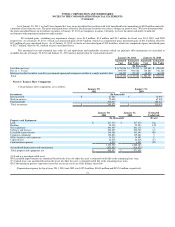

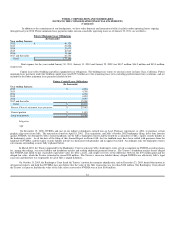

The elements of the License Agreement are accounted for as follows:

1. Legal settlement: In connection with the License Agreement, both parties agreed to settle all outstanding legal disputes. The fair value allocated to the

settlement of $57.0 million was recorded in the fourth quarter of fiscal year 2011, as a benefit to operating expense.

2..License to Intel: We will recognize $1,583.0 million in total, or $66.0 million per quarter, as revenue over the term of the agreement of six years, the

period over which Intel will have access to newly filed NVIDIA patents. We will commence recognition of the license revenue in April 2011 when our

performance obligation under the agreement begins. Consideration received in advance of the performance period will be classified as deferred

revenue.

3. License from Intel: We recognized $140.0 million as an intangible asset upon execution of the agreement. Amortization of $5.0 million per quarter will

be charged to cost of sales over the seven year estimated useful life of the technology beginning in April 2011.

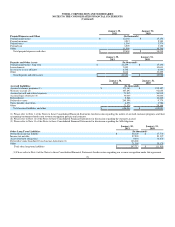

Fair Value Determination

In determining the estimated fair value of the elements of the License Agreement, we assumed the highest and best use of each element from a

market participant perspective. The inputs and assumptions used in our valuation included projected revenue, royalty rates, discount rates, useful lives and

income tax rates, among others. The development of a number of these inputs and assumptions in the model required a significant amount of management

judgment and is based upon a number of factors, including the selection of industry comparables, royalty rates, market growth rates and other relevant factors.

Changes in any number of these assumptions may have had a substantial impact on the estimated fair value of each element. These inputs and assumptions

represent management’s best estimate at the time of the transaction.

73