Mitsubishi 2015 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2015 Mitsubishi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Message from the Director in Charge of Corporate Planning & Finance

New test course at Mitsubishi Motors (Thailand) Groundbreaking ceremony at our new plant in Indonesia

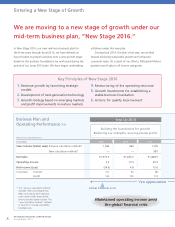

Maintaining and Increasing Investment in Line with

Our Growth Strategy

Capital Expenditures

0

50

100

150

2016

(Target)

2015

(Target)

2014

(Actual)

(Billions of yen)

(FY) (FY)

(Billions of yen)

68.0

105.0 100.0

R&D Expenditures

0

50

100

150

2016

(Target)

2015

(Target)

2014

(Actual)

74.6 82.0 84.5

MITSUBISHI MOTORS CORPORATION

Annual Report 2015 11

In scal 2014, Mitsubishi Motors generated approximately ¥180.0

billion in cash ow from operating activities. This high level was

thanks to the Company’s highest levels of pro ts to date.

First of all, we will apply this cash toward investments to real-

ize sustainable growth and enhanced corporate value through ini-

tiatives to reinforce and expand our business foundation. In scal

2014, we channeled capital expenditures of approximately ¥70.0

billion to Thailand, to augment and update production facilities

and in relation to new products, including a new model launch.

From scal 2015, we plan to increase capital expenditures by

around ¥100.0 billion per year. These funds will go toward new

products and reinforcing our production and sales structures in

emerging markets. In addition, we will invest in new test research

facilities for the development of future technologies, such as a test

course in Thailand and an environmental test building in Japan.

Separately from the capital expenditures mentioned above, we

have embarked on the construction of a new plant in Indonesia

as part of our emerging market strategy. Over the next two years,

we expect to invest approximately ¥30.0 billion for this plant.

In scal 2014, our R&D expenditures amounted to around

¥75.0 billion. As the upfront development of various core

technologies, including eco-car and safety technologies, has

become of increasing importance in new-car development, we

will expand our initiatives in this area.

Financially, we are strengthening shareholders’ equity and

curtailing interest-bearing debt. As a result, as of March 31, 2015,

our shareholders’ equity ratio was 41.6%, an improvement from

We are proactively making focused investments in

emerging markets, on enhancing product attractive-

ness and environmental initiatives.

Yutaka Tabata

Managing Director, Head Of cer of the Headquarters,

Corporate Planning & Finance Group Headquarters

the 35.0% recorded a year earlier. As the automobile industry is

susceptible to exchange rate uctuations as well as the external

environment, we will continue working to strengthen our nan-

cial base and are targeting a shareholders’ equity ratio of 50%.

We recognize the return of pro ts to shareholders as one

of our topmost management priorities going forward. In scal

2014, we did not award a special dividend commemorating our

resumption of dividends as we had in the preceding scal year,

but we raised the regular dividend by ¥1 per share, to ¥16.

The Company has made the stable return of pro ts to

shareholders one of its key principles going forward. Accord-

ingly, we will consider expanding dividend levels further, while

taking into overall account such factors as cash ow, operating

performance trends, the status of growth strategy implementa-

tion and the need to reinforce our nancial base.