Mitsubishi 2015 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2015 Mitsubishi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

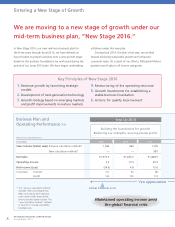

Operating Performance and Forecast

FY2013 (Actual) FY2014 (Actual) FY2015 (Forecast)

Sales Volume (Retail) 1,047 1,090 1,100

Net Sales 2,093.4 2,180.7 2,280.0

Operating Income 123.4 135.9 125.0

Operating Income Ratio

5.9% 6.2% 5.5%

Net Income* 104.7 118.2 100.0

Net Income Ratio 5.0% 5.4% 4.4%

In scal 2015, we expect to increase our sales volume in the

ASEAN region by 26,000 units against scal 2014 levels, buoyed

by the introduction of the new Pajero Sport and a full year of

sales of the new Triton, which we launched in scal 2014. We

also anticipate ongoing growth in overall demand in North Asia,

helping to augment sales volume for Asia as a whole by 34,000

units, or 10%, to 378,000 units. In Europe, we expect sales in

Russia to remain sluggish in scal 2015, due to the substantial

worsening of economic conditions in that country. In Western

Europe, on the other hand, we look forward to an increase led

by the introduction of the new Triton. For Europe as a whole,

we believe sales volume will fall year on year by 36,000 units,

or 16%, to 191,000 units. In North America, in the rst half

we will launch the new Outlander, achieving a solid increase in

product competitiveness. Helped by these sales, we anticipate

sales volume in North America of 128,000 units, up 11,000

units, or 9%. We forecast a decline in overall demand in Japan

for scal 2015, resulting in a decline of 8,000 units, or 7%

from the scal 2014 gure, to 107,000 units. In other regions,

we look to a year-on-year increase of 9,000 units, or 3%, to

296,000 units. Summing up our forecasts for all regions, in s-

cal 2015 we expect sales volume to amount to 1.1 million units,

up 10,000 units, or 1%.

Based on these sales volume forecasts, for scal 2015 we

expect to generate net sales of ¥2,280.0 billion, operating

income of ¥125.0 billion and pro t attributable to owners of

parent of ¥100.0 billion.

2015

(Target)

2014

(Actual)

Japan

Regional Sales Volume (Retail)

(Thousands of units)

(FY)

(Thousands of units)

(FY)

(Thousands of units)

(FY)

(Thousands of units)

(FY)

Registered

Vehicles

Minicars

2015

(Target)

2014

(Actual)

North America

United

States

Canada &

Mexico

2015

(Target)

2014

(Actual)

Europe

Western

Europe &

Others

Russia &

others

2015

(Target)

2014

(Actual)

Asia

North Asia

ASEAN

(Thousands of units)

(FY) 2015

(Target)

2014

(Actual)

Regions

Australia

& NZ

Latin

America

Middle East

& Africa

115

75

40

68

39

117

82

35

128

91

37

227

73

154

191

31

160

344

128

216

378

242

136

287

79

107

101

296

113

101

82

107

Message from Management

Forecasts for Fiscal 2015

* “Profit attributable to owners of parent” in fiscal 2015.

(Billions of yen, thousands of units)

MITSUBISHI MOTORS CORPORATION

Annual Report 2015

10