Mitsubishi 2010 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2010 Mitsubishi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

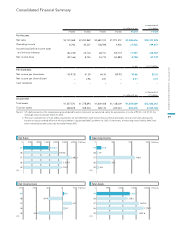

(¥ billion, units)

FY2009 Actual 1FY2010 Forecast 2Change 2 – 1

Net Sales 1,445.6 1,900.0 +454.4

Operating Income 13.9 45.0 +31.1

Ordinary Income 13.0 30.0 +17.0

Net Income 4.8 15.0 +10.2

Sales Volume (Retail) 96.0 112.1 +16.1

Assumed Forex Rate (Yen) USD 92

EUR 130

AUD 79

USD 90

EUR 120

AUD 82

Note: Sales volume figures exclude OEM supplies.

FY2010 Results Forecast Summary (vs. FY2009 Actual)

Performance Outlook

Aiming for Increases in Revenue and Profit with Increase in Sales Volume and

Further Cost Reductions

—Increase in sales volume will be driven by the new compact SUV

The Step Up 2010 mid-term business plan which we announced in February 2008 included an operating income

target of ¥90 billion in fiscal 2010, the final year of the plan.

However, the environment surrounding the automobile industry that we envisioned when formulating the plan

has changed significantly, and the bankruptcy of a major U.S. financial institution in September 2008 brought about

three serious problems for the Japanese automobile sector: a drastic decline in retail sales volume, the credit

crunch, and the appreciation of the yen. In conjunction with this dramatic change in the business environment, in

fiscal year 2008 we were unable to avoid a considerable decline in both sales and profits. Still, by taking emer-

gency measures in the face of the economic crisis, such as production cutbacks to reduce excess inventories and

implementing rigorous cost reductions, we were able to secure operating profit.

In fiscal 2009, we took steps to optimize inventories and accelerated shipments to recovering markets, in addi-

tion to carrying out thorough cost reduction initiatives. These activities led to a turnaround in the bottom line

despite a decline in sales, and we successfully achieved our initial target of returning to net profitability.

In fiscal 2010, we expect an increase in both sales and profits on the back of higher sales volume and enhanced

cost reductions, and have set an operating income target of ¥45 billion. Our current assumptions are much less

optimistic than at the time of the Step Up 2010 plan, as we are now assuming a roughly 300,000 unit decline in

sales volume and a ¥15 appreciation against the U.S. dollar. This will certainly result in profits undercutting our

forecasts in our Step Up 2010 mid-term business plan. Nonetheless, we will work to regain our footing through

such measures as curbing personnel expenses, reducing advertising expenditure, and further enhancing our cost

reduction programs, and expect operating income to recover to one-half of the ¥90 billion we set as an operating

income target for the last year of Step Up 2010.

We have seen a harsh business environment since the second half of fiscal 2008, but during this time we have

taken steps to enhance our business platform by bolstering our strengths. In fiscal 2010, we will improve profitabil-

ity by rolling out our new compact SUV around the globe as demand recovers, particularly in emerging countries,

which will lead to growth and a significant leap forward in fiscal 2011 and beyond.

08

MITSUBISHI MOTORS CORPORATION Annual Report 2010