Mercury Insurance 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 Mercury Insurance annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

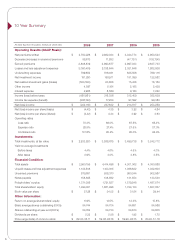

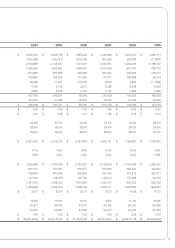

10 Year Summary

All dollar figures in thousands, except per share data 2008 2007 2006 2005

Operating Results (GAAP Basis):

Net premiums written $ 2,750,226 $2,982,024 $ 3,044,774 $ 2,950,523

Decrease (increase) in unearned premiums 58,613 11,85 3 (47,751) (102,790)

Earned premiums 2,808,839 2,993,877 2,997,023 2,847,733

Losses and loss adjustment expenses 2,060,409 2,036,644 2,021,646 1,862,936

Underwriting expenses 799,682 818,481 825,508 769,116

Net investment income 151,280 15 8,911 151,099 122,582

Net realized investment gains (losses) (550,520) 20,808 15,436 16,160

Other income 4,597 5,15 4 5,185 5,438

Interest expense 4,966 8,589 9,180 7,222

Income (loss) before taxes (450,861) 315,036 312,409 352,639

Income tax expense (benefit) ( 20 8,742 ) 77,204 97,592 99,380

Net (loss) income $ ( 242,119 ) $2 37, 8 3 2 $ 214,817 $ 253,259

Net (loss) income per share (basic) $ (4.42) $4.35 $ 3.93 $ 4.64

Net (loss) income per share (diluted) $ (4.42) $4.34 $ 3.92 $ 4.63

Operating ratios

Loss ratio 73.3% 68.0% 67.5% 65.4%

Expense ratio 28.5% 27.4 % 27.5% 27.0%

Combined ratio 101.8% 95.4% 95.0% 92.4%

Investments:

Total investments, at fair value $ 2,933,820 $3,588,675 $ 3,499,738 $ 3,242,712

Yield on average investments

Before taxes 4.4% 4.6% 4.5% 4.0%

After taxes 3.9% 4.0% 3.8% 3.5%

Financial Condition:

Total assets $ 3,950,195 $ 4,414,496 $ 4,301,062 $ 4,050,868

Unpaid losses and loss adjustment expenses 1,13 3,50 8 1,103,915 1,088,822 1,022,603

Unearned premiums 879,651 938,370 950,344 902,567

Notes payable 158,625 138,562 141,554 143,540

Policyholders’ surplus 1,371,095 1,721,827 1,579,248 1,487,574

Total shareholders’ equity 1,494,051 1,861,998 1,724,130 1,607,837

Book value per share $ 27. 2 8 $34.02 $ 31.54 $ 29.44

Other Information:

Return on average shareholders’ equity 6.9% 12.5% 12.3% 15.8%

Basic average shares outstanding (000’s) 54,74 4 54,704 54,651 54,566

Shares outstanding at year-end (000’s) 54,764 54,730 54,670 54,605

Dividends per share $ 2.32 $2.08 $ 1.92 $ 1.72

Price range (bids) of common stock $ 6 2. 0 0 -3 6.11 $59.06-48.76 $ 59.90-48.75 $ 60.45-51.16