Mercury Insurance 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Mercury Insurance annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Mapping out the Road Ahead 2008 Annual Report

Table of contents

-

Page 1

Mapping out the Road Ahead 2008 Annual Report -

Page 2

... that yields security for its policyholders and consistent returns for its shareholders. Total of $4.0 billion in assets 4.0 Agents Billion 4,700 Total of $1.5 billion in Shareholders' Equity Mercury finished 2008 with 4,700 independent insurance agents and brokers in 13 states 1.5 Billion -

Page 3

... for personal automobile insurance remained intense during 2008. Favorable underwriting results for the industry over the past several years has extended the duration of the soft market. One of the primary drivers of this trend has been lower loss frequency. However, we believe increases in claim... -

Page 4

...we put in place a new pricing plan, which improves our risk segmentation and increases overall rates by 5%. In addition, we have tightened our underwriting pro- cedures, made changes to our claims process for PIP and Bodily Injury coverage and continue to work with our agents to improve results. We... -

Page 5

...position. In January of 2009, we completed our purchase of AIS, a major producer of personal lines insurance in the state of California. AIS represented approximately 15% of Mercury's premium volume in 2008. We are pleased to report that the transition and integration efforts are going very smoothly... -

Page 6

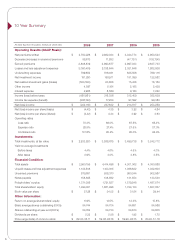

... STOCK (in dollars) COMBINED RATIO VS. INDUSTRY (in percent) Source for industry data: A.M. Best Company 120 70 60 50 40 30 20 10 0 99 00 01 02 03 04 05 06 07 08 120 100 80 60 40 20 0 99 00 01 02 03 04 05 06 07 08 Mercury General U.S. Industry OPERATING LEVERAGE (Net Premiums... -

Page 7

PREMIUMS WRITTEN (in millions) 3,500 3,000 2,500 2,000 1,500 1,000 500 0 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 NUMBER OF AGENTS/BROKERS 6,000 5,000 4,000 3,000 2,000 1,000 0 99 00 01 02 03 04 05 06 07 08 5 -

Page 8

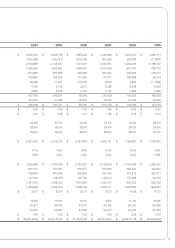

... 4.0% 3.5% $ 2,933,820 $ 3,588,675 $ 3,499,738 $ 3,242,712 Financial Condition: Total assets Unpaid losses and loss adjustment expenses Unearned premiums Notes payable Policyholders' surplus Total shareholders' equity Book value per share $ $ 3,950,195 1,133,508 879,651 158,625 1,371,095 1,494,051... -

Page 9

2004 $ 2,646,704 (118,068) 2,528,636 1,582,254 673,838 109,681 25,065 4,775 4,222 407,843 121,635 $ $ $ 286,208 5.25 5.24 62.6% 26.6% 89.2% $ $ $ $ 2003 2,268,778 (123,731) 2,145,047 1,452,051 564,609 104,520 11,207 4,743 3,056 245,801 61,480 184,321 3.39 3.38 67.7% 26.3% 94.0% $ $ $ $ 2002 1,865,... -

Page 10

... This Annual Report document includes Mercury General Corporation's financial statements and supporting data, management's discussion and analysis of financial condition and results of operations and quantitative and qualitative disclosures about market risks from the Company's Form 10-K filed with... -

Page 11

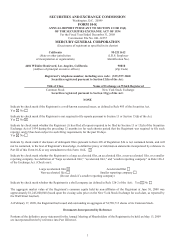

... December 31, 2008 Commission File No. 001-12257 MERCURY GENERAL CORPORATION (Exact name of registrant as specified in its charter) California (State or other jurisdiction of incorporation or organization) 4484 Wilshire Boulevard, Los Angeles, California (Address of principal executive offices) 95... -

Page 12

... in St. Petersburg, Florida and in Oklahoma City, Oklahoma, which house employees of the Company and several third party tenants. The Company maintains branch offices in a number of locations in California as well as branch offices in Richmond, Virginia; Latham, New York; Bridgewater, New Jersey... -

Page 13

... Production and Servicing of Business The Company sells its policies through approximately 4,700 independent agents and brokers, of which approximately 1,000 are located in each of California and Florida. The remainder are located in Georgia, Illinois, Texas, Oklahoma, New York, New Jersey, Virginia... -

Page 14

..., the Company offers mechanical breakdown insurance in many states outside of California and homeowners insurance in Florida, Illinois, Oklahoma, New York, Georgia, and Texas. Claims Claims operations are conducted by the Company. The claims staff administers all claims and directs all legal and... -

Page 15

... development from these years relates primarily to increases in loss severity estimates and defense and cost containment expense estimates for the California Bodily Injury coverage as well as increases in the provision for losses in New Jersey. See "Critical Accounting Estimates-Reserves" in "Item... -

Page 16

..., auto parts and body shop labor costs. Operating Ratios Loss and Expense Ratios Loss and underwriting expense ratios are used to interpret the underwriting experience of property and casualty insurance companies. Under SAP, losses and loss adjustment expenses are stated as a percentage of premiums... -

Page 17

... similar lines where differences in risk may be related to corporate structure, investment policies, reinsurance arrangements and a number of other factors. Based on the formula adopted by the NAIC, the Company has calculated the risk-based capital requirements of each of the Insurance Companies as... -

Page 18

...and Investment Results General The Company's investments are directed by the Company's Chief Investment Officer under the supervision of the Company's Board of Directors. The Company follows an investment policy that is regularly reviewed and revised. The Company's policy emphasizes investment grade... -

Page 19

...value option were included in net realized investment losses and gains. Competitive Conditions The property and casualty insurance industry is highly competitive and consists of a large number of multi-state competitors offering automobile, homeowners, commercial property insurance, and other lines... -

Page 20

... a "good driver." The Company's rate plan was approved by the California DOI and operates under these rating factor regulations. Insurance rates in Georgia, New York, New Jersey, Pennsylvania and Nevada require prior approval from the state DOI, while insurance rates in Illinois, Texas, Virginia... -

Page 21

... that was established to provide a market for earthquake coverage to California homeowners. The Company places all new and renewal earthquake coverage offered with its homeowners policy through the CEA. The Company receives a small fee for placing business with the CEA, which was recorded... -

Page 22

... the provisions of which are substantially similar to those of the Holding Company Act. Assigned Risks Automobile liability insurers in California are required to sell bodily injury liability, property damage liability, medical expense and uninsured motorist coverage to a proportionate number (based... -

Page 23

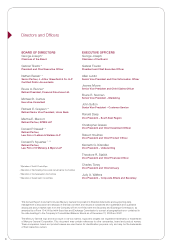

... Product Manager at Progressive Insurance Company from 1999 to 2005. Mr. Kitzmiller, Vice President-Underwriting, has been employed by the Company in the underwriting department since 1972. In 1991, he was appointed Vice President of Underwriting of Mercury General and has supervised the California... -

Page 24

... may emerge. These issues may adversely affect the Company's business by either extending coverage beyond its underwriting intent or by increasing the number or size of claims. In some instances, these changes may not become apparent until some time after the Company has issued insurance policies... -

Page 25

...relative to those of the Company's competitors, its ability to market products to new customers and to renew the policies of current customers could be harmed. A lowering of the ratings could also limit the Company's access to the capital markets or adversely affect pricing of new debt sought in the... -

Page 26

..., and create a consistently high level of customer satisfaction. If these independent agents find it preferable to do business with the Company's competitors, it would be difficult to renew the Company's existing business or attract new business. State regulations may also limit the manner in which... -

Page 27

... on its results of operations. The Company faces a significant risk of loss in the ordinary course of its business for property damage resulting from natural disasters, man-made catastrophes and other catastrophic events, particularly hurricanes, earthquakes, hail storms, explosions, tropical storms... -

Page 28

... of its business, including underwriting, policy acquisition, claims processing and handling, accounting, reserving and actuarial processes and policies, and to maintain its policyholder data. The Company is developing and deploying new information technology systems that are designed to manage many... -

Page 29

... new employees, and retain current employees to handle the resulting increase in new inquiries, policies, customers and claims. The failure of the Company to successfully hire and retain a sufficient number of skilled employees could result in the Company having to slow the growth of its business... -

Page 30

... settlements, increasing the Company' s legal costs, diverting management attention from other business issues or harming the Company' s reputation with customers. Such litigation is inherently unpredictable. The Company and its insurance subsidiaries are named as defendants in a number of lawsuits... -

Page 31

... medical care. Increased litigation of claims, particularly those involving allegations of bad faith or seeking extra contractual and punitive damages, may also adversely affect loss costs. The insurance industry is subject to extensive regulation, which may affect the Company's ability to execute... -

Page 32

... a market. For example, these states may limit a private passenger auto insurer' s ability to cancel and non-renew policies or they may prohibit the Company from withdrawing one or more lines of insurance business from the state unless prior approval is received from the state insurance department... -

Page 33

... these assessments and mandatory shared-market mechanisms or changes in them could reduce the Company's profitability in any given period or limit its ability to grow its business. Loss or significant restriction of the use of credit scoring in the pricing and underwriting of personal lines products... -

Page 34

... 100% * Location Brea, CA Los Angeles, CA Rancho Cucamonga, CA St. Petersburg, FL Oklahoma, OK Folsom, CA Purpose Home office and I.T. facilities (2 buildings) Executive offices Administrative Administrative Administrative Administrative and Data Center * The building has been occupied by Company... -

Page 35

... Range of Common Stock The Company' s common stock is traded on the New York Stock Exchange (symbol: MCY). The following table shows the high and low sales price per share in each quarter during the past two years as reported in the consolidated transaction reporting system. 2008 1st Quarter 2nd... -

Page 36

...31 89.53 The peer group consists of Ace Limited, Alleghany Corporation, Allstate Corporation, American Financial Group, Berkshire Hathaway, Chubb Corporation, Cincinnati Financial Corporation, CNA Financial Corporation, Erie Indemnity Company, Hanover Insurance Group, HCC Insurance Holdings, Markel... -

Page 37

... laws. The Company is headquartered in Los Angeles, California and operates primarily as a personal automobile insurer selling policies through a network of independent agents and brokers in thirteen states. The Company also offers homeowners insurance, mechanical breakdown insurance, commercial and... -

Page 38

...increasing rates. Rate increases generally indicate that the market is hardening. Revenues, Income and Cash Generation The Company generates its revenues through the sale of insurance policies, primarily covering personal automobiles and homeowners. These policies are sold through independent agents... -

Page 39

... to help support growth. Opportunities, Challenges and Risks The Company currently underwrites personal automobile insurance in thirteen states: Arizona, California, Florida, Georgia, Illinois, Michigan, Nevada, New Jersey, New York, Oklahoma, Pennsylvania, Texas and Virginia. The Company expects to... -

Page 40

... rate changes varies by state, with California, Georgia, New York, New Jersey, Pennsylvania and Nevada requiring prior approval from the DOI before a rate may be implemented. Illinois, Texas, Virginia, Arizona and Michigan only require that rates be filed with the DOI, while Oklahoma and Florida... -

Page 41

... that a portion of management fee expenses paid by Mercury Insurance Services, LLC should be disallowed. Based on these assertions, the FTB has issued notices of proposed tax assessments for the 2001, 2002 and 2004 tax years totaling approximately $5 million. The Company strongly disagrees with the... -

Page 42

.... The Company's BI policy covers injuries sustained by any person other than the insured, except in the case of uninsured and underinsured motorist BI coverage, which covers damages to the insured for BI caused by uninsured or underinsured motorists. BI payments are primarily for medical costs and... -

Page 43

... trend in the total number of claims reported is reflective of declining loss frequencies and a decline in the number of insurance policies issued. During 2008, the Company experienced a large increase in the average cost paid on claims that closed within the 2008 accident period. Only between... -

Page 44

... New Jersey bodily injury claims. New Jersey is a no-fault state, which means that the majority of medical costs are paid directly by a policyholder's insurance company rather than by the insurance company of the person who was at-fault in the accident. This coverage is known as personal injury... -

Page 45

... its exposure to extra-contractual claims in Florida and increased its reserve estimates for prior accident years. To mitigate this specific risk, during 2006 the Company established new claims handling and review procedures in Florida, as well as in other states, that are intended to reduce... -

Page 46

.... The Company is now using its own historical data, rather than industry data to set New Jersey loss reserves. Management believes that, over time this will lead to less variation in reserve estimates. Premiums The Company complies with SFAS No. 60, "Accounting and Reporting by Insurance Enterprises... -

Page 47

...into a sale-leaseback transaction using one or more properties of its appreciated real estate holdings. Finally, the Company has an established history of generating capital gain premiums earned through its common stock call option program. Based on the continued existence of the options market, the... -

Page 48

...the establishment of the product management function; and approximately $2 million of AIS acquisition-related expenses. The combined ratio of losses and expenses (GAAP basis) is the key measure of underwriting performance traditionally used in the property and casualty insurance industry. A combined... -

Page 49

...in New Jersey and Florida, which were experiencing significant competition. The decrease was partially offset by a slight increase in the average premium collected per policy. During 2007, the Company implemented no rate changes in California. In states outside of California, the Company implemented... -

Page 50

... for the Insurance Companies are premiums, sales and maturity of invested assets and dividend and interest income from invested assets. The principal uses of funds for the Insurance Companies are the payment of claims and related expenses, operating expenses, dividends to Mercury General and the... -

Page 51

..., 2008: Amortized cost Fair value (Amounts in thousands) Fixed maturity securities: U.S. government bonds and agencies States, municipalities and political subdivisions Mortgage-backed securities Corporate securities Redeemable preferred stock Equity securities: Common stock: Public utilities Banks... -

Page 52

... 31, 2008 at fair value: December 31, 2008 (Amounts in thousands) AAA U.S. government bonds and agencies: Treasuries Government Agency Total Municipal securities: Insured * Uninsured Total Mortgage-backed securities: Agencies Non-agencies: Prime Alt-A Total Corporate securities: Communications... -

Page 53

...-to-value ratios or limited supporting documentation. The average rating of the Company's Alt-A mortgages is AA and the average rating of the entire mortgage backed securities portfolio is AAA. The valuation of these securities is based on Level 2 inputs that can be observed in the market. Corporate... -

Page 54

...of change. In February 2008, the Company acquired an 88,300 square foot office building in Folsom, California for approximately $18.4 million. The Company financed the transaction through an $18 million secured bank loan. The loan matures on March 1, 2013 with interest payable quarterly at an annual... -

Page 55

..., the building has been occupied by the Company's Northern California employees. The Company financed the transaction through an $18 million secured bank loan. The NextGen project began in 2002 and total capital investment has been approximately $41 million as of December 31, 2008. The Mercury First... -

Page 56

... and returns. The Company manages exposures to market risk through the use of asset allocation, duration, credit ratings, and value-atrisk limits. Asset allocation limits place restrictions on the total funds that may be invested within an asset class. Duration limits on the fixed maturities... -

Page 57

...AIS; the Company's success in managing its business in states outside of California; the impact of potential third party "bad-faith" legislation, changes in laws or regulations, tax position challenges by the California Franchise Tax Board, and decisions of courts, regulators and governmental bodies... -

Page 58

...; changes in driving patterns and loss trends; acts of war and terrorist activities; court decisions and trends in litigation and health care and auto repair costs; adverse weather conditions or natural disasters in the markets served by the Company; the stability of the Company' s information... -

Page 59

...Reports of Independent Registered Public Accounting Firm Consolidated Financial Statements: Consolidated Balance Sheets as of December 31, 2008 ...31, 2008 Consolidated Statements of Comprehensive (Loss) Income for Each of the Years in the Three-Year Period Ended December 31, 2008 Consolidated ... -

Page 60

... also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Mercury General Corporation' s internal control over financial reporting as of December 31, 2008, based on criteria established in Internal Control - Integrated Framework issued by... -

Page 61

...' equity and comprehensive (loss) income, and cash flows for each of the years in the three-year period ended December 31, 2008, and our report dated February 27, 2009 expressed an unqualified opinion on those consolidated financial statements. /s/ KPMG LLP Los Angeles, California February 27, 2009... -

Page 62

...; $13,126) Short-term investments, at fair value in 2008; at cost in 2007 (cost $208,278 in 2008) Total investments Cash Receivables: Premiums receivable Premium notes Accrued investment income Other Total receivables Deferred policy acquisition costs Fixed assets, net Current income taxes Deferred... -

Page 63

..., except per share data) 2008 Revenues: Net premiums earned Net investment income Net realized investment (losses) gains Other Total revenues Expenses: Losses and loss adjustment expenses Policy acquisition costs Other operating expenses Interest Total expenses (Loss) Income before income taxes... -

Page 64

... period Income tax benefit related to reclassification adjustment for net gains included in net income Comprehensive (loss) income, net of tax $ 2008 (242,119) $ (1,348) (1,348) (472) (242,995) $ 2007 237,832 25,583 (8,800) 16,783 8,958 $ 2006 214,817 12,144 (7,373) 4,771 4,248 (2,580) 217,920... -

Page 65

... of stock options exercised Share-based compensation expense Tax benefit on sales of incentive stock options Common stock, end of year Accumulated other comprehensive income, beginning of year Net increase (decrease) in other comprehensive income, net of tax Accumulated other comprehensive (loss... -

Page 66

... of stock options Decrease (increase) in premiums receivable Decrease (increase) in premiums notes receivable Decrease (increase) in deferred policy acquisition costs Increase in unpaid losses and loss adjustment expenses (Decrease) increase in unearned premiums (Decrease) increase in liability... -

Page 67

... independent agents and brokers in thirteen states. The Company also offers homeowners insurance, commercial automobile and property insurance, mechanical breakdown insurance, commercial and dwelling fire insurance and umbrella insurance. The private passenger automobile lines of insurance exceeded... -

Page 68

..., of the Company's direct premiums written. Effective January 1, 2009, MCC acquired all of the membership interests of AIS Management LLC, a California limited liability company, which is the parent company of AIS and PoliSeek AIS Insurance Solutions, Inc. Premium Notes Premium notes receivable... -

Page 69

...ultimately affect the final settlement of a claim and, therefore, the reserve that is required. Changes in the regulatory and legal environment, results of litigation, medical costs, the cost of repair materials or labor rates can impact ultimate claim costs. In addition, time can be a critical part... -

Page 70

Depreciation and Amortization Buildings are stated at the lower of cost or fair value and depreciated on a straight line basis over 30 years. Furniture and equipment and purchased software are stated at cost and depreciated on a combination of straight-line and accelerated methods over 3 to 10 years... -

Page 71

... performance. The Company does not have any operations that require separate disclosure as reportable operating segments for the periods presented. The annual direct premiums written attributable to private passenger and commercial automobile, homeowners and other lines of insurance were as follows... -

Page 72

... value of a financial asset when the market for that financial asset is not active. Such considerations include inputs to broker quotes, assumptions regarding future cash flows and use of risk-adjusted discount rates. The adoption of FSP FAS No. 157-3 did not have a material impact on the Company... -

Page 73

...-term investments Total investment income Investment expense Net investment income $ $ Realized Investment Gains and Losses Effective January 1, 2008, the losses due to changes in fair value for items measured at fair value pursuant to the Company' s election of the fair value option are included... -

Page 74

... $2.0 million gain and $1.4 million loss related to the change in the fair value of trading securities and hybrid financial instruments, respectively. Gross gains and losses realized on the sales of investments (excluding calls) are shown below: Year ended December 31, 2008 2007 2006 (Amounts in... -

Page 75

... 2006 Effective January 1, 2008, the Company adopted SFAS No. 159. The gains and losses due to changes in fair value for items measured at fair value pursuant to election of the fair value option were included in net realized investment losses for 2008. A summary of the net increase and decrease in... -

Page 76

... broker quotes are obtained and less than 1% for which management performed discounted cash flow modeling. Level 1 Measurements U.S. government bonds and agencies: U.S. treasuries and agencies are priced using unadjusted quoted market prices for identical assets in active markets. Common stock... -

Page 77

...-backed securities Corporate securities Redeemable preferred stock Equity securities: Common stock: Public utilities Banks, trusts and insurance companies Industrial and other Non-redeemable preferred stock Short-term investments Derivative contracts Total assets at fair value Liabilities Notes... -

Page 78

...follows: Gross Unrealized Gains $ Gross Unrealized Losses Amortized Cost U.S. government bonds and agencies Municipal securities Mortgage-backed securities Corporate securities Redeemable preferred stock Total $ 36,157 2,435,215 227,606 126,272 2,079 Estimated Fair Value $ 36,375 2,464,541 227,575... -

Page 79

... for by unrealized losses of fixed maturity securities, and amounted to 0.3% of the total investment market value at December 31, 2007. Contractual Maturity At December 31, 2008, bond holdings rated below investment grade or non rated were 3.6% of total investments at fair value. Additionally, the... -

Page 80

...,562 Unsecured senior notes Secured promissory note Total $ $ In February 2008, the Company acquired an 88,300 square foot office building in Folsom, California for approximately $18.4 million. The Company financed the transaction through an $18 million bank loan. On January 2, 2009, the loan was... -

Page 81

... possession of the property at December 31, 2008. The aggregated maturities for notes payable are as follows: Year 2009 2010 2011 2012 2013 Maturity $ $ $ $ $ 125,000,000 120,000,000 18,000,000 (6) Income Taxes Income tax provision The Company and its subsidiaries file a consolidated federal income... -

Page 82

... Deferred acquisition costs Tax liability on net unrealized gain on securities carried at fair value Tax depreciation in excess of book depreciation Accretion on bonds Undistributed earnings of insurance subsidiaries Accounting method transition adjustments Other deferred tax liabilities Total gross... -

Page 83

... through 2007 for California state taxes. On July 1, 2008, the California Superior Court ruled in favor of the Company in a case filed against the California FTB for tax years 1993 through 1996, entitling the Company to a tax refund of $24.5 million, including interest. The time period for appeal... -

Page 84

...in the provision for insured events of prior years in 2006 relates largely to the unexpected development of several large extra-contractual claims in the state of Florida and increases in reserve estimates for the bodily injury and personal injury protection coverages in New Jersey. In 2008 and 2007... -

Page 85

...losses) gains from sale of investments $ $ $ In 2007, the Company issued a promissory note of $4.5 million in connection with the acquisition of a 4.25 acre parcel of land in Brea, California. The note was paid in full in December 2008. (10) Statutory Balances and Accounting Practices The Insurance... -

Page 86

... deduction from option exercises of the share-based payment awards totaled $121,000, $273,000 and $505,000 during 2008, 2007 and 2006, respectively. The fair value of stock option awards was estimated using the Black-Scholes option pricing model with the following grant-date assumptions and weighted... -

Page 87

...88 to 58.83 513,200 6.2 Options Exercisable Weighted Avg. Exercise Price $ 24.00 $ 48.33 Weighted Avg. Number Exercisable Exercise Price 18,245 $ 24.00 258,100 $ 45.03 As of December 31, 2008, $1,457,000 of total unrecognized compensation cost related to non-vested stock options is expected to be... -

Page 88

... situated v. Mercury Insurance Company (Los Angeles Superior Court), filed June 16, 2002, the Plaintiff is challenging the Company' s use of certain automated database vendors to assist in valuing claims for medical payments alleging that they systematically undervalue medical payment claims to the... -

Page 89

... interests of AIS Management LLC, which is the parent company of AIS and PoliSeek AIS Insurance Solutions, Inc. AIS is a major producer of automobile insurance in the state of California and the Company's largest independent broker producing over $400 million of direct premiums written, which... -

Page 90

... their fair values at the acquisition date. The following table summarizes the consideration paid for AIS and the preliminary allocation of the purchase price. January 1, 2009 (Amounts in thousands) Consideration Cash Fair value of total consideration transferred Acquisition-related costs Recognized... -

Page 91

..., is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission rules and forms, and that such information is accumulated and communicated to the Company' s management, including its Chief Executive Officer and Chief Financial Officer, as... -

Page 92

... Executive Officers of the Registrant Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions Principal Accounting Fees and Services Information regarding executive officers of the Company... -

Page 93

... Company of Florida. 10.27(16) Management Agreement dated January 22, 1997 between Mercury County Mutual Insurance Company (formerly known as Elm County Mutual Insurance Company and Vesta County Mutual Insurance Company) and Mercury Insurance Services, LLC (as successor in interest). 10.28* Director... -

Page 94

... March 31, 2006, and is incorporated herein by this reference. (23) This document was filed as an exhibit to Registrant' s Form 10-Q for the quarterly period ended September 30, 2008, and is incorporated herein by this reference. *Denotes management contract or compensatory plan or arrangement. 84 -

Page 95

...on the dates indicated. Signature /s/ GEORGE JOSEPH George Joseph /s/ GABRIEL TIRADOR Gabriel Tirador /s/ THEODORE STALICK Theodore Stalick Title Chairman of the Board Date February 27, 2009 President and Chief Executive Officer and Director (Principal Executive Officer) Vice President and Chief... -

Page 96

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 97

... The Board of Directors Mercury General Corporation: Under date of February 27, 2009, we reported on the consolidated balance sheets of Mercury General Corporation and subsidiaries as of December 31, 2008 and 2007, and the related consolidated statements of operations, comprehensive (loss) income... -

Page 98

... bonds and agencies Municipal securities Mortgage-backed securities Corporate securities Redeemable preferred stock Total fixed maturity securities Equity securities: Common stock: Public utilities Banks, trust and insurance companies Industrial, miscellaneous and all other companies Non-redeemable... -

Page 99

... bonds and agencies Municipal securities Mortgage-backed securities Corporate securities Redeemable preferred stock Total fixed maturity securities Equity securities: Common stock: Public utilities Banks, trust and insurance companies Industrial, miscellaneous and all other companies Non-redeemable... -

Page 100

... II MERCURY GENERAL CORPORATION CONDENSED FINANCIAL INFORMATION OF REGISTRANT BALANCE SHEETS December 31, 2008 2007 (Amounts in thousands) ASSETS Investments: Fixed maturities available for sale, at fair value (amortized cost $961) Fixed maturities trading, at fair value (amortized cost $576... -

Page 101

..., Continued MERCURY GENERAL CORPORATION CONDENSED FINANCIAL INFORMATION OF REGISTRANT STATEMENTS OF INCOME Three years ended December 31, 2008 Revenues: Net investment income Net realized investment losses Total Revenues Expenses: Other operating expenses Interest Total expenses Loss before income... -

Page 102

SCHEDULE II, Continued MERCURY GENERAL CORPORATION CONDENSED FINANCIAL INFORMATION OF REGISTRANT STATEMENTS OF CASH FLOWS Three years ended December 31, 2008 Cash flows from operating activities: Net cash provided by (used in) operating activities Cash flows from investing activities Capital ... -

Page 103

... American Mercury MGA, Inc. Concord Insurance Services, Inc. Mercury County Mutual Insurance Company Mercury Insurance Company of Florida Mercury Indemnity Company of America Mercury Group, Inc. The method of allocation between the companies is subject to agreement approved by the Board of Directors... -

Page 104

SCHEDULE IV MERCURY GENERAL CORPORATION REINSURANCE Three years ended December 31, Property and Liability insurance earned premiums Ceded to Other Companies Assumed (Amounts in thousands) $ $ $ 3,801 4,119 11,092 $ $ $ 2,270 1,069 1,108 $ $ $ Direct Amount Net Amount 2008 2007 2006 $ $ $ 2,810,... -

Page 105

...website at www.mercuryinsurance.com. CORPORATE COUNSEL Latham & Watkins LLP Los Angeles, California CORPORATE CERTIFICATIONS The Company has included as Exhibit 31 to its 2008 Annual Report on Form 10-K/A filed with the Securities and Exchange Commission certificates of its Chief Executive Officer... -

Page 106

www.mercuryinsurance.com