Mattel 1999 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 1999 Mattel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

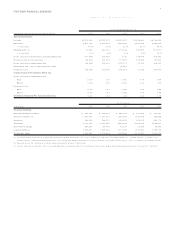

Mattel, Inc. and Subsidiaries

Buy Sell

Weighted Weighted

Contract Average Fair Contract Average Fair

( In thousands of US dollars) Amount Contract Rate Value Amount Contract Rate Value

1999

Euro $ 92,4 4 5 1.0 1 $ 9 0 ,92 2 $2 5 3,09 6 1.05 $2 44,44 8

British pounds sterling 6,3 1 6 1.6 1 6,33 2 1 6 ,6 7 9 1.6 5 1 6 ,433

Canadian dollar 7,6 0 4 1.4 5 7,61 9 4 0 ,6 7 9 .68 4 1 ,4 9 8

Japanese yen – – – 19 ,4 1 2 11 6 1 9 ,5 5 7

Australian dollar – – – 8,4 3 8 .64 8 ,661

Swiss franc 1 4 ,8 9 3 1.5 8 1 4 ,798– – –

Indonesian rupiah 19 ,4 5 5 7,67 6 2 0 ,9 98– – –

Singapore dollar – – – 4,0 6 6 1.6 8 4,09 1

Thai bhat 3,9 9 0 39.59 4 ,207 – – –

$1 4 4 ,7 0 3 $1 4 4 ,8 7 6 $342,3 7 0 $334,6 8 8

1998

German mark $ 19,11 9 1.67 $ 1 8 ,9 8 4 $ 1 4 4 ,6 60 1.6 8 $ 1 4 5 ,688

Italian lira 20,01 4 1,7 6 4 .00 21,15 5 6 8 ,3 5 8 1,660.00 6 7 ,9 5 0

Hong Kong dollar 55 ,8 2 9 8.0 2 5 7 ,790– – –

French franc 27 ,4 3 5 5.6 2 2 7 ,536 9,1 0 5 5.8 2 9,4 7 9

British pounds sterling 6,5 4 8 0.6 0 6,41 5 6 6 ,8 5 6 0.6 1 6 6 ,950

Canadian dollar 16 ,1 4 4 1.5 5 1 6 ,545 18,79 4 1.46 1 8 ,1 1 9

Spanish peseta 5,6 2 5 1 4 2 .30 5,5 7 7 2,8 9 9 1 4 8 .23 2,9 9 7

Dutch guilder 5,07 9 1.89 5 ,050 8 ,0 86 1.96 8,3 4 2

Japanese yen – – – 12 ,5 0 1 1 1 6 .00 12,75 9

Australian dollar 4,9 8 8 1.6 6 5,26 8 2 1 ,6 1 0 1.5 8 2 1 ,732

Belgian franc – – – 11 ,6 4 1 35.4 6 1 1 ,8 7 1

Swiss franc 1 8 ,3 4 1 1.3 7 1 8 ,251– – –

Mexican peso – – – 22 ,0 0 0 10.0 2 2 1 ,9 5 6

Indonesian rupiah 10 ,0 0 0 15 ,7 2 0 .50 19,18 3 – – –

Singapore dollar – – – 3,9 6 2 1.6 4 3,94 3

Brazilian real – – – 2 ,5 00 1.2 5 2,5 5 4

$1 8 9 ,1 2 2 $2 0 1 ,7 5 4 $392,9 7 2 $394,3 4 0

General

Mattel is also involved in various other litigation and legal matters, including claims related

to intellectual property, product liability and labor, which Mattel is addressing or defending

in the ordinary course of business. Management believes that any liability which may

potentially result upon resolution of such matters will not have a material adverse effect

on Mattel’s business, financial condition or results of operations.

Commitments

In the normal course of business, Mattel enters into contractual arrangements for

future purchases of goods and services to ensure availability and timely delivery,

and to obtain and protect Mattel’s right to create and market certain products. These

arrangements include commitments for future inventory purchases and royalty pay-

ments. Certain of these commitments routinely contain provisions for guaranteed

or minimum expenditures during the term of the contracts.

As of December 31, 1 99 9, the Operations segment had outstanding commit-

ments for 20 00 purchases of inventory of approximately $9 2 million. Licensing and

similar agreements with terms extending through 2 00 7 contain provisions for future

guaranteed minimum payments aggregating approximately $3 46 million.

Foreign Currency Risk

Mattel’s results of operations and cash flows can be impacted by exchange rate

fluctuations. To limit the exposure associated with exchange rate movements, Mattel

enters into foreign currency forw ard exchange and option contracts primarily to hedge

its purchase of inventory, sales and other intercompany transactions denominated in

foreign currencies. Mattel’s results of operations can also be affected by the transla-

tion of foreign revenues and earnings into US dollars.

Market risk exposures exist with respect to the settlement of foreign currency

transactions during the year because currency fluctuations cannot be predicted with

certainty. Mattel seeks to mitigate its exposure to market risk by monitoring its

currency exchange exposure for the year and partially or fully hedging such exposure.

In addition, Mattel manages its exposure through the selection of currencies used for

foreign borrowings and intercompany invoicing. Mattel does not trade in financial

instruments for speculative purposes.

Mattel’s foreign currency forward exchange contracts that were used to hedge

firm foreign currency commitments as of December 31 , 1 99 9 and 19 98 are shown in

the following table.

These contracts generally mature within 18 months from the date of execution.

Contracts outstanding at year-end mature during the next 13 months. All contracts

are against the US dollar and are maintained by reporting units with a US dollar

functional currency, with the exception of the Indonesian rupiah contracts that are

maintained by an entity with a rupiah functional currency.

For the purchase of foreign currencies, fair value reflects the amount, based

on dealer quotes, that Mattel would pay at maturity for contracts involving the same

currencies and maturity dates, if they had been entered into as of year-end 19 99 and

19 98 . For the sale of foreign currencies, fair value reflects the amount, based on dealer

quotes, that Mattel would receive at maturity for contracts involving the same currencies

and maturity dates, if they had been entered into as of year-end 19 99 and 19 98 . The dif-

ferences between the fair value and the contract amounts are expected to be fully offset by

foreign currency exchange gains and losses on the underlying hedged transactions.