Mattel 1999 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 1999 Mattel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

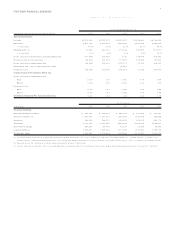

Mattel, Inc. and Subsidiaries

Total long-term debt remained approximately the same at year end 1 99 9 com-

pared to year end 1 99 8. Although $3 01 .0 million of the senior notes are maturing in

20 00 , they have been classified as long-term in the consolidated balance sheet at

December 31 , 1999 since management has the ability and intent to repay these obliga-

tions upon maturity with proceeds from the issuance of other long-term debt instruments.

Despite the recent rating agency downgrades of Mattel’s long-term debt, Mattel’s long-

term debt rating continues to be investment grade and the downgrades are not expected

to impact Mattel’s ability to access the capital markets to implement the refinancing.

However, the rating agency downgrades will have a negative impact on the pricing spread

over the Treasury rates and could cause Mattel to pay a slightly higher interest rate on the

issued debt than it otherwise would have paid. Mattel expects to satisfy its future long-

term capital needs through the retention of corporate earnings and the issuance of long-

term debt instruments. In November 1 99 8, Mattel filed its current universal shelf regis-

tration statement allowing it to issue up to $ 40 0.0 million of debt and equity securities,

all of which was available to be issued as of December 31 , 1 99 9. Stockholders’ equity

of $2 .0 billion at year end 1 99 9 decreased $2 08 .1 million from year end 1998, primar-

ily due to dividend declarations on common and preferred stock, Mattel’s net loss position

due to restructuring and other nonrecurring charges, treasury stock purchases and unfavor-

able effect of currency translation adjustments, partially offset by cash received from exer-

cise of employee stock options.

Liquidity and Capital Resources

Mattel’s primary sources of liquidity over the last three years have been cash on hand at

the beginning of the year, cash flows generated from operations, long-term debt

issuances and short-term seasonal borrowings. Operating activities generated cash flows

of $5 8.6 million during 19 99 , compared to $5 71 .7 million in 1 99 8 and $5 03 .4 mil-

lion in 19 97 . The decrease in cash flows from operating activities in 1999 is largely

due to the negative impact of Learning Company’s results.

Mattel invested its cash flows during the last three years mainly in the acquisitions

of Pleasant Company, Sofsource, Inc., Bluebird and Mindscape, Inc., additions to tooling in

support of new products, and construction of new manufacturing facilities.

Mattel received cash flows from its short-term borrowings, which was primarily

used to support operating activities. Mattel also received cash flows from the issuance

of Senior Notes in 19 98 , and Medium-Term Notes and Softkey warrants in 19 98 and

19 97 . Cash received from these debt issuances was used to fund the 19 98 acquisi-

tions of Pleasant Company, Mindscape, Inc. and Bluebird, to retire higher-cost debt and

to support operating activities. In 1 99 9, Mattel repaid $ 30 .0 million of its Medium-

Term Notes. In 19 98 , Mattel repaid the long-term debt and mortgage note assumed

as part of the Pleasant Company acquisition. In 1 99 7, Mattel redeemed the 10 -1/ 8%

Notes assumed as part of the acquisition of Tyco and repaid its 6 -7/ 8% Senior Notes

upon maturity. Cash was also spent during the last three years to purchase treasury

stock to provide shares for issuance under Mattel’s employee stock option plans and

the exercise of outstanding warrants. In addition, over the last three years, Mattel has

consistently increased its cash payments for dividends on its common stock. The pay-

ment of any dividends in the future is at the discretion of Mattel’s board of directors.

Seasonal Financing

Mattel expects to finance its seasonal working capital requirements for the coming

year by using existing and internally generated cash, issuing commercial paper and

selling certain trade receivables under its commited revolving credit facility and using

various short-term bank lines of credit. Mattel’s domestic committed unsecured credit

facility provides up to a total of $1 .0 billion in short-term borrow ings from a commer-

cial bank group. This facility provides for up to $7 00 .0 million in advances and back-

up for commercial paper issuances, and up to an additional $3 00 .0 million for nonre-

course purchases of certain trade accounts receivable by the bank group over the next

three years. Under its domestic credit facility, Mattel is required to meet financial

covenants for consolidated debt-to-capital and interest coverage. Currently Mattel is in

compliance w ith such covenants.

Mattel is currently in the process of negotiating a 36 4 day, $4 00 million

companion facility to its existing $ 1.0 billion credit facility, with essentially the same

group of commercial banks. The terms and conditions of the companion facility will

be similar to the existing $ 1.0 billion credit facility. Mattel expects to have the com-

panion facility in place by the end of April 20 00 .

Mattel also expects to have approximately $3 70 million of individual short-

term foreign credit lines with a number of banks available in 200 0, which will be used

as needed to finance seasonal working capital requirements of certain foreign affiliates.

Business Combinations

Mattel and Learning Company completed the following business combinations during

the last three years. Each transaction has been accounted for as a pooling of inter-

ests, which means the companies involved in the transaction are treated as if they

had always been combined for accounting and financial reporting purposes.

In May 1 99 9, Mattel completed its merger with Learning Company, after

which Learning Company was merged with and into Mattel, with Mattel being the sur-

viving corporation. Each share of Learning Company Series A Preferred Stock was

then converted into 20 shares of Learning Company common stock immediately prior

to the consummation of the merger. Pursuant to the merger agreement, each out-

standing share of Learning Company common stock was converted into 1.2 shares of

Mattel common stock upon consummation of the merger. As a result, approximately

12 6 million Mattel common shares were issued in exchange for all shares of Learning

Company common stock outstanding as of the merger date. The outstanding share of

Learning Company special voting stock was converted into one share of Mattel

Special Voting Preferred Stock. Each outstanding exchangeable share of Learning

Company’s Canadian subsidiary, Softkey Software Products Inc., remains outstanding,

but upon consummation of the merger became exchangeable for 1.2 shares of Mattel

common stock.

In August 1 99 8, Learning Company completed its merger with Broderbund

Software, Inc. ( “ Broderbund” ), a publisher and developer of consumer software

for the home and school market. Under the merger agreement, each share of

Broderbund common stock was converted into 0.8 0 shares of Learning Company

common stock and resulted in the issuance of approximately 17 million shares of

Learning Company common stock.

In March 19 97 , Mattel completed its merger with Tyco. Under the merger

agreement, each Tyco common stockholder received 0 .4 88 76 shares of Mattel com-

mon stock for each share of Tyco common stock outstanding, which resulted in the

issuance of approximately 17 million Mattel common shares. Tyco restricted stock

units and stock options outstanding as of the merger date were exchanged for