Mattel 1999 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 1999 Mattel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

Mattel, Inc. and Subsidiaries

Disney and Nickelodeon®, increased 1 4% largely due to the 1998 introduction of toys

associated with the feature motion pictures “ A Bug’s Life” and “ The Rugrats Movie” .

Sales of Learning Company consumer software products increased 3 5%, mainly due to the

acquisition of Mindscape, Inc. which added $1 88 .1 million to 19 98 sales, introduction of

new software titles such as The ClueFinders™4th Grade Adventures, Arthur’s®Computer

Adventures, and upgraded products.

Gross profit as a percentage of net sales remained relatively constant at 51.8 %

compared to 51 .7% in 1 99 7. As a percentage of net sales, advertising and promotion

expenses increased approximately one percentage point to 16 .3%, and selling and

administrative expenses increased 1.7 percentage points to 2 0.3 %. Both ratios

increased relative to 1 99 7 as a result of unanticipated cutbacks in buying by domestic

toy retailers due to a continuing shift by these retailers to just-in-time inventory manage-

ment. To respond to such shifts, Mattel took appropriate actions to adjust its own ship-

ping to more of a just-in-time pattern. As a result, toy products that would have previ-

ously been shipped in December of 19 98 were shipped closer to the time that they

were purchased by the consumer. Amortization of intangibles decreased by $ 35 7.5 mil-

lion, mainly as a result of completed amortization of intangibles related to certain

Learning Company acquisitions, partially offset by amortization resulting from the 19 98

acquisitions of Pleasant Company, Sofsource, Inc., Bluebird Toys PLC ( “ Bluebird” ) and

Mindscape, Inc.

Interest expense increased $1 5.9 million primarily due to increased short-

and long-term borrowings to finance the 19 98 acquisitions of Pleasant Company and

Bluebird, partially offset by the repurchase of certain of the 5-1/ 2 % Senior Notes of

Learning Company.

Other income, net increased $ 8.3 million, mainly due to an $ 11 .1 million

gain realized on sale of investments.

Business Segment Results

The USA Toys segment sales were down 5% in 1 99 8 compared to 19 97 , largely due

to lower sales of Barbie®products, as a result of high retail inventory levels entering

19 98 and domestic toy retailers shift to a just-in-time buying pattern. This decrease

was partially offset by increased sales of Wheels and Entertainment products. The US

Fisher-Price/ Tyco Preschool segment sales declined by 1 3% due to decreased sales of

Sesame Street®and Fisher-Price®products. Sales in the Other segment increased to

$2 56 .1 million in 1 99 8 from $ 58 .3 million in 1 99 7 due to American Girl®sales

generated from the July 19 98 acquisition of Pleasant Company. The International

Toy Marketing segment sales decreased 1% due to lower sales of Barbie®products,

partially offset by stronger sales of Wheels and Infant/ Preschool products. Consumer

Software segment sales increased 35 %, mainly due to the acquisition of Mindscape,

Inc. which added $ 18 8.1 million to 19 98 net sales, introduction of new software

titles such as The ClueFinders™4th Grade Adventures and Arthur’s®Computer

Adventures, and upgraded products.

Operating profit in the USA Toys and International Toy Marketing segments

declined by 27 % and 2 9%, respectively. The decline in operating profit in each of these

segments was largely attributable to lower sales volume and unfavorable shift in product

mix. The US Fisher-Price/ Tyco Preschool segment operating profit increased 1 1%, driven

by improved profitability in the Fisher-Price®product line, partially offset by unfavorable

shift in product mix of Tyco Preschool products. The Other segment operating profit

increased to $20.2 million in 1 99 8 from $ 7.3 million in 1 99 7 mainly due to the July

19 98 acquisition of Pleasant Company. The Consumer Software segment realized profit

of $1 14 .3 million in 1 99 8 compared to a loss of $312.5 million in 1 99 7, largely due

to increased sales and lower amortization.

Income Taxes

The effective income tax rate for 1 99 9 w as 2 5.6%, favorably impacted by domestic loss-

es incurred by Learning Company, and by income earned in foreign jurisdictions taxed at

lower rates. This represents a substantial reduction from 1998 and 19 97 , during which

the effective income tax rates w ere in excess of the US federal tax rate of 35 %. The

reduction in the tax rate is the result of a decrease in the amount of non-deductible items,

particularly the writeoff of incomplete technology and other non-deductible expenses

incurred in connection with business acquisitions, that unfavorably impacted the 19 98

and 1 99 7 tax rates.

Pre-tax losses from US operations as a percentage of the consolidated pre-tax

income was less than the sales to US customers as a percentage of the consolidated

gross sales. This difference results from operating losses, amortization of intangibles

and corporate headquarters expenses incurred in the US that decreased US pre-tax

income, and foreign profits related to sales ultimately made to US customers.

Financial Position

Mattel’s cash position was $ 27 5.0 million, compared to $4 69 .2 million as of the end

of 19 98 . Cash decreased $1 94 .2 million primarily due to the payment of restructur-

ing and integration costs related to the Learning Company merger, repayment of

Learning Company’s credit lines and the termination of Learning Company’s receivable

factoring facilities. Accounts receivable, net increased by $1 20 .0 million to

$1 ,27 0.0 million at year end 1 99 9 principally due to the cancellation of Learning

Company’s receivable factoring facilities. Inventories decreased by $ 10 0.0 million to

$5 44 .3 million at year end 1 99 9, reflecting Mattel’s shift to just-in-time production

and shipping programs, partially offset by higher Learning Company inventory. Prepaid

expenses and other current assets decreased by $ 41 .1 million to $330.7 million at

year end 19 99 , primarily due to the reclassification of certain deferred income tax

assets related to operating losses to noncurrent assets, partially offset by higher pre-

paid royalties and softw are development costs. Property, plant and equipment, net

decreased $1 3.6 million to $7 49 .5 million at year end 1 99 9 largely due to asset

writedowns related to the 19 99 restructuring. Intangibles, net decreased $9 1.3 mil-

lion to nearly $1.4 billion at year end 1 99 9, mainly due to goodwill amortization.

Other noncurrent assets increased by $ 29 9.9 million to $5 64 .2 million at year end

19 99 , principally due to increased noncurrent deferred tax assets related to operating

losses.

Short-term borrowings increased $170.5 million compared to 19 98 year

end, primarily due to the funding of Learning Company’s cash requirements.

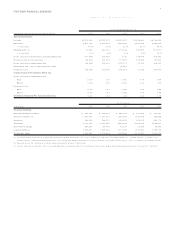

A summary of Mattel’s capitalization is as follows:

As of Year End

( In millions, except percentage information) 19 9 9 19 9 8

Senior notes $ 6 0 1 .0 18 % $ 6 0 1 .0 17 %

Medium-term notes 54 0 .5 17 54 0 .5 16

Other long-term debt obligations 42 .4 1 43 .0 1

Total long-term debt 1,1 8 3 .9 36 1,1 8 4 .5 34

Other long-term liabilities 16 2 .9 5 14 9 .1 4

Stockholders’ equity 1,9 6 2 .7 59 2,1 7 0 .8 62

$3 ,3 0 9 .5 100 % $3 ,504.4 1 0 0 %