LinkedIn 2014 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2014 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

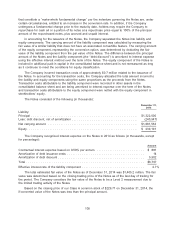

equity awards. To retain the services of certain former employees, LinkedIn offered 79,604 shares of

unvested Class A common stock with a total fair value of $12.5 million that will be earned over two

years from the date of acquisition. As the equity awards are subject to post-acquisition employment,

the Company is accounting for them as post-acquisition compensation expense.

These acquisitions, including Bizo and Bright, have been accounted for as business combinations

under the acquisition method and, accordingly, the total purchase price is allocated to the tangible and

intangible assets acquired and the liabilities assumed based on their respective fair values on the

acquisition dates. The results of operations of these acquisitions have been included in the

consolidated financial statements from the date of each respective acquisition. The Company has

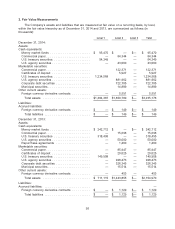

recognized $22.9 million in revenue related to its acquisition of Bizo. The following table presents the

purchase price allocations recorded in the Company’s consolidated balance sheets as of the acquisition

dates (in thousands):

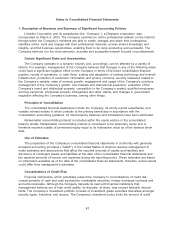

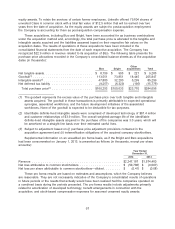

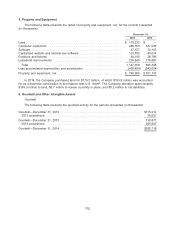

Other

Bizo Bright acquisitions Total

Net tangible assets .......................... $ 8,159 $ 905 $ 221 $ 9,285

Goodwill(1) ................................ 113,551 73,851 18,445 205,847

Intangible assets(2) .......................... 47,800 32,200 5,299 85,299

Net deferred tax liability ...................... (9,257) (6,323) (195) (15,775)

Total purchase price(3) ...................... $160,253 $100,633 $23,770 $284,656

(1) The goodwill represents the excess value of the purchase price over both tangible and intangible

assets acquired. The goodwill in these transactions is primarily attributable to expected operational

synergies, assembled workforces, and the future development initiatives of the assembled

workforces. None of the goodwill is expected to be deductible for tax purposes.

(2) Identifiable definite-lived intangible assets were comprised of developed technology of $81.4 million

and customer relationships of $3.9 million. The overall weighted-average life of the identifiable

definite-lived intangible assets acquired in the purchase of the companies was 3.0 years, which will

be amortized on a straight-line basis over their estimated useful lives.

(3) Subject to adjustment based on (i) purchase price adjustment provisions contained in the

acquisition agreement and (ii) indemnification obligations of the acquired company stockholders.

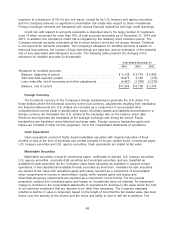

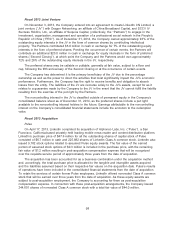

Supplemental information on an unaudited pro forma basis, as if the Bright and Bizo acquisitions

had been consummated on January 1, 2013, is presented as follows (in thousands, except per share

amounts):

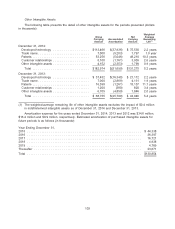

Year Ended

December 31,

2014 2013

Revenue ................................................ $2,247,187 $1,574,460

Net loss attributable to common stockholders ...................... $ (50,786) $ (9,007)

Net loss per share attributable to common stockholders—diluted ......... $ (0.41) $ (0.08)

These pro forma results are based on estimates and assumptions, which the Company believes

are reasonable. They are not necessarily indicative of the Company’s consolidated results of operations

in future periods or the results that actually would have been realized had the companies operated on

a combined basis during the periods presented. The pro forma results include adjustments primarily

related to amortization of developed technology, benefit arrangements in connection with the

acquisition, and stock-based compensation expenses for assumed unearned equity awards.

97