LinkedIn 2014 Annual Report Download - page 98

Download and view the complete annual report

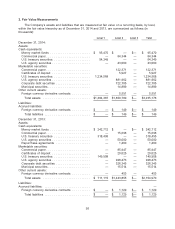

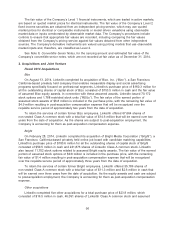

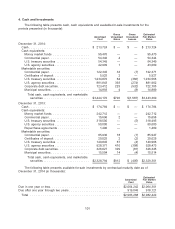

Please find page 98 of the 2014 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The fair value of the Company’s Level 1 financial instruments, which are traded in active markets,

are based on quoted market prices for identical instruments. The fair value of the Company’s Level 2

fixed income securities are obtained from an independent pricing service, which may use quoted

market prices for identical or comparable instruments or model driven valuations using observable

market data or inputs corroborated by observable market data. The Company’s procedures include

controls to ensure that appropriate fair values are recorded, including comparing the fair values

obtained from the Company’s pricing service against fair values obtained from other independent

sources. The Company’s derivative instruments are valued using pricing models that use observable

market inputs and, therefore, are classified as Level 2.

See Note 8, Convertible Senior Notes, for the carrying amount and estimated fair value of the

Company’s convertible senior notes, which are not recorded at fair value as of December 31, 2014.

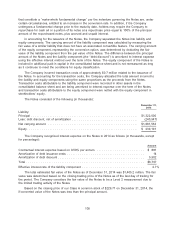

3. Acquisitions and Joint Venture

Fiscal 2014 Acquisitions

Bizo

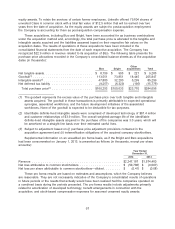

On August 13, 2014, LinkedIn completed its acquisition of Bizo, Inc. (‘‘Bizo’’), a San Francisco,

California-based privately held company that enables measurable display and social advertising

programs specifically focused on professional segments. LinkedIn’s purchase price of $160.3 million for

all the outstanding shares of capital stock of Bizo consisted of $153.5 million in cash and the fair value

of assumed Bizo equity awards. In connection with these assumed awards, LinkedIn issued 70,172

stock options and 1,788 restricted stock units (‘‘RSUs’’). The fair value of the earned portion of

assumed stock awards of $6.8 million is included in the purchase price, with the remaining fair value of

$4.9 million resulting in post-acquisition compensation expense that will be recognized over the

requisite service period of approximately two years from the date of acquisition.

To retain the services of certain former Bizo employees, LinkedIn offered 67,664 shares of

non-vested Class A common stock with a total fair value of $14.6 million that will be earned over two

years from the date of acquisition. As the shares are subject to post-acquisition employment, the

Company is accounting for them as post-acquisition compensation expense.

Bright

On February 28, 2014, LinkedIn completed its acquisition of Bright Media Corporation (‘‘Bright’’), a

San Francisco, California-based privately held online job board with candidate matching capabilities.

LinkedIn’s purchase price of $100.6 million for all the outstanding shares of capital stock of Bright

consisted of $50.5 million in cash and 241,875 shares of LinkedIn Class A common stock. LinkedIn

also issued 11,702 stock options related to assumed Bright equity awards. The fair value of the earned

portion of assumed stock options of $0.8 million is included in the purchase price, with the remaining

fair value of $1.4 million resulting in post-acquisition compensation expense that will be recognized

over the requisite service period of approximately three years from the date of acquisition.

To retain the services of certain former Bright employees, LinkedIn offered 55,186 shares of

non-vested Class A common stock with a total fair value of $11.3 million and $2.6 million in cash that

will be earned over three years from the date of acquisition. As the equity awards and cash are subject

to post-acquisition employment, the Company is accounting for them as post-acquisition compensation

expense.

Other acquisitions

LinkedIn completed five other acquisitions for a total purchase price of $23.8 million, which

consisted of $16.5 million in cash, 46,091 shares of LinkedIn Class A common stock and assumed

96