JetBlue Airlines 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73JETBLUE AIRWAYS CORPORATION-2014Annual Report

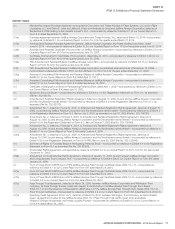

PART IV

ITEM 15Exhibits and Financial Statement Schedules

4.7(y) MBIA Insurance Corporation Financial Guaranty Insurance Policy, dated March 24, 2004, bearing Policy Number 43567(2) issued

to Wilmington Trust Company, as Subordination Agent for the Class G-2 Certificates—incorporated by reference to Exhibit 4.26 to

our Current Report on Form 8-K dated March 24, 2004.

4.7(z) Intercreditor Agreement, dated as of March 24, 2004, among Wilmington Trust Company, as Pass Through Trustee, Landesbank

Hessen- Thüringen Girozentrale, as Primary Liquidity Provider, Morgan Stanley Capital Services, Inc., as Above-Cap Liquidity

Provider, MBIA Insurance Corporation, as Policy Provider, and Wilmington Trust Company, as Subordination Agent—incorporated

by reference to Exhibit 4.27 to our Current Report on Form 8-K dated March 24, 2004.

4.7(aa) Note Purchase Agreement, dated as of March 24, 2004, among JetBlue Airways Corporation, Wilmington Trust Company, in its

separate capacities as Pass Through Trustee, as Subordination Agent, as Escrow Agent and as Paying Agent—incorporated by

reference to Exhibit 4.28 to our Current Report on Form 8-K dated March 24, 2004.

4.7(ab) Form of Trust Indenture and Mortgage between JetBlue Airways Corporation, as Owner, and Wilmington Trust Company, as

Mortgagee—incorporated by reference to Exhibit 4.29 to our Current Report on Form 8-K dated March 24, 2004.

4.7(ac) Form of Participation Agreement among JetBlue Airways Corporation, as Owner, and Wilmington Trust Company, in its separate

capacities as Mortgagee, as Pass Through Trustee and as Subordination Agent—incorporated by reference to Exhibit 4.30 to our

Current Report on Form 8-K dated March 24, 2004.

4.8 Form of Three-Month LIBOR plus 0.375% JetBlue Airways Pass Through Certificate Series 2004-2G-1-O, with attached form of

Escrow Receipt—incorporated by reference to Exhibit 4.1 to our Current Report on Form 8-K dated November 9, 2004.

4.8(a) Form of Three-Month LIBOR plus 0.450% JetBlue Airways Pass Through Certificate Series 2004-2G-2-O, with attached form of

Escrow Receipt—incorporated by reference to Exhibit 4.2 to our Current Report on Form 8-K dated November 9, 2004.

4.8(b) Form of Three-Month LIBOR plus 3.100% JetBlue Airways Pass Through Certificate Series 2004-2C-O, with attached form of

Escrow Receipt—incorporated by reference to Exhibit 4.3 to our Current Report on Form 8-K dated November 9, 2004.

4.8(c) Pass Through Trust Agreement, dated as of November 15, 2004, between JetBlue Airways Corporation and Wilmington

Trust Company, as Pass Through Trustee, made with respect to the formation of JetBlue Airways Pass Through Trust, Series

2004-2G-1-O and the issuance of Three-Month LIBOR plus 0.375% JetBlue Airways Pass Through Trust, Series 2004-2G-1-O,

Pass Through Certificates—incorporated by reference to Exhibit 4.4 to our Current Report on Form 8-K dated November 9, 2004 (3).

4.8(d) Revolving Credit Agreement (2004-2G-1), dated as of November 15, 2004, between Wilmington Trust Company, as Subordination

Agent, as agent and trustee for the JetBlue Airways 2004-2G-1 Pass Through Trust, as Borrower, and Landesbank Baden-

Württemberg, as Primary Liquidity Provider—incorporated by reference to Exhibit 4.5 to our Current Report on Form 8-K dated

November 9, 2004.

4.8(e) Revolving Credit Agreement (2004-2G-2), dated as of November 15, 2004, between Wilmington Trust Company, as Subordination

Agent, as agent and trustee for the JetBlue Airways 2004-2G-2 Pass Through Trust, as Borrower, and Landesbank Baden-

Württemberg, as Primary Liquidity Provider—incorporated by reference to Exhibit 4.6 to our Current Report on Form 8-K dated

November 9, 2004.

4.8(f) Revolving Credit Agreement (2004-2C), dated as of November 15, 2004, between Wilmington Trust Company, as Subordination

Agent, as agent and trustee for the JetBlue Airways 2004-2C Pass Through Trust, as Borrower, and Landesbank Baden-

Württemberg, as Primary Liquidity Provider—incorporated by reference to Exhibit 4.7 to our Current Report on Form 8-K dated

November 9, 2004.

4.8(g) Deposit Agreement (Class G-1), dated as of November 15, 2004, between Wilmington Trust Company, as Escrow Agent,

and HSH Nordbank AG, New York Branch, as Depositary—incorporated by reference to Exhibit 4.8 to our Current Report on

Form 8-K dated November 9, 2004.

4.8(h) Deposit Agreement (Class G-2), dated as of November 15, 2004, between Wilmington Trust Company, as Escrow Agent,

and HSH Nordbank AG, New York Branch, as Depositary—incorporated by reference to Exhibit 4.9 to our Current Report on

Form 8-K dated November 9, 2004.

4.8(i) Deposit Agreement (Class C), dated as of November 15, 2004, between Wilmington Trust Company, as Escrow Agent, and HSH

Nordbank AG, New York Branch, as Depositary—incorporated by reference to Exhibit 4.10 to our Current Report on Form 8-K

dated November 9, 2004.

4.8(j) Escrow and Paying Agent Agreement (Class G-1), dated as of November 15, 2004, among Wilmington Trust Company, as Escrow

Agent, Morgan Stanley & Co. Incorporated, Citigroup Global Markets Inc., HSBC Securities (USA) Inc. and J.P. Morgan Securities,

Inc., as Underwriters, Wilmington Trust Company, as Pass Through Trustee for and on behalf of JetBlue Airways Corporation

Pass Through Trust 2004-2G-2-O, as Pass Through Trustee, and Wilmington Trust Company, as Paying Agent—incorporated by

reference to Exhibit 4.11 to our Current Report on Form 8-K dated November 9, 2004.

4.8(k) Escrow and Paying Agent Agreement (Class G-2), dated as of November 15, 2004, among Wilmington Trust Company, as Escrow

Agent, Morgan Stanley & Co. Incorporated, Citigroup Global Markets Inc., HSBC Securities (USA) Inc. and J.P. Morgan Securities,

Inc., as Underwriters, Wilmington Trust Company, as Pass Through Trustee for and on behalf of JetBlue Airways Corporation

Pass Through Trust 2004-2G-2-O, as Pass Through Trustee, and Wilmington Trust Company, as Paying Agent—incorporated by

reference to Exhibit 4.12 to our Current Report on Form 8-K dated November 9, 2004.

4.8(l) Escrow and Paying Agent Agreement (Class C), dated as of November 15, 2004, among Wilmington Trust Company, as Escrow

Agent, Morgan Stanley & Co. Incorporated, Citigroup Global Markets Inc., HSBC Securities (USA) Inc. and J.P. Morgan Securities,

Inc., as Underwriters, Wilmington Trust Company, as Pass Through Trustee for and on behalf of JetBlue Airways Corporation Pass

Through Trust 2004-2C-O, as Pass Through Trustee, and Wilmington Trust Company, as Paying Agent—incorporated by reference

to Exhibit 4.13 to our Current Report on Form 8-K dated November 9, 2004.

4.8(m) ISDA Master Agreement, dated as of November 15, 2004, between Citibank, N.A., as Above Cap Liquidity Facility Provider, and

Wilmington Trust Company, as Subordination Agent for the JetBlue Airways Corporation Pass Through Trust 2004-2G-1-O—

incorporated by reference to Exhibit 4.14 to our Current Report on Form 8-K dated November 9, 2004 (4).