JetBlue Airlines 2014 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2014 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2014Annual Report18

PART I

ITEM1BUnresolved Staff Comments

Changes in government regulations imposing additional requirements

and restrictions on our operations could increase our operating costs

and result in service delays and disruptions.

Airlines are subject to extensive regulatory and legal requirements, both

domestically and internationally, involving significant compliance costs. In

the last several years, Congress has passed laws, and the agencies of the

federal government, including, but not limited to, the DOT, FAA, CBP and

the TSA have issued regulations relating to the operation of airlines that have

required significant expenditures. We expect to continue to incur expenses

in connection with complying with government regulations. Additional laws,

regulations, taxes and airport rates and charges have been proposed from

time to time that could significantly increase the cost of airline operations or

reduce the demand for air travel. If adopted or materially amended, these

measures could have the effect of raising ticket prices, reducing air travel

demand and/or revenue and increasing costs. We cannot assure you these

and other laws or regulations enacted in the future will not harm our business.

In addition, the U.S. Environmental Protection Agency, or EPA, has proposed

changes to underground storage tank regulations that could affect certain

airport fuel hydrant systems. In addition to the proposed EPA and state

regulations, several U.S. airport authorities are actively engaged in efforts

to limit discharges of de-icing fluid to local groundwater, often by requiring

airlines to participate in the building or reconfiguring of airport de-icing facilities.

Federal budget constraints or federally imposed furloughs due to budget

negotiations deadlocks may adversely affect our industry, business,

results of operations and financial position.

Many of our airline operations are regulated by governmental agencies,

including the FAA, the DOT, the CBP, the TSA and others. If the federal

government were to experience issues in reaching budgetary consensus in the

future resulting in mandatory furloughs and/or other budget constraints, our

operations and results of operations could be materially negatively impacted.

The travel behaviors of the flying public could also be affected, which may

materially adversely impact our industry and our business.

Compliance with future environmental regulations may harm our business.

Many aspects of airlines’ operations are subject to increasingly stringent

environmental regulations, and growing concerns about climate change

may result in the imposition of additional regulation. Since the domestic

airline industry is increasingly price sensitive, we may not be able to recover

the cost of compliance with new or more stringent environmental laws

and regulations from our passengers, which could adversely affect our

business. Although it is not expected the costs of complying with current

environmental regulations will have a material adverse effect on our financial

position, results of operations or cash flows, no assurance can be made

the costs of complying with environmental regulations in the future will not

have such an effect.

We could be adversely affected by an outbreak of a disease or an

environmental disaster that significantly affects travel behavior.

Any outbreak of a disease affecting travel behavior could have a material

adverse impact on airlines. In addition, outbreaks of disease could result in

quarantines of our personnel or an inability to access facilities or our aircraft,

which could adversely affect our operations. Similarly, if an environmental

disaster were to occur and adversely impact any of our destination cities,

travel behavior could be affected and in turn, could materially adversely

impact our business.

ITEM1B. Unresolved Staff Comments

None.

ITEM2. Properties

Aircraft

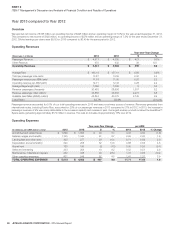

As of December 31, 2014, we operated a fleet consisting of 13 Airbus A321 aircraft, 130 Airbus A320 aircraft and 60 EMBRAER 190 aircraft as summarized

in the table below:

Aircraft

Seating

Capacity Owned

Capital

Leased

Operating

Leased Total

AverageAge

in Years

Airbus A320 150 96 4 30 130 9.3

Airbus A321 190 / 159(1) 11 2 — 13 0.6

EMBRAER 190 100 30 — 30 60 6.2

137 6 60 203 7.8

(1) Our Airbus A321 with a single cabin layout has a seating capacity of 190 seats. Our Airbus A321 with our Mint™ premium service has a seating capacity of 159 seats.

As of December 31, 2014, our aircraft leases have an average remaining term of approximately 7 years, with expiration dates between 2016 and 2026.

We have the option to extend most of these leases for additional periods or to purchase the aircraft at the end of the related lease term. All but 39 of

our 137 owned aircraft are subject to secured debt financing and all of our 33 spare engines are owned.