JetBlue Airlines 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2014Annual Report30

PART II

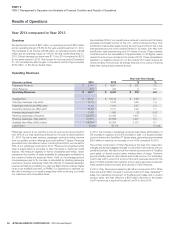

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

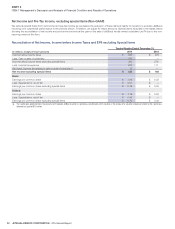

Net Income and Pre-Tax Income, excluding special items (Non-GAAP)

We exclude special items from net income and pre-tax income as we believe the exclusion of these items is helpful to investors to evaluate JetBlue’s

recurring core operational performance in the periods shown. Therefore, we adjust for these amounts. Special items excluded in the tables below

showing the reconciliation of net income and pre-tax income include the gain on the sale of JetBlue’s wholly-owned subsidiary LiveTV due to the non-

recurring nature of this item.

Reconciliation of Net Income, Income before Income Taxes and EPS excluding Special Items

(in millions, except per share amounts)

Twelve Months Ended December 31,

2014 2013

Income before income taxes $ 623 $ 279

Less: Gain on sale of subsidiary 241 —

Income before income taxes excluding special items 382 279

Less: Income tax expense 222 111

Add back: Income tax relating to gain on sale of subsidiary(a) 72 —

Net Income excluding special items $ 232 $ 168

Basic:

Earnings per common share $ 1.36 $ 0.59

Less: Special items, net of tax $ 0.57 $ —

Earnings per common share excluding special items $ 0.79 $ 0.59

Diluted:

Earnings per common share $ 1.19 $ 0.52

Less: Special items, net of tax $ 0.49 $ —

Earnings per common share excluding special items $ 0.70 $ 0.52

(a) The capital gain generated from the sale of LiveTV allowed JetBlue to utilize a capital loss carryforward which resulted in the release of a valuation allowance related to the capital loss

deferred tax asset of $19 million.