Incredimail 2008 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2008 Incredimail annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Not applicable.

Not applicable.

Investing in our ordinary shares involves a high degree of risk. You should consider carefully the following risk factors, as well as the other

information in this annual report before deciding to invest in our ordinary shares. Our business, financial condition or results of operations could

be affected adversely by any of these risks. The trading price of our ordinary shares could decline due to any of these risks and you might lose all

or part of your investment in our ordinary shares.

Risks Related to Our Business

If we are unable to continually enhance our existing products and develop new products that achieve widespread market acceptance, our

ability to attract and retain customers could be impaired, our competitive position may be harmed and we may be unable to generate

additional revenues.

We believe that the number of downloads of our free products indicates that many consumers are interested in having a customized and

entertaining email or instant messaging experience. Our future revenue and profit growth will depend, in part, on increasing the number of

downloads and acceptance of the search properties offered with them, and subsequently, the percentage of registered or active users of our free

product who become actual purchasers of our products and services, as well as making our products and services attractive to new users. In order

to induce those consumers to use our products, accept the search properties offered, and subsequently, to a certain extent, purchase or license our

products, we must continually enhance our existing products by offering additional features and content and we must continue to introduce novel

products. The enhancement of existing products and the development and commercialization of new products can be very complex. Software

product development and commercialization depends upon a number of factors, including:

5

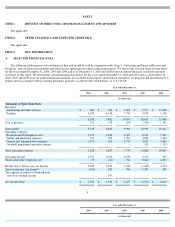

Net earnings (loss) per share (1):

Basic

$

0.44

$

0.17

$

0.27

$

(0.29

)

$

0.47

Diluted

$

0.39

$

0.16

$

0.27

$

(0.29

)

$

0.46

Weighted average number of shares used

in net earnings (loss) per share (1):

Basic

4,606,657

4,869,698

8,982,201

9,442,658

9,427,424

Diluted

5,197,558

5,280,003

9,146,393

9,442,658

9,516,477

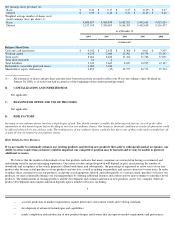

As of December 31,

2004

2005

2006

2007

2008

(in thousands)

Balance Sheet Data:

Cash and cash equivalents

$

4,342

$

2,428

$

8,366

$

4,611

$

7,835

Working capital

6,238

2,966

21,561

19,756

25,143

Total assets

8,264

8,460

31,424

31,766

37,651

Total short

-

term debt

12

4

-

-

-

Total liabilities

2,349

5,465

8,847

10,995

12,107

Redeemable convertible preferred shares

3,063

3,030

-

-

-

Shareholders' equity (deficiency)

2,852

(35

)

22,577

20,771

25,544

(1) All references to shares and per share amounts have been retroactively restated to reflect our 38-for-one ordinary share dividend on

January 30, 2006, as if such event had occurred as of the beginning of the earliest period presented.

B.

CAPITALIZATION AND INDEBTEDNESS

C.

REASONS FOR OFFER AND USE OF PROCEEDS

D.

RISK FACTORS

—

accurate prediction of market requirements, market preferences and content trends and evolving standards;

—

development of advanced technologies and capabilities;

—

timely completion and introduction of new product designs and features that incorporate market requirements and preferences;