Hyundai 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY I 2010 ANNUAL REPORT I 131HYUNDAI MOTOR COMPANY I 2010 ANNUAL REPORT I 130

HYUNDAI MOTOR COMPANY

>>

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2009 AND 2008

HYUNDAI MOTOR COMPANY

>>

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2009 AND 2008

(8) The Company made an agreement with its European sales subsidiaries and agents for them to be responsible for projected costs for dismantling and recycling vehicles

sold in corresponding countries to comply with European Parliament directive regarding End-of-Life vehicles (ELV).

(9) In 2006, the Company sold 10,658,367 shares of Hyundai Rotem Company to MSPE Metro Investment AB and entered into a shareholders’ agreement. MSPE Metro

Investment AB is entitled to put option to sell those shares back to the Company in certain events (as defined) in accordance with the agreement.

(10) Hyundai Capital Services, Inc., one of domestic subsidiaries of the Company, made a credit facility agreement on a US$ 1,000 million renewable one-year revolving credit

facility up to 3 years to be provided by General Electric Capital Corporation (the “GECC”) to Hyundai Capital Services, Inc. on January 13, 2009. Under the terms of such

agreement, Hyundai Capital Services, Inc. shall pay commitment fee of 3M Euribor+631bp for the usage of facility and 28bp for the remaining. Also, the maturity of

individual draw-down is within 1 year from the time of withdrawal and in case of termination, the maturity for previous withdrawals can be extended to 1 year from the

time of termination. In addition, Hyundai Capital Services, Inc., GECC and the Company made a support agreement on credit facility agreement on the same date of the

credit facility agreement. According to the support agreement, when Hyundai Capital Services, Inc. cannot redeem in a year after the withdrawal, GECC has the right

of debt-to-equity swap for the relevant draw-down and has the put option that GECC can sell converted stocks to the Company within the ownership of the Company.

In this case, the amount which the Company pays to GECC is the amount of withdrawal for debt-to-equity swap multiplied by the ownership of the Company. Also,

the Company has the call option that it can buy converted stocks from GECC on the same condition of put option when the GECC does not exercise the put option.

According to the support agreement, Hyundai Capital Services, Inc. is supposed to pay 15bp commission to the Company based on the amount on which the credit

facility agreement was established multiplied by the ownership percentage of the company.

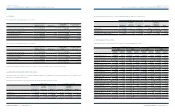

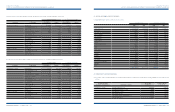

Consolidated

Subsidiaries

Company providing

guarantee of indebtedness

Amounts of guarantee

KRW in millions

U.S. Dollars

(Note 2)

in thousands

Hyundai Rotem Company Machinery Financial Cooperative and others EGP 15,000 3

NZD 20,405 15

Hyundai Card Co., Ltd. Seoul Guarantee Insurance Company KRW 5,534 4,740

Hyundai WIA Corporation The Export-Import Bank of Korea USD 16,237,916 16,238

JPY 888,732,000 9,612

Shinhan Bank USD 10,248,255 10,248

KRW 266 228

EUR 110,000 158

CAD 270,000 256

Hana Bank USD 180,820 181

Kookmin Bank USD 6,888,345 6,888

EUR 987,100 1,415

JPY 253,444,000 2,741

Woori Bank USD 6,864,000 6,864

Machinery Financial Cooperative and others KRW 217,046 185,891

Autoever Systems Corp. Shinhan Bank USD 1,998,000 1,998

Korea Exchange Bank USD 300,000 300

Seoul Guarantee Insurance Company KRW 601 515

M & Soft Co., Ltd. Seoul Guarantee Insurance Company KRW 179 153

(11) Hyundai Capital Services, Inc. made a Revolving Credit Facility Agreement with the following financial institutions for credit line:

(12) Hyundai Card Co., Ltd., one of domestic subsidiaries of the Company, made an agreement regarding asset backed securitization. According to the agreement, in order

for the credibility of the asset-backed securities, several required provisions are made as a trigger clauses to be used for early redemption calls, thereby limiting the risk

that investors will have resulting from a change in quality of the assets in the future. In the event the asset-backed securitization of the Hyundai Card Co., Ltd. violates

the applicable trigger clause, Hyundai Card Co., Ltd. is obliged to make early redemption for asset-backed securities.

(13) Hyundai WIA Corp., one of domestic subsidiaries of the Company, made a general installment financing contracts with Doosan Capital Co., Ltd., Hyundai Commercial

Inc. and Hyundai Capital Services, Inc. in order to promote the sales of its machine tools. According to the contracts, if a user of the installment financing service is

in default, Hyundai WIA Corp. has to accept responsibility for the default receivable. The amounts of principal that have not matured are ₩8,582 million (US$7,350

thousand), ₩6,639 million (US$5,686 thousand) and ₩43,402 million (US$37,172 thousand) for Doosan Capital Co., Ltd., Hyundai Commercial Inc. and Hyundai Capital

Service Inc. respectively. The ceiling amounts are ₩150,000 million (US$128,469 thousand), ₩54,000 million (US$46,249 thousand) and ₩68,157 million (US$58,374

thousand) for Doosan Capital Co., Ltd., Hyundai Commercial Inc. and Hyundai Capital Services, Inc., respectively, as of December 31, 2009.

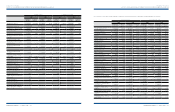

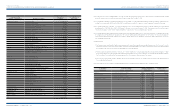

Financial institution Credit line Commission Contract term

Mizuho Corporate Bank,

Seoul Branch KRW 65,000 million

- committed : 91dayCD+1.5%

- uncommitted : 30bp Dec 15, 2009 ~ Dec 14, 2010

JP Morgan Seoul Branch KRW 34,000 million

- committed : 91dayCD+1.5%

- uncommitted : 30bp Sep 29, 2009 ~ Sep 28, 2010

Citibank, Seoul KRW 50,000 million

- committed : 91dayCD+1.5%

- uncommitted : 30bp Sep 29, 2009 ~ Sep 28, 2010

Standard Chartered,

Seoul Branch KRW 50,000 million

- committed : 91dayCD+1.8%

- uncommitted : 30bp Dec 28, 2009 ~ Dec 28, 2010

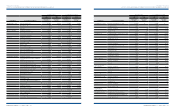

For the years ended December 31, 2009 and 2008, the Company recognized the net loss of ₩42,050 million (US$36,014 thousand) and ₩130,929 million (US$112,135

thousand), respectively, on valuation of the ineffective portion of such instruments and the other derivative instruments in current operations.

The Company recorded total gain on valuation of outstanding derivatives and to be paid of ₩35,836 million (US$30,692 thousand) and ₩22,536 million (US$19,301

thousand) in current and non-current derivative assets as of December 31, 2009 and 2008, respectively. Also, total loss on valuation of outstanding derivatives and present

value of premiums to be received of ₩179,020 million (US$153,323 thousand) and ₩393,804 million (US$337,276 thousand) is recorded in current and non-current

derivative liabilities as of December 31, 2009 and 2008, respectively.

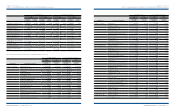

29. DERIVATIVE INSTRUMENTS:

(

1

)

The Company entered into derivative instrument contracts including forwards, options and swaps to hedge the exposure to changes in foreign exchange rate. As of

December 31, 2009 and 2008, the Company deferred the net loss of

₩

101,135 million (US$86,618 thousand) and

₩

226,514 million (US$194,000 thousand), respectively, on

valuation of the effective portion of derivative instruments for cash flow hedging purposes from forecasted exports as accumulated other comprehensive income (loss). The

longest period in which the forecasted transactions are expected to occur is within 23 months from December 31, 2009. Of the net loss on valuation recorded as accumulated

other comprehensive income (loss) as of December 31, 2009, net gain of

₩

10,625 million (US$9,100 thousand) is expected to be realized and charged to current operations

within one year from December 31, 2009.