Hyundai 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY I 2010 ANNUAL REPORT I 105HYUNDAI MOTOR COMPANY I 2010 ANNUAL REPORT I 104

HYUNDAI MOTOR COMPANY

>>

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2009 AND 2008

HYUNDAI MOTOR COMPANY

>>

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2009 AND 2008

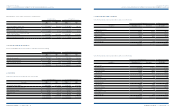

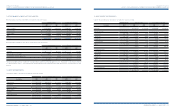

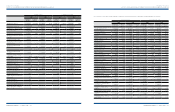

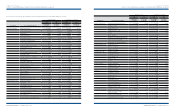

Debentures as of December 31, 2009 and 2008 consist of the following:

Description Maturity 2009 2009 2008 2009 2008

Domestic debentures:

Guaranteed debentures

Oct.10, 2010 ~

Dec.14, 2012 5.33 ~ 9.90 ₩ 790,280 ₩ 330,000 $ 676,841 $ 282,631

Non-guaranteed debentures

Jan.17, 2010 ~

Mar.18, 2018 3.22 ~ 8.98 19,972,493 17,738,818 17,105,595 15,192,547

Convertible bonds - - - 92,369 - 79,110

Bonds with warrants

Oct.31, 2010 ~

Mar.19, 2012 1.00 ~ 8.98 458,723 200,000 392,877 171,292

Other May.18, 2012 3.5 37,885 - 32,447 -

Overseas debentures

Jun.24, 2010 ~

Apr.25, 2015 5.5 589,784 658,617 505,125 564,077

21,849,165 19,019,804 18,712,885 16,289,657

Less: discount on debentures, call premium and

other adjustments to debentures 17,049 (3,043) 14,601 (2,607)

₩ 21,832,116 ₩ 19,022,847 $ 18,698,284 $ 16,292,264

Korean Won in millions U. S. Dollars (Note 2) in thousands

Annual

interest rate (%)

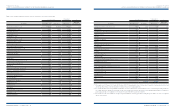

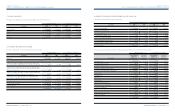

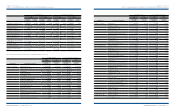

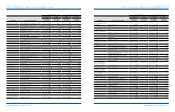

Details of bonds with warrants as of December 31, 2009 and 2008 are as follows:

In 2009, 82,353 shares of Hyundai Card Co., Ltd. and 41,140,593 shares of Kia Motors Corporation were issued as a result of the exercise of warrants. In addition, the

amount of ₩141,277 million (US$ 120,998 thousand) of the bond with warrants issued by Kia Motors Corporation is redeemed in 2009.

Issuing Company Hyundai Card Co., Ltd. Kia Motors Corporation

Type of bond Non-guaranteed subordinated bond with stock warrant (separable) Non-guaranteed bond with stock warrant (separable)

Face value ₩ 200,000 million ($ 171,292 thousand) ₩ 400,000 million ($ 342,583 thousand)

Coupon rate 7.99% 1.00%

Date of issue October 31, 2005 March 19, 2009

Maturity October 31, 2010 March 19, 2012

Exercise price ₩ 8,831 per share ₩ 6,880 per share

Exercise period Two weeks from the date of issue ~ April 30, 2009 April 19, 2009 ~ February 19, 2012

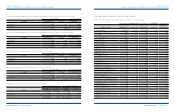

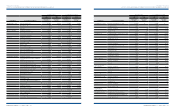

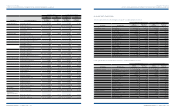

The maturity of long-term debt and debentures as of December 31, 2009 is as follows:

Description Debentures

Local

currency loans

Foreign

currency loans Total Total

2011 ₩ 5,172,996 ₩ 1,144,539 ₩ 1,559,403 ₩ 7,876,938 $ 6,746,264

2012 7,466,132 282,354 2,575,974 10,324,460 8,842,463

2013 678,852 433,198 1,074,996 2,187,046 1,873,112

Thereafter 1,165,140 303,114 1,409,607 2,877,861 2,464,767

14,483,120 2,163,205 6,619,980 23,266,305 19,926,606

Less : discount on debentures 15,876 - - 15,876 13,597

₩ 14,467,244 ₩ 2,163,205 ₩ 6,619,980 ₩ 23,250,429 $ 19,913,009

Korean Won in millions

U. S. Dollars (Note 2)

in thousands

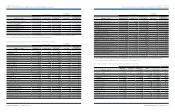

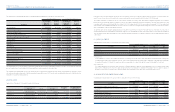

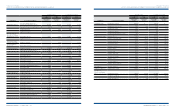

16. PLEDGED ASSETS, CHECKS AND NOTES:

As of December 31, 2009, the following assets, checks and notes are pledged as collateral:

(1)

The Company’s and its subsidiaries’ property, plant and equipment are pledged as collateral for various loans to a maximum of

₩

5,019,019 million (US$4,298,577 thousand).

(2) The Company’s and its subsidiaries’ certain bank deposits and investment securities, including 213,466 shares of Kia Motors Corporation, and some government bonds

are pledged as collateral to financial institutions and others.

(3) Certain overseas subsidiaries’ receivables and other financial business assets are pledged as collateral for their borrowings.

(4) 40 blank checks, 1 check amounting to ₩2,624 million (US$ 2,247 thousand), 116 blank promissory notes and 3 promissory notes amounting to ₩24,144 million (US$

20,678 thousand) are pledged as collateral for short-term borrowings, long-term debt and other payables.