Hyundai 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

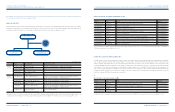

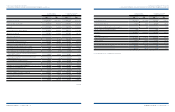

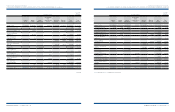

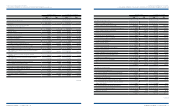

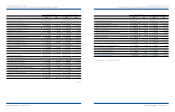

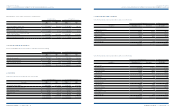

LIABILITIES AND SHAREHOLDERS’ EQUITY 2009 2008 2009 2008

Shareholders’ equity:

Capital stock (Note 20) ₩ 1,488,993 ₩ 1,488,993 $ 1,275,260 $ 1,275,260

Capital surplus 5,793,489 5,839,874 4,961,878 5,001,605

Capital adjustments (Note 21) (743,909) (719,235) (637,127) (615,994)

Accumulated other comprehensive income (Notes 18 and 22) 505,970 618,309 433,342 529,555

Retained earnings 14,617,652 11,841,859 12,519,400 10,142,051

Minority interests 7,299,465 6,282,097 6,251,683 5,380,350

Total shareholders’ equity 28,961,660 25,351,897 24,804,436 21,712,827

Total liabilities and shareholders’ equity ₩ 102,324,934 ₩ 103,205,783 $ 87,636,977 $ 88,391,387

LIABILITIES AND SHAREHOLDERS’ EQUITY 2009 2008 2009 2008

Current liabilities:

Trade notes and accounts payable ₩ 8,314,944 ₩ 8,247,726 $ 7,121,398 $ 7,063,828

Short-term borrowings (Note 14) 12,949,025 21,628,102 11,090,292 18,523,554

Trade notes and accounts payable-other 4,998,611 4,732,974 4,281,099 4,053,592

Accrued expenses 2,748,647 2,205,681 2,354,100 1,889,072

Income tax payable (Note 19) 500,294 752,771 428,481 644,717

Current maturities of long-term debt and debentures (Notes 8 and 15) 9,789,043 6,418,366 8,383,901 5,497,059

Accrued warranties (Note 17) 1,379,039 1,419,427 1,181,089 1,215,679

Derivative liabilities (Note 29) 99,347 343,517 85,087 294,208

Deferred tax liabilities (Note 19) 884 15,955 757 13,665

Withholdings and other current liabilities 2,474,941 2,181,551 2,119,681 1,868,406

Total current liabilities 43,254,775 47,946,070 37,045,885 41,063,780

Long-term liabilities:

Long-term debt and debentures, net of current maturities and discount on

debentures issued (Notes 8 and 15) 23,250,429 22,237,911 19,913,009 19,045,830

Deposit for letter of guarantees and others 1,042,506 1,083,159 892,862 927,680

Accrued severance benefits, net of National Pension payments for employees

of ₩21,658 million in 2009 and ₩27,788 million in 2008, and individual

severance insurance deposits of ₩2,206,932 million in 2009 and ₩1,920,288

million in 2008 (Note 2) 950,274 1,119,567 813,869 958,862

Long-term accounts payable 22,498 37,608 19,269 32,210

Long-term unearned income 231,890 252,024 198,604 215,848

Long-term accrued warranties (Note 17) 3,393,089 3,465,091 2,906,037 2,967,704

Provision for other liabilities 259,666 222,095 222,393 190,215

Derivative liabilities (Note 29) 216,869 288,033 185,739 246,688

Deferred tax liabilities (Note 19) 537,149 438,272 460,045 375,361

Other long-term liabilities 4,465 238 3,824 204

Total long-term liabilities 29,908,835 29,143,998 25,615,651 24,960,602

Other financial business liabilities (Note 13) 199,664 763,818 171,005 654,178

Total liabilities 73,363,274 77,853,886 62,832,541 66,678,560

See accompanying notes to consolidated financial statements.

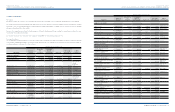

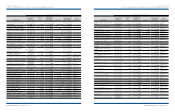

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

>>

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (CONTINUED) AS OF DECEMBER 31, 2009 AND 2008

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

>>

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (CONTINUED) AS OF DECEMBER 31, 2009 AND 2008

Korean Won in millions U. S. Dollars (Note 2) in thousands Korean Won in millions U. S. Dollars (Note 2) in thousands

HYUNDAI MOTOR COMPANY I 2010 ANNUAL REPORT I 65HYUNDAI MOTOR COMPANY I 2010 ANNUAL REPORT I 64

(Continued)