Hyundai 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

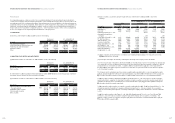

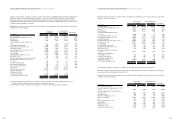

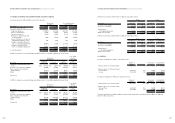

18. INCOME TAX EXPENSE AND DEFERRED INCOME TAX DEBITS (CREDITS)

Income tax expense in 2002 and 2001 consists of the following:

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Description 2002 2001 2002 2001

Income tax currently payable 1,023,118 604,744

$

852,314

$

503,785

Changes in deferred income taxes due to:

Temporary differences (178,981) (162,229) (149,101) (135,146)

Tax loss carried forward 95,899 138,866 79,889 115,683

Tax credit carried over (6,159) (8,881) (5,131) (7,398)

Deduction of capital surplus and

retained earnings (480) 96,499 (400) 80,389

Excess of limitation on donation to

designated organization, others 607 (607) 506 (506)

Changes in temporary differences

due to consolidating adjustments (68,901) 47,036 (57,398) 39,184

Changes in retained earnings

due to consolidation adjustments (20,759) (44,264) (17,293) (36,874)

(178,774) 66,420 (148,928) 55,332

Income tax expense 844,344 671,164 $703,386 $559,117

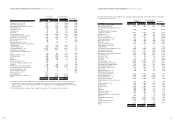

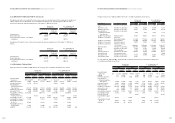

In 2002, the changes in accumulated temporary difference due to consolidation adjustments are as follows:

Korean won

(in millions)

Beginning End End

Description Of the year Changes of the year of the year

Elimination of unrealized profits and

losses 248,562 40,438 289,000

$

240,753

Reversal of accrued product liabilities (66,700) (29,468) (96,168) (80,113)

Gain on valuation of investments

(equity method) (63,135) 111,576 48,441 40,354

Others (13,559) 109,444 95,885 79,877

105,168 231,990 337,158 280,871

Tax rate (%) 29.7% 29.7% 29.7% 29.7 %

31,235 68,901 100,136 $83,419

In 2001, the changes in accumulated temporary difference due to consolidation adjustments are as follows:

Korean won

(in millions)

Beginning End End

Description Of the year Changes of the year of the year

Elimination of unrealized profits and

losses 140,837 107,725 248,562

$

207,066

Reversal of accrued product liabilities (54,569) (12,131) (66,700) (55,565)

Gain on valuation of investments

(equity method) 182,526 (245,661) (63,135) (52,595)

Others (14,666) 1,107 (13,559) (11,295)

254,128 (148,960) 105,168 87,611

Tax rate (%) 30.8% 29.7% 29.7%

78,271 (47,036) 31,235 $26,020

U. S. dollars

(Note 2)

(in thousands)

U. S. dollars

(Note 2)

(in thousands)

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

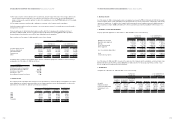

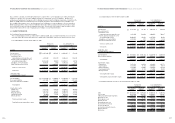

Deferred income taxes as of December 31, 2002 are computed as follows:

Debits Credits

Korean won U.S. dollars Korean won

U.S. dollars (Note 2)

Description (in millions) (in thousands) (in millions) (in thousands)

Accounts of the Company 365,120

$

304,165 -

$

-

Accounts of subsidiaries 684,204 569,980 78,371 65,288

1,049,324 874,145 78,371 65,288

Changes due to

consolidating adjustments 317,313 264,340 45,924 38,257

Deferred income taxes 1,366,637 $1,138,485 124,295 $103,545

Deferred income taxes as of December 31, 2001 are computed as follows:

Debits Credits

Korean won U.S. dollars Korean won

U.S. dollars (Note 2)

Description (in millions) (in thousands) (in millions) (in thousands)

Accounts of the Company 241,570

$

201,241 -

$

-

Accounts of subsidiaries 854,793 712,090 78,437 65,342

1,096,363 913,331 78,437 65,342

Changes due to

consolidating adjustments 37,689 31,397 6,454 5,377

Deferred income taxes 1,134,052 $944,728 84,891 $70,719

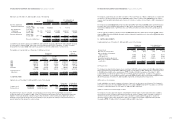

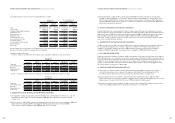

19. DIVIDENDS

The proposed dividends for 2002 is computed as follows:

Number of Korean won

U.S. dollars (Note 2)

shares Dividend rate (in millions) (in thousands)

Common shares, net of treasury shares 218,083,132 17% 185,371

$

154,424

Preferred shares, net of treasury shares:

First and Third 24,492,541 18% 22,043 18,363

Second 37,542,305 19% 35,665 29,711

243,079 $202,498

The proposed dividends for 2001 was computed as follows:

Number of Korean won

U.S. dollars (Note 2)

shares Dividend rate (in millions) (in thousands)

Common shares, net of treasury shares 218,187,967 15% 163,641

$

136,322

Preferred shares, net of treasury shares:

First and Third 24,492,541 16% 19,594 16,323

Second 37,541,005 17% 31,910 26,583

215,145 $179,228

The proposed dividends for 2002 and 2001 were approved by shareholders’ meeting being held on March 14, 2003 and

March 15, 2002, respectively.

80 81