Hyundai 2002 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2002 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

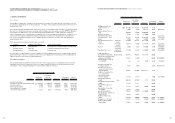

Debt securities held for investment are classified as either held-to-maturity investment debt securities or available for sale

investment debt securities at the time of purchase. Held-to-maturity debt securities are stated at acquisition cost, as

determined by the moving average method. When the face value of a held-to-maturity investment debt security differs

from its acquisition cost, the effective interest method is applied to amortize the difference over the remaining term of the

security. Available-for-sale investment debt securities are stated at fair value, resulting valuation gain or loss reported as a

consolidated capital adjustment within shareholder’ equity. However, if the fair value of a held-to-maturity or an available-

for-sale investment debt security declines compared to the acquisition cost and is not expected to recover (impaired

investment security), the carrying value of the debt security is adjusted to fair value, with the resulting valuation loss

charged to current operations. If the fair value of the security subsequently recovers, in the case of a held-to-maturity debt

security, the increase in value is recorded in current operations, up to the amount of the previously recognized impairment

loss, and in the case of an available-for-sale debt security, the increase in value is recorded in capital adjustments.

The lower of the acquisition cost of investments in treasury stock funds and the fair value of treasury stock included in a

fund is accounted for as treasury stock in consolidated capital adjustments.

Property, Plant and Equipment and Related Depreciation

Property, plant and equipment are recorded at cost, except for assets revalued upward in accordance with the Asset

Revaluation Law of Korea. Routine maintenance and repairs are expensed as incurred. Expenditures that result in the

enhancement of the value or extension of the useful lives of the facilities involved are treated as additions to property, plant

and equipment.

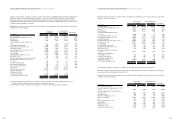

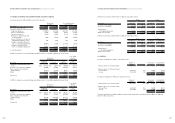

Depreciation is computed using the straight-line method based on the estimated useful lives of the assets as follows:

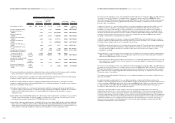

Before 2002, the Company and Kia, one of its domestic subsidiaries, had capitalized a portion of financial cost including

interest expense and similar expenses in conformity with Financial Accounting Standards of Republic of Korea. However,

in 2002, the Company elected to adopt the accounting method of charging all financing cost to current operations in

accordance with Statement of Korea Accounting Standards (SKAS) No. 7 – Capitalization of Financing Costs. This

Statement is effective for fiscal years subsequent to December 31, 2002 but early adoption in 2002 is permitted. This

Statement provides that all financing cost must be charged to current operations but capitalization of financial cost can be

acceptable under certain conditions. In accordance with SKAS No. 7, in the first effective fiscal year, the company should

elect one of such accounting methods for financing cost as its accounting policy and consistently apply it. If the

accounting method of charging all financing cost to current operations is selected, it would result in an accounting change

and in accordance with this Statement, this change is accounted for using prospective approach. This change of

accounting method resulted in the decrease of consolidated net income and assets by 55,515 million (US$46,247

thousand), respectively, compared with the results based on the previous method. The Company and its subsidiaries

capitalized financial cost of 103,083 million (US$ 85,874 thousand) as part of the cost of constructing major facilities and

equipment in 2001.

Intangibles

Intangible assets are stated at cost, net of accumulated amortization. Subsequent expenditures on intangible assets after

their purchases or completions, which will probably enable the assets to generate future economic benefits and can be

measured and attributed to the assets reliably, are treated as additions to intangible assets.

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

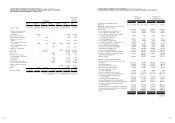

Useful lives (years)

Buildings and structures 2 – 60

Machinery and equipment 4 – 50

Vehicles 2 – 21

Dies and moulds 2 – 12

Tools 2 – 12

Other equipment 2 – 12

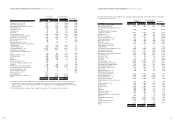

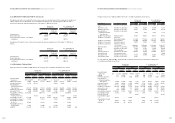

Amortization is computed using the straight-line method based on the estimated useful lives of the assets as follows:

If the recoverable value of intangible assets is lower than book value, book value is adjusted to the recoverable value with

impairment loss charged to current operations.

In 2002, the Company adopted Statement of Korea Accounting Standards (SKAS) No. 3 – Intangible Assets. This

Statement, effective for fiscal years subsequent to December 31, 2002 but early adoption in 2002 is permitted, provides

more clarifications of accounting method of intangible assets including definition, scope, recognition, amortization and

valuation. Also, considering the trend in the automotive market, the Company shortened the estimated economic useful

lives for certain types of development costs and reclassified the ordinary development expenses and research expenses.

This accounting change resulted in the decrease of consolidated net income by 445,990 million (US$371,534 thousand)

compared with the results based on the previous method.

In 2002, Hyundai HYSCO, a domestic subsidiary changed the estimated economic useful life of development cost from

twenty years to ten years. This accounting change resulted in the decrease of consolidated net income by 1,775 million

(US$1,479 thousand) compared with the results based on the previous method.

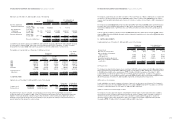

Valuation of Receivables and Payables at Present Value

Receivables and payables arising from long-term installment transactions, long-term cash loans (borrowings) and other

similar loan (borrowing) transactions are stated at present value, if the difference between nominal value and present value

is material. The present value discount is amortized using the effective interest rate method. Effective interest rate ranges

from 8.25 percent to 10.00 percent in 2002 and is 10.0 percent in 2001.

Restructuring of Receivables and Payables

If principal, interest rate or repayment period of receivables is changed unfavourably for the Company by the court

imposition such as commencement of reorganization or by mutual agreements and the difference between nominal value

and present value is material, such difference is recorded in other expense as provision for doubtful accounts. The

difference is amortized using the effective interest method, with the amortization included in interest income or interest

expense.

Discount on Debentures

Discount on debentures, which is the difference between the issued amount and the face value of debenture, is presented

as a deduction from to the face value of debentures and amortized over the redemption period of the debenture using the

effective interest rate method. Amortization of discount is recognized as interest expense on the debenture.

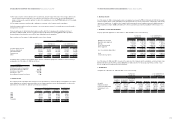

Accrued Severance Benefits

Employees and directors of the Company and its subsidiaries are entitled to receive a lump-sum payment upon

termination of their service based on the applicable severance plan of each company. The accrued severance benefits that

would be payable assuming all eligible employees of the Company and its domestic subsidiaries terminated their

employment amount to 2,592,509 million ($2,159,704 thousand) and 2,143,955 million ($1,786,034 thousand) as of

December 31, 2002 and 2001, respectively.

Accrued severance benefits are funded through a group severance insurance plan and individual severance insurance

plan. The group severance insurance deposits under this insurance plan are classified as other assets. Subsequent

provisions are funded at the discretion of the Company. Group severance insurance deposits may only be withdrawn for

the payment of severance benefits. Individual severance insurance deposits, of which a beneficiary is a respective

employee, are presented as deduction from accrued severance benefits. Actual payments of severance benefits amounted

to 308,575 million ($257,060 thousand) and 288,906 million ($240,675 thousand) in 2002 and 2001, respectively.

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

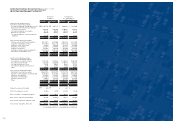

Useful lives (years)

Goodwill (Negative goodwill) not to exceed 20 years

Development costs 3 – 10

Other 4 – 20

62 63