Hyundai 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

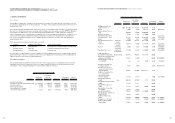

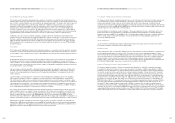

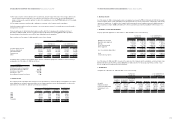

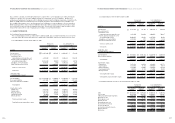

Debentures as of December 31, 2002 and 2001 consist of the following:

Korean won U.S. dollars(Note 2)

Annual (in millions) (in thousands)

Maturity Interest rate(%) 2002 2001 2002 2001

Domestic debentures

Guaranteed debentures 12 Sep, 2003 ~

27 March, 2004 6.3 ~ 6.6 10,500 -

$

8,747

$

-

Non-guaranteed 3 Jan, 2003 ~

Debentures 23 Sep, 2007 5.0 ~ 8.0 8,218,132 6,718,200 6,846,161 5,596,634

Convertible bonds 31 Dec, 2003 3.0 69,972 110,478 58,291 92,035

Overseas debentures 9 April, 2003 ~

18 July, 2006 3.07 ~ 9.40 1,025,586 1,240,706 854,370 1,033,577

9,324,190 8,069,384 7,767,569 6,722,246

Discount on debentures (73,305) (121,348) (61,067) (101,090)

9,250,885 7,948,036 $7,706,502 $6,621,156

Convertible bonds with the carrying value of 69,972 million ($58,291 thousand) and 110,478 million ($92,034 thousand)

as of December 31, 2002 and 2001, respectively, were issued by Hyundai HYSCO, a subsidiary. In, 2002, convertible

bonds with the face value of 28 million ($24 thousand) were converted to 5,660 shares of common stock.

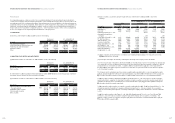

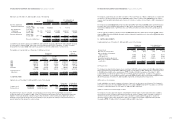

The maturities of long-term debt as of December 31, 2002 are as follows:

Korean won

(in millions)

Won Foreign

Currency Currency

Debentures Loans Loans Total Total

2003 2,568,075 294,360 188,071 3,050,506

$

2,541,241

2004 3,979,803 293,595 274,074 4,547,472 3,788,297

2005 1,938,176 121,569 113,839 2,173,584 1,810,717

2006 808,136 119,267 70,365 997,768 831,196

Thereafter 30,000 239,963 94,124 364,087 303,305

9,324,190 1,068,754 740,473 11,133,417 9,274,756

Less: Discount on

debentures (73,305) - - (73,305) (61,067)

9,250,885 1,068,754 740,473 11,060,112 $9,213,689

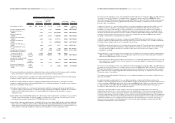

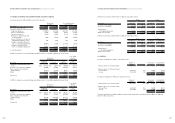

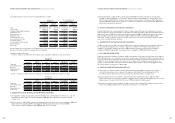

13. CAPITAL STOCK

Capital stock as of December 31, 2002 and 2001 consist of the following:

Korean won

U.S. dollars (Note 2)

Authorized Issued Par value (in millions) (in thousands)

Common stock 450,000,000 219,088,702 shares 5,000 1,145,443

$

954,218

Preferred stock 150,000,000 65,202,146 shares 5,000 331,011 275,750

1,476,454 $1,229,968

The preferred shares are non-cumulative, non-participating and non-voting. Of the total preferred stock issued of

65,202,146 shares as of December 31, 2002, a total of 27,588,281 preferred shares (First and Third preferred shares) are

eligible to receive cash dividends, if declared, equal to that declared for common shares plus an additional 1 percent

minimum increase while the dividend rate for the remaining 37,613,865 preferred shares (Second preferred shares) is 2

percent higher than that declared for common shares.

U. S. dollars

(Note 2)

(in thousands)

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

The Company acquired treasury stock after cancellation of Trust Cash Funds as of March 2, 2001 and in accordance with

the decision of the Board of Directors,retired 10,000,000 common shares in treasury and 1,000,000 preferred shares in

treasury, which had additional dividends rate of 2 percent to the rate of common stock on March 5, 2001, using retained

earnings.

The Company issued 10,000,000 Global Depositary Receipts (GDRs) representing 5,000,000 shares of preferred stock in

November 1992, 4,675,324 GDRs representing 2,337,662 shares of preferred stock in June 1995 and 7,812,500 GDRs

representing 3,906,250 shares of preferred stock in June 1996, all of which have been listed on the Luxembourg Stock

Exchange.

In the second half of 1999, the Company issued 45,788,000 Global Depositary Shares representing 22,894,000 common

shares for 601,356 million ($500,963 thousand), which include paid-in capital in excess of par value of 486,886 million

($405,603 thousand).

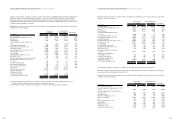

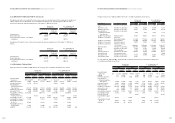

14. CAPITAL ADJUSTMENTS

Capital adjustments as of December 31, 2002 and 2001 consist of the following:

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

2002 2001 2002 2001

Treasury stock (86,514) (79,648)

$

(72,071)

$

(66,351)

Discounts on stock issuance (374) (621) (311) (518)

Gain on valuation of investment

equity securities 14,889 22,775 12,403 18,973

Stock option cost 13,605 13,687 11,334 11,402

Cumulative translation adjustments (70,923) (5,251) (59,083) (4,374)

Gain (Loss) on valuation of derivatives

(see Note 2) 22,900 (16,377) 19,077 (13,643)

(106,417) (65,435) $(88,651) $(54,511)

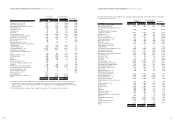

(1) Treasury stock

The Company has shares held as treasury stock consisting of 1,005,570 common shares and 3,167,300 preferred shares

with a carrying value of 73,036 million ($60,843 thousand) as of December 31, 2002, and 992,155 common shares and

3,168,600 preferred shares with a carrying value of 71,786 million ($59,802 thousand) as of December 31, 2001,

acquired directly or indirectly through the Treasury Stock Funds and Trust Cash Funds. In addition, the Company’s

shares of subsidiaries’ stocks held by themselves, amounting to 13,478 million ($11,228 thousand) and 7,862 million

($6,549 thousand) as of December 31, 2002 and 2001, respectively, are included in the treasury stock.

(2) Discounts on stock issuance

Certain subsidiaries accounted for expense on issuance of new stock as discounts on stock issuance. The Company’s

share of these discounts amounting to 374 million ($312 thousand) and 621 million ($517 thousand) is accounted for

as a debit to capital adjustments as of December 31, 2002 and 2001, respectively.

(3) Gain on valuation of investment equity securities

The Company recorded a gain from valuation of marketable investment equity securities and investments on affiliates,

which were accounted for using the equity method (see Note 4), and the Company’s share of the gain on valuation of

investment equity securities reported in accounts of its subsidiaries in capital adjustments as gain on valuation of

investment equity securities within shareholders’ equity. The Company recorded gains of 14,889 million ($12,403

thousand) and 22,775 million ($18,973 thousand) in 2002 and 2001, respectively.

76 77