Huntington National Bank 2013 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2013 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TO FELLOW OWNERS AND FRIENDS:

I am pleased to report 2013 was a year of solid performance as the dynamic efforts of our approximately

11,000 colleagues allowed the Company to perform at a high level despite the challenging operating

environment. Their efforts resulted in a return on average assets (ROA) of 1.13%. Last year was the second

consecutive year that the ROA was within our targeted range of 1.10%-1.35% and placed Huntington in the top

third of ROAs for the largest 100 banks in the United States.

For the last several years, we have been focused on executing our strategic plan, which along with our

building a strong risk and credit culture, positions Huntington for consistent long-term profitability, for the third

year in a row with a return on tangible common equity of 13%. Delivering these steady returns has allowed the

Company to continue to execute on its capital priorities: (1) Grow the core franchise. We increased both

consumer and commercial relationships by at least 6% and accelerated loan growth. (2) Support the dividend. We

increased the dividend by 19% while staying below the regulators’ targeted dividend payout ratio of 30%. (3) All

other opportunistic uses. We repurchased over 16 million shares, announced the acquisition of Camco Financial,

and redeemed $50 million of very high cost preferred securities. Our capital levels remain strong, and as we look

forward, disciplined capital management remains a top priority.

For the last several years, I have been writing about some of the specifics around the difficult operating

environment: interest rates impact on net interest margin (NIM), ever-increasing regulation, and a tepid economy

delivering limited growth. None of those materially changed in 2013; if anything, the overall environment

became more difficult as the prolonged effects of growing industry wide capital levels chasing limited customers

resulted in some banks moving away from what we would consider disciplined standards. The commitment of

our colleagues, combined with our Fair Play banking philosophy, allows us to take this environment and turn it

into an advantage. Customers, whether it is our more than 1.3 million consumer checking households or

160 thousand commercial checking relationships, see our passion about doing the right thing, and time and time

again, they tell us that is why they chose Huntington as their primary financial relationship.

The economy at the start of the year was considerably less vibrant than we had hoped. Consumers and

businesses were unsure about how the actions in Washington D.C. would impact them, and that caused them to

pause. At that point, we were already resizing and changing the timing of our investments. It soon became clear

that if we were to do the right thing for our shareholders, additional action would be needed. Some of the more

noticeable actions we took included refining the branch network after three years of net additions and rightsizing

the mortgage business to reflect declining volumes. We made investments around Continuous Improvement,

which has resulted in hundreds of small changes in process improvement that will continue as we strive to reach

all of our long-term goals.

The improvements in our efficiency ratio, credit quality, and capital levels demonstrated how Huntington

colleagues have risen to meet the challenges of the current banking environment. Let me offer a recap of 2013

performance and then our expectations for 2014.

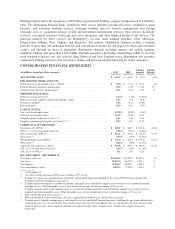

Net income for 2013 was $639 million, which was relatively unchanged from the prior year, and earnings

per common share increased to $0.72, an increase of $0.01 from the prior year. Fully taxable equivalent total

revenue decreased $99 million, or 3%, from 2012; noninterest income decreased $100 million, or 9%; and net

interest income increased $1 million, or less than 1%, since the prior year.

The net interest income increase reflected the impact of 4% loan growth, a 5 basis point decrease in the fully

taxable equivalent net interest margin (NIM) to 3.36%, as well as a 7% reduction in other earnings assets, the

majority of which were loans held for sale.

The loan growth reflected an increase in two areas that have been significant areas of focus of our strategic

plan, Commercial and Industrial (C&I) and automobile loans. Average C&I loans experienced little change in

1