Huntington National Bank 2009 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2009 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Huntin

g

ton Bancshares Incorporated (NASDAQ: HBAN) is a $52 billion re

g

ional bank holdin

g

compan

y

headquartered in Columbus, Ohio, and has served the financial needs of its customers for more than 144

y

ears.

Huntin

g

ton’s principal markets are Indiana, Kentuck

y

, Michi

g

an, Ohio, Penns

y

lvania, and West Vir

g

inia. Nearl

y

11,000 co

ll

ea

g

ues prov

id

e consumer an

d

commerc

i

a

lb

an

ki

n

g

, mort

g

a

g

e

b

an

ki

n

g

, automo

bil

e

fi

nanc

i

n

g,

equ

i

pment

l

eas

i

n

g

,

i

nvestment mana

g

ement,

b

ro

k

era

g

e, trust, an

di

nsurance serv

i

ces. Customers

h

ave

convenient access to bankin

g

services throu

g

h more than

6

00 re

g

ional bankin

g

offices, the customer servic

e

call center at (800) 480-BANK (2265), online at www.huntin

g

ton.com, via the technolo

g

icall

y

advanced 24-hou

r

te

l

ep

h

one

b

an

k

,an

d

t

h

rou

gh

Hunt

i

n

g

ton’s networ

k

o

f

over 1,300 ATMs. Non-

b

an

ki

n

gfi

nanc

i

a

l

serv

i

ces ar

e

prov

id

e

d

t

h

rou

gh

se

l

ect

b

an

ki

n

g

o

ffi

ces, as we

ll

as ot

h

er

l

oca

lf

ac

ili

t

i

es.

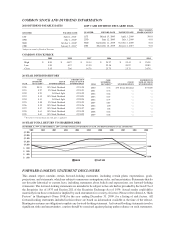

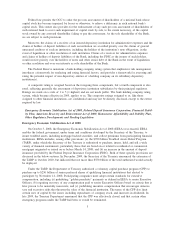

CO

N

SO

LIDATED FINAN

C

IAL HI

G

HLI

G

HT

S

(In millions, exce

p

t

p

er share amounts)

2

009 2008 Chan

ge

NET LOS

S

................................................

$(3

,

094

)

$

(

114

)

$

(

2,980

)

N.M.%

PER COMMON SHARE AMOUNT

S

Net

l

oss

p

er common s

h

are –

dil

ute

d

..............................

.

$(

6.14

)

$(

0.44

)$(

5.70

)

N.M.%

Cash dividend declared per common share . . . . . . . . . . . . . . . . . . . . . . . . . . .

0

.

4000

0.662

5(

0.262

5) (

40

)

T

an

g

ible book value per common shar

e

(1)

...........................

4.21

5

.64

(

1.43

)(

2

5)

PERF

O

RMAN

C

ERATI

OS

Return on avera

g

e total assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(

5.90

)

%

(

0.21

)

%

(

5.69

)%

Return on average total shareholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . .

(

53.5

)

(

1.8

)(5

1.7

)

Net interest margin

(2)

.........................................

3

.

11

3.2

5(

0.14

)

Efficienc

y

rati

o

(3)

g

g

............................................

55

.4

5

7.0

(

1.6

)

C

APITAL RATIOS

Tier 1 risk-based capital ratio

(1)

..................................

12.0

3%

10

.7

2% 1

.

31%

Tota

l

r

i

s

k

-

b

ase

d

ca

pi

ta

l

rat

io

(1)

...................................

14

.

41

13.

9

10.

50

Tan

gibl

e equ

i

t

y

/tan

gibl

e assets rat

io

(1)(4)

............................

9.24

7

.72 1.

52

Tan

g

ible common equit

y

/tan

g

ible asset ratio

(

1

)(

5

)

......................

5.92

4

.

0

41.

88

CREDIT

Q

UALITY MEASURES

Net c

h

ar

g

e-o

ff

s (NCOs) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

$

1

,

47

7

$

758

$

719 95%

NCOs as a % of average loans and leases . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

.82

%

1.8

5

% 1.97

%

Nonaccrual loans

(

NALs

)

(1)

.....................................

$

1

,

917 $1

,

502 $ 415 2

8

NAL rat

i

o

(1)(6)

..............................................

5

.21

%

3.66% 1.

55

%

Nonperforming assets (NPAs)

(

1

)

..................................

$

2

,

05

8

$1

,

637 $ 421 2

6

NPA rat

io

(1)(7)

g

...............................................

5

.57

%

3.

9

7% 1.

6

0

%

Allowance for credit losses

(

ACL

)

(

1

)

...............................

$

1

,

53

1

$

944

$

587 6

2

AC

Lasa%o

f

tota

ll

oans an

dl

eases

(1)

.............................

4.16

%

2

.

30

%1.

86%

AC

Lasa%ofNAL

s

(1)

........................................

80

63

1

7

BALANCE

S

HEET – DECEMBER 31

,

Tota

ll

oans an

dl

eases........................................

.

$

36

,

79

1

$

41,092

$(

4,301

)(

10

)%

Total assets

................................................

5

1,

555

5

4,3

5

3

(

2,798

) (5)

Tota

ld

e

p

os

i

ts...............................................

40

,

494

37

,

943 2

,55

17

Tota

l

s

h

are

h

o

ld

ers’ equ

i

t

y

......................................

5,336

7,229

(

1,893

)(

2

6)

N.M., not a mean

i

n

gf

u

l

va

l

ue.

(1

)

At Decem

b

er

3

1

.

(2)

On a full

y

-taxable equivalent (FTE) basis assumin

g

a 35% tax rate

.

(

3

)

Non

i

nterest expense

l

ess amort

i

zat

i

on o

fi

ntan

gibl

es an

dg

oo

d

w

ill i

mpa

i

rment

di

v

id

e

dby

t

h

e sum o

f

FTE net

i

nterest

i

ncome an

d

non

i

nterest

i

ncome exc

l

u

di

ng secur

i

t

i

es

l

osses

.

(4

)

Tan

g

ible equit

y

(total equit

y

less

g

oodwill and other intan

g

ible assets) divided b

y

tan

g

ible assets (total assets less

g

oodwill and othe

r

intan

g

ible assets). Other intan

g

ible assets are net of deferred tax

.

(

5)

Tan

g

ible common equit

y

(total common equit

y

less

g

oodwill and other intan

g

ible assets) divided b

y

tan

g

ible assets (total assets les

s

g

oodwill and other intan

g

ible assets). Other intan

g

ible assets are net of deferred tax

.

(6

)

NALs

di

v

id

e

dby

tota

ll

oans an

dl

eases

.

(

7

)

NPAs

di

v

id

e

dby

t

h

e sum o

f

tota

ll

oans an

dl

eases,

i

mpa

i

re

dl

oans

h

e

ld

-

f

or-sa

l

e, an

d

net ot

h

er rea

l

estate

.