Harman Kardon 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 Harman Kardon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

Harman International Annual Report 2009

FROM THE CHAIRMAN AND CHIEF EXECUTIVE OFFICER

Fiscal Year 2009 was a time of both extraordinary challenge and accomplishment for Harman International.

We experienced the deepest global economic crisis of a lifetime, while launching a record number of new

audio and infotainment platforms to start delivering on the largest project backlog in Harman’s history. As more

than 70 companies in the automotive sector declared insolvency, Harman fought back aggressively to optimize

its cost structure while continuing its legacy of innovation. We are emerging as a stronger company and we are

well positioned to gain market share and grow profi tably in the coming years.

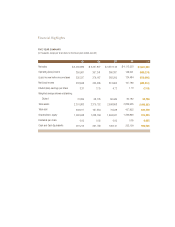

Net sales for the fi scal year ending June 30, 2009 were $2.9 billion, a decrease of 30 percent from the

previous year as consumer confi dence and spending activity fell to the lowest level in a generation. Amidst this

sharp drop in market volume, we recorded an operating loss of $509 million including non-recurring costs.

Net loss was $423 million and loss per diluted share was $7.19 including non-recurring costs.

As the fi scal year began, global economic concerns were

deepening amidst a widespread credit crisis spurred by

sub-prime lending. Strategically, Harman had acted earlier to

launch its $400 million STEP Change permanent cost savings

and productivity improvement program. Nearly 250 distinct

measures were defi ned to optimize the Company’s cost struc-

ture and operations, driven by a dedicated project team and

real-time tracking systems.

STEP Change achievements to date include the closure or

consolidation of more than a dozen facilities and the reduction

of nearly 2,000 jobs in the mature markets to optimize our

global footprint. We recognize the hardship these actions

bring to some employees and we have worked hard to treat them with respect and dignity while clearly

communicating our strategy for long-term success. Other STEP Change measures focus on such areas as

supply-chain effi ciencies, information technology infrastructure, simplifi ed sales channels and new strategic

providers for travel, consulting and services.

As of year end, we achieved $190 million in sustainable cost savings, well ahead of our $144 million target for

the year. The full $400 million STEP Change program will be completed by the end of fi scal year 2011,

positioning Harman International to more profi tably serve pent-up market demand as the world economy

rebounds. Amidst this environment of aggressive cost reduction and prudent cash management, we took many

other steps to strengthen Harman for the future.

Managing liquidity was an area of intense focus during the year. Beyond the sustainable STEP Change measures

under way, we took incremental actions to weather the economic storm by freezing salaries and suspending

pension contributions where permitted and reducing travel costs by 30 percent through mandatory controls.

Our capital investment programs were guided by an executive tribunal which allowed us to reduce capital outlays

by more than 40 percent from the previous year without compromising innovation or customer programs.

To further strengthen liquidity, we successfully amended our primary revolving credit facility to extend its

maturity through December 2011. We launched a successful capital off ering of more than ten million common

To Our Shareholders