Hamilton Beach 2012 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2012 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

market portion of the U.S. small kitchen

appliance market are projected to grow

only moderately in 2013 compared

with 2012. International and commer-

cial product markets are expected to

continue to grow reasonably in 2013

compared with 2012.

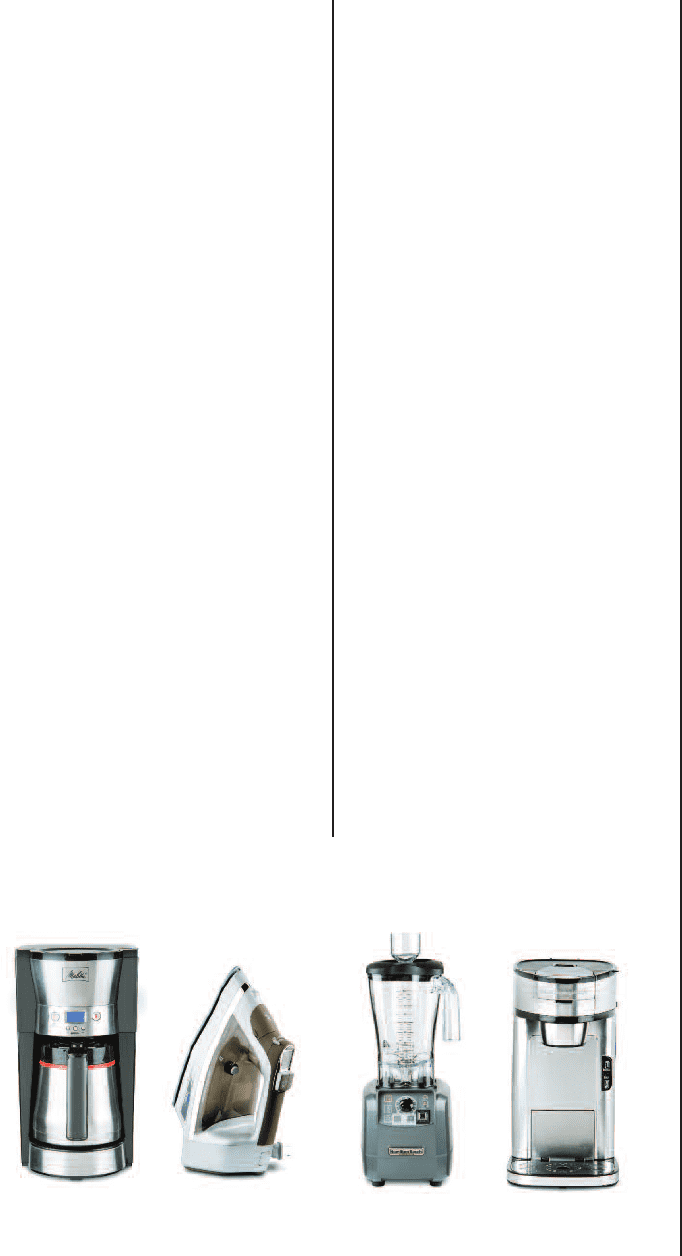

HBB continues to focus on strength-

ening

its North American consumer

market position through product inno-

vation, promotions, increased placements

and branding programs, together with

appropriate levels of advertising for the

company’s highly successful and inno-

vative product lines. Particular focus is

being placed on single-serve coffee prod-

ucts such as The Scoop®and FlexBrew

TM

.

HBB expects The Scoop®, the Two-Way

Brewer and the Durathon

TM

iron product

line, all introduced in late 2011, as well

as the FlexBrew

TM

, launched in late

2012, to continue to gain market posi-

tion as broader distribution is attained

over time. The company is continuing

to introduce innovative products in

several small appliance categories. In the

first quarter of 2013, HBB expects to

launch the Hamilton Beach®Breakfast

Sandwich Maker, which provides an

innovative and convenient way for con-

sumers to cook breakfast sandwiches

quickly at home. These products, as well

as other new product introductions in

the pipeline for 2013, are expected to

increase both revenues and operating

profit. As a result of these new products,

the company’s improving position in

commercial and international markets,

and execution of the company’s strategic

initiatives, HBB expects to increase

volumes and revenues in 2013 compared

with 2012 at more than the 2013 mar-

ket forecast rate of increase.

Overall, HBB expects full-year 2013

net income to be comparable to 2012 as

anticipated increases in profit from

increased revenues are forecasted to be

largely offset by expected increases in

operating expenses to support HBB’s

strategic initiatives. Product and trans-

portation costs are currently expected

to remain comparable to 2012. HBB

continues to monitor commodity costs

closely and will adjust product prices

and product placements, as appropri-

ate, if these costs increase more than

anticipated. HBB expects 2013 cash

flow before financing activities to be

moderately lower than in 2012 due to

increased working capital needs.

Longer-Term Perspective.

HBB’s vision is to be the leading

designer, marketer and distributor of

small electric household and commercial

appliances sold worldwide under strong

brand names and to achieve profitable

growth from innovative solutions that

improve everyday living. To achieve this

vision, HBB will focus on five strategic

growth initiatives, each of which is

described separately below:

1. Enhancing placements in the

North American consumer business

through consumer-driven innovative

products and strong sales and market-

ing support. The company’s product

and placement track record is strong

due to innovation processes centered

on understanding and meeting end-user

needs. In the North American consumer

market, HBB believes it has a stronger

and deeper portfolio of new products

than its competitors. HBB expects its

product pipeline in 2013 and beyond to

be at or above already increased 2012

levels, with strong brands and best-in-

class products.

2. Enhancing Internet sales by

providing best-in-class retailer support

and increased consumer content and

engagement. In the past few years,

Internet sales have grown significantly

in all product areas. Small kitchen

appliances are no exception. During

2012, 18 percent of small kitchen appli-

ances were purchased online. Retailers

are looking for partners that can pro-

vide not only products, but also new

capabilities and support for promotion,

marketing and distribution programs.

As consumers’ shopping habits evolve

to rely more on the Internet, HBB is

focused on being the leading partner to

its retailers and by increasing engage-

ment with end users by enhancing its

Left to Right: Melitta 10-cup thermal coffeemaker, the newest version of the Durathon™ Digital Iron with

Durathon™ Nonstick Soleplate, Hamilton Beach® Tournant™ high-performance commercial food blender

and The Scoop® single-cup coffeemaker.