Hamilton Beach 2012 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2012 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

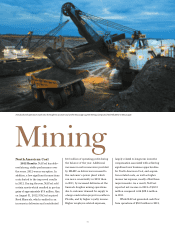

Much of the development work at the new Liberty Mine in Mississippi involves assembling mining equipment, such as this dragline that will eventually be used to

remove overburden.

12

cash flow before financing activities

was actually negative at $6.1 million

predominantly due to several unique

transactions in 2012. These included

cash paid of $69.3 million to acquire

Reed Minerals, the purchase of two

draglines for $26.8 million, the sale of

two draglines for $31.2 million and the

receipt of $14.4 million in payment for

a long-term note related to a dragline

sold in 2009. Cash flow before financing

activities was $21.0 million in 2011.

Outlook for 2013. While NACoal

will work to integrate Reed Minerals

in 2013, the company will remain

focused on safety, environmental com-

pliance and continuous improvement

programs. These well-established

programs provide a solid foundation for

all of the company’s coal and limerock

mining operations. NACoal expects

steady operating performance at its

coal mining operations in 2013. Steam

coal tons delivered in 2013 are expected

to increase over 2012 at both the con-

solidated and unconsolidated mining

operations provided end-use customers

achieve currently planned power plant

operating levels. NACoal is optimistic

that the power plant served by MLMC

will build on its operating improvements

in 2012 and run more consistently in

2013. However, metallurgical coal sales

for Reed Minerals are expected to be

below the company

’

s initial expecta-

tions as demand for steel is down and

customers are reducing inventories.

Limerock deliveries are expected to

decrease in 2013 compared with 2012

as customer requirements are expected

to decline moderately because the large

construction project that increased

2012 requirements will be completed

in early 2013 and the overall Florida

construction market remains weak.

Demery Resources Company’s Five

Forks Mine commenced delivering coal

to its customer in 2012 and is expected

to increase production in 2013, with

full production levels expected to be

reached in late 2015 or 2016. Royalty

income is expected to be lower in 2013

compared with 2012.

NACoal expects to continue to

generate modest income in 2013 from

the four unconsolidated mines which