Hamilton Beach 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

basis were realized at NACoal (17.3

percent) and HBB (29.4 percent) but

Kitchen Collection had a negative return

of 6.1 percent. The Company generated

cash flow before financing activities from

continuing operations of $10.7 million

in 2012 as strong positive cash flow

before financing activities at HBB

was offset by negative cash flow before

financing activities at NACoal, primarily

due to the cash paid of $69.3 million for

the acquisition of Reed Minerals. Cash

flow before financing activities from

continuing operations of $83.8 million

generated in 2011 included the receipt

of $60 million for the Applica litigation

settlement. The Company’s cash posi-

tion at December 31, 2012 was strong

at $139.9 million despite paying both a

special dividend of $3.50 per share and

a regular quarterly dividend of $0.25

per share to stockholders on December

14, 2012, which used $31.4 million of

cash. Consolidated debt as of December

31, 2012 increased to $177.7 million

from $148.2 million as of December 31,

2011, largely as a result of the Reed

Minerals acquisition. NACCO expects

strong cash flow before financing activ-

ities from NACoal and HBB in 2013

and modest cash flow before financing

activities at Kitchen Collection.

On the first trading day of 2012,

NACCO’s stock price closed at $91.43.

The stock reached a high of $129.20 in

July 2012 following the announcement

of the spin-off of the materials handling

business, and closed on September

28, 2012 at $125.41. The spin-off was

completed after the market closed on

September 28th when the Company

distributed one share of Hyster-Yale

Class A common stock and one share

of Hyster-Yale Class B common stock

to NACCO stockholders for each share

of NACCO Class A common stock or

Class B common stock owned. Post-

spin, NACCO’s stock opened at $41.50

and achieved an average price of $53.31

for the fourth quarter of 2012. Hyster-

Yale’s stock (NYSE: HY) opened at

$40.00 per share on its first day of

trading and achieved an average price

of $42.74 for the fourth quarter of 2012.

Combining the value of one NACCO

share with the value of two Hyster-Yale

shares, in line with the distribution in

the spin-off, equals a combined opening

value of $121.50 per share on the first

day after the spin-off and $138.79 per

share on average for the fourth quarter.

Share prices for NACCO and Hyster-

Yale on March 4, 2013 were $57.91 and

$51.93, respectively, equaling $161.77

per share on a similarly calculated “one

NACCO share plus two Hyster-Yale

shares” basis.

NACCO’s objective is to realize

improved valuation over time as the

Company executes its strategies for

growth and to reach its subsidiaries’

financial targets. In addition, in Novem-

ber 2012, NACCO’s Board of Directors

approved an extension of the Company’s

stock repurchase program through

December 31, 2013. The stock repur-

chase program permits the repurchase

of up to $50 million of the Company’s

outstanding Class A common stock.

The share repurchase program does

not require the Company to acquire

any specific number of shares. As of

December 31, 2012, NACCO had pur-

chased a total of 75,074 shares since the

buyback’s inception, including 30,851

shares purchased before the spin-off

at an average price of $85.59 per share

and 44,223 shares purchased after the

spin-off at an average price of $58.76

per share.

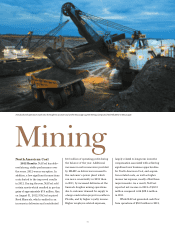

Subsidiary Financial

Objectives

Each of NACCO’s subsidiary com-

panies has specific long-term financial

objectives (described on page 8). In

2012, NACoal met its ROTCE objective

but fell short of its other objectives.

Continued improvements in perform-

ance at NACoal’s Mississippi Lignite

Mining Company (“MLMC”) and the

integration and expected growth of

Reed Minerals are anticipated to help

NACoal achieve all of its objectives.

HBB had sound operating profit but

fell below its long-term operating profit

margin target. Kitchen Collection fell

well below its operating profit margin

target and declined substantially

compared with 2011. Looking forward,

HBB is expected to continue to improve

results but will need additional sales

volumes through execution of its strate-

gic initiatives, or possibly through a

synergistic partnership or acquisition

to reach its target. Kitchen Collection’s

goal will be difficult to achieve if the

Le Gourmet Chef®stores continue to

struggle and customer visits to outlet

malls fail to recover. The Kitchen

Collection®store format is expected to

continue to produce sound results over

time but the Le Gourmet Chef®stores

are not expected to achieve their target

objective until sales volumes increase

and additional underperforming stores

have been closed. As each of NACCO’s

subsidiaries executes its strategic

initiatives, the Company expects that

its subsidiaries will be positioned to

achieve or exceed their long-term

financial goals.