Hamilton Beach 2012 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2012 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

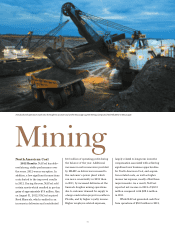

North American Coal

2012 Results. NACoal has deliv-

ered strong, stable performance over

the years. 2012 was no exception. In

addition, a few significant transactions

contributed to the improved results

in 2012. During the year, NACoal sold

certain assets which resulted in pre-tax

gains of approximately $7.0 million. Also,

on August 31, 2012, NACoal acquired

Reed Minerals, which resulted in an

increase in deliveries and contributed

$1.5 million of operating profit during

the balance of the year. Additional

increases in net income were provided

by MLMC as deliveries increased to

the customer’s power plant which

ran more consistently in 2012 than

in 2011, by increased deliveries at the

limerock dragline mining operations

due to customer demand for supply to

a large construction project in southern

Florida, and by higher royalty income.

Higher employee-related expenses,

largely related to long-term incentive

compensation associated with achieving

significant new business opportunities

for North American Coal, and acquisi-

tion-related costs, as well as higher

income tax expense, mostly offset these

improvements. As a result, NACoal

reported net income in 2012 of $32.8

million compared with $29.4 million

in 2011.

While NACoal generated cash flow

from operations of $50.2 million in 2012,

Mining

A truck/shovel operation works into the night to uncover coal at the Mississippi Lignite Mining Company’s Red Hills Mine in Mississippi.