HR Block 2006 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2006 HR Block annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of difference has enabled us to move well ahead in the emerging market for blended

channel services, through which we offer digital do-it-yourselfers the safety net of

professional support. When a digital user’s tax situation calls for full professional assistance,

the H&R Block brand has the recognition and trust to win that business.

Underlying all of these efforts is the need to satisfy our clients. Improvements in client

satisfaction scores confirm that clients continue to find our services valuable and

appropriately priced.

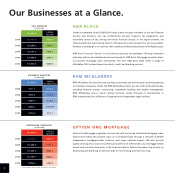

FOCUSING ON COST EFFICIENCY IN MORTGAGE

A cyclical change is occurring in the non-prime mortgage industry. Rising interest rates have

slowed the housing market and reduced mortgage originations from record volumes to

what appears to be a more sustainable level. The industry can no longer count on rising

volume to improve results. Now cost competitiveness and service quality will distinguish

winners from losers. Option One Mortgage and H&R Block Mortgage are both striving to

improve their cost competitiveness among leading mortgage lenders. We are working to

reduce costs through expanded use of technology, aligning staffing with origination

volume, and adjusting our retail service model from offices to centralized service centers.

In 2006, we consolidated mortgage locations and reduced staffing by about 22 percent. As

we manage costs, we remain committed to protect our reputation for superior quality of

service both to mortgage broker clients and the borrowers whose loans we service.

Our record $40.8 billion in loan originations offset compressed loan profitability, resulting

in fiscal 2006 revenues of $1.2 billion, while pretax income fell to $322 million (including a

$13 million charge for restructuring). We are selective about our areas of participation in

the mortgage market and manage the business to generate strong cash flows and a high

return on invested capital. We are fortunate to have the financial strength and flexibility

to accommodate industry volatility – and manage for long-term value creation.

ATTAINING MIDDLE-MARKET LEADERSHIP

RSM McGladrey emerged this year as the leading accounting, tax and business consulting

firm serving middle-market clients. The combination of continued strong organic growth,

along with our strategic acquisition of the American Express Tax and Business Services unit

(Amex TBS), has established us as a clear middle-market leader and alternative to the Big 4

accounting firms.

The Amex TBS acquisition also strengthened our presence in key geographic markets and

brought us a group of skilled industry professionals who share our culture and values. The

acquisition offers financial returns that meet our high expectations for return on

investment. And, with our greater size, investments we have begun in brand recognition

and other initiatives can now create even greater value for shareholders.

We acted on growth through acquisition at RSM McGladrey only after demonstrating

strong organic growth in our core business as well as a growing payoff from investments in

extended business opportunities. In June 2006, we took a first step to expand our global

capabilities, in eight countries initially. We announced a new wholly owned international

subsidiary and a related staffing agreement with another member (based in Germany) of

the RSM International network of independent companies.

In fiscal 2006, revenues for Business Services increased 53 percent to $877 million, and

pretax income climbed 79 percent to $53 million. The segment is beginning to demonstrate

the earnings potential we knew was there, and I expect it to become a noticeably larger

contributor to H&R Block’s results.

5

DEBT TO TOTAL CAPITAL

DEBT DIVIDED BY DEBT PLUS STOCKHOLDERS’ EQUITY

2002 2003 2004 2005 2006

40.3%

35.6%

31.3%

32.7%

30.1%

STOCKHOLDERS’ EQUITY

TANGIBLE EQUITY (Stockholders’ Equity less

goodwill and intangibles)

$165

$1,375

$828

$2,148

$524

$1,589

$518

$1,805

$686

$1,949

2002 2003 2004 2005 2006

STOCKHOLDERS’ EQUITY AND

TANGIBLE EQUITY

(IN MILLIONS)