HR Block 2006 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2006 HR Block annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(Left to right) Kathy Barney, President, H&R Block Bank;

Rob Bernabe, Senior Vice President, H&R Block Mortgage;

Steve Nadon; Joan Cohen, President, H&R Block

Financial Advisors

STEVE NADON

President

Consumer Financial Services Group

Our Consumer Financial Services (CFS)

Group was established at the start of fiscal

2007 to better align the services and products

of three H&R Block branded businesses

with the financial needs of our tax clients.

Expanding our relationships – in ways that

no competitor can match – strengthens our

partnerships with clients in achieving their

personal financial objectives. That builds

client loyalty to the H&R Block brand.

To further leverage our new structure, we

are evaluating potential opportunities to be

more effective and efficient internally,

including the coordination of different ways

our CFS companies interface with the tax

business and how they market to clients.

15

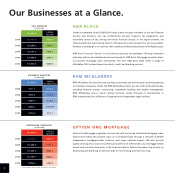

financial advisor. It’s another way tax professionals bring value to their clients. And when

clients deepen their brand relationship by funding a financial advisory account, we see

greater loyalty – a significant increase in retention rate for tax services.

H&R Block Financial Advisors opened more than 17,000 new accounts for tax clients in 2006.

Annual production revenue for these and previously referred clients was $31 million, or 16

percent of the Investment Services segment total. Since partnering formally began several

years ago, referrals from our tax professionals have brought in about 90,000 accounts and

$2.8 billion in assets. With referred clients rising beyond the number who could be helped

face-to-face, the H&R Block Financial Advisors’ Select Client Group call center was formed

in 2006 and is able to handle tens of thousands more clients.

Our business model of advisors partnering with tax professionals for client referrals is an

advantage in recruiting advisors. It differentiates H&R Block Financial Advisors from our

competition for talented people and attracts high-quality professionals looking to grow

their business. Advisors look favorably as well on the freedom they have to counsel their

clients without influence from proprietary investment products. H&R Block Financial

Advisors is benefiting from higher advisor productivity and disciplined cost management,

driven in part by investments in technology and other tools to serve clients better.

PROGRESS IN RETAIL MORTGAGE AND BANKING

H&R Block Mortgage provides direct-to-consumer mortgage loans nationwide. The business

was restructured during the year to improve cost efficiency while positioning it for better

service to customers. Loan inquiries are now handled faster and more efficiently within a

realigned network of mortgage centers.

The retail mortgage unit also sharpened its focus on H&R Block clients, and we increased

by one-third the conversion of referred tax clients to those obtaining a mortgage loan. We

introduced a proprietary software application enabling company loan officers to instantly

offer clients a menu of customized mortgage solutions. Total loans funded and average

dollar size rose in 2006, combining to increase total originations by 18 percent to $4.8 billion.

H&R Block Bank began operations at the start of fiscal 2007. Extending the brand to banking

gives us another competitive edge in the marketplace. The Bank will provide easy access to

affordable personal and business banking options, including traditional credit and FDIC-

insured deposit products and services. Our research shows about 7 million H&R Block clients

are underbanked. Through the Bank, we now have greater opportunity to help clients

improve their financial lives. The Bank also enables H&R Block to reduce its dependency on

third-party banks that currently fulfill certain banking needs for our clients, and it enables

us to house some of our corporate assets currently held by outside institutions.